A Six Sigma Master Black Belt’s Guide to Effective Risk Mitigation Strategies and Implementation

In today’s volatile business landscape, understanding and implementing risk mitigation is no longer optional—it’s essential for survival and success.

Risk mitigation, simply put, is the process of identifying, assessing, and reducing potential threats to an organization’s operations, assets, and objectives. It’s a critical component of risk management that goes beyond mere identification to reduce the likelihood and impact of adverse events actively.

In this comprehensive guide, you’ll learn not just the theory, but practical, actionable strategies that you can implement in your organization immediately. We’ll explore:

- The fundamentals of risk mitigation and its importance in today’s business environment

- A step-by-step process for effective risk assessment and mitigation planning

- Proven risk mitigation strategies and techniques, including those leveraged in Six Sigma methodology

- Real-world case studies and examples from my consulting experience

- Emerging trends in risk mitigation, including the integration of AI and machine learning

Whether you’re a seasoned project manager, a business professional looking to enhance your risk management skills or a process improvement enthusiast, this guide will equip you with the knowledge and tools to navigate the complex landscape of risk mitigation effectively.

Understanding Risk Mitigation

Risk mitigation is the process of identifying, evaluating, and implementing strategies to reduce or eliminate potential threats to an organization’s objectives, assets, or operations.

It’s a critical component of risk management, but it’s important to understand the distinction. While risk management encompasses the entire process of dealing with risks, risk mitigation specifically focuses on reducing the likelihood or impact of identified risks.

In my experience leading Six Sigma deployments across various industries, I’ve found that effective risk mitigation is not just about avoiding negative outcomes; it’s about creating a resilient business strategy. It’s about turning potential threats into opportunities for growth and innovation.

Curious about how to turn risks into opportunities? Our Lean Six Sigma Green Belt course teaches you to:

- Identify and assess potential risks in your organization

- Develop effective mitigation strategies

- Transform challenges into growth opportunities

The Importance of Risk Mitigation

The benefits of effective risk mitigation cannot be overstated. In my work with companies like HP and Intel, I’ve seen how it can:

- Protect financial stability and shareholder value

- Enhance operational efficiency and productivity

- Improve decision-making processes

- Boost stakeholder confidence

- Ensure regulatory compliance

On the flip side, inadequate risk mitigation can lead to disastrous consequences. I recall a project with a major tech company where overlooking a supply chain risk led to a production delay costing millions.

This experience underscores a startling statistic: according to a study by Aon, companies that effectively manage risks outperform their peers by 40% in terms of financial performance.

Types of Risks

In my years of consulting, I’ve encountered a wide array of risks. Generally, we can categorize them into:

- Financial Risks: Market volatility, credit risks, liquidity issues

- Operational Risks: Process failures, human errors, system breakdowns

- Strategic Risks: Competitive threats, changing customer preferences, technological disruptions

- Compliance Risks: Regulatory changes, legal issues

- Reputational Risks: Negative publicity, brand damage

Emerging risks in today’s landscape include cybersecurity threats, climate change impacts, and global supply chain disruptions. Each of these requires a unique approach to mitigation.

For instance, when I worked with a consumer electronics manufacturer on improving their supply chain resilience, we had to develop a completely different set of strategies compared to when I helped a print and digital document products and services mitigate financial risks.

This highlights a crucial point: effective risk mitigation isn’t one-size-fits-all. It requires a deep understanding of your specific business context and a tailored approach.

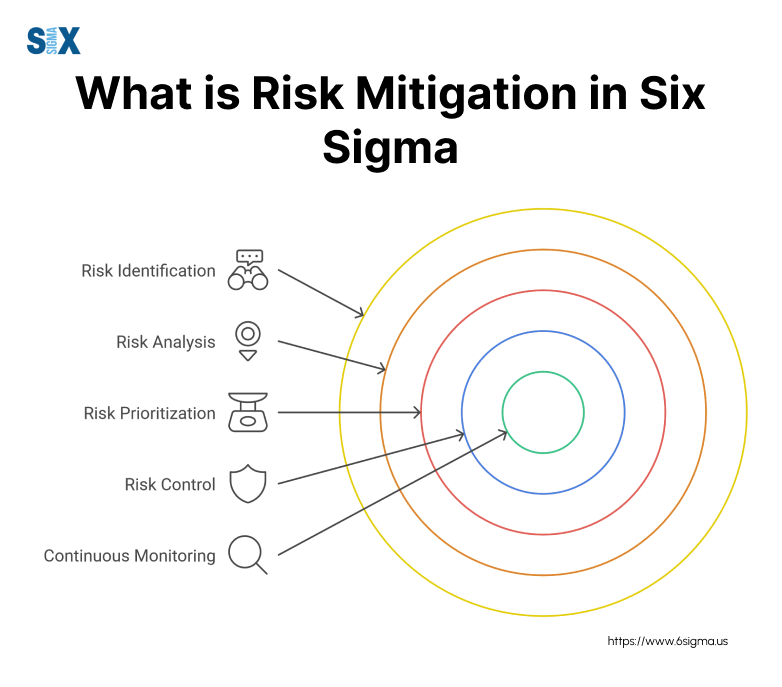

The Risk Mitigation Process

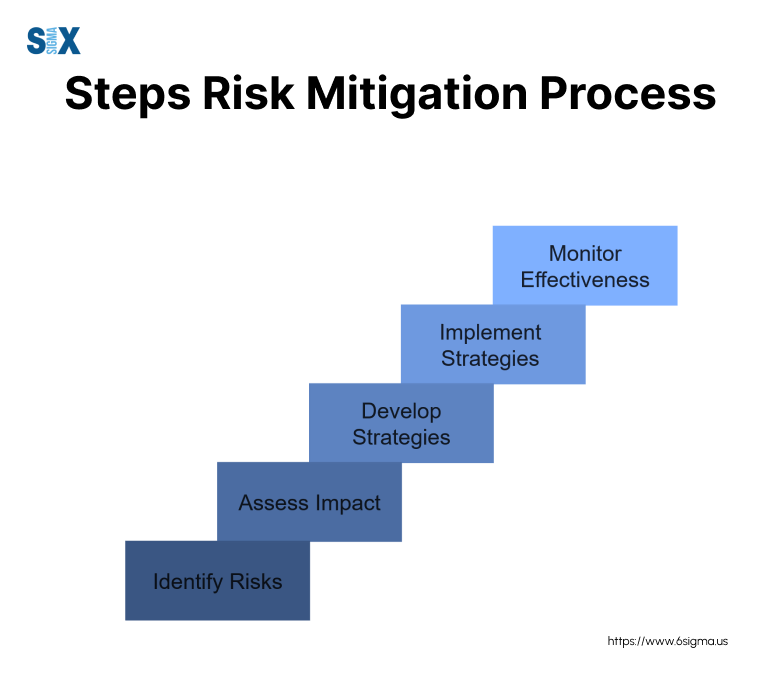

I’ve refined the risk mitigation process to a fine art. Let me walk you through the steps I’ve used successfully.

Risk Identification

The first step in any risk mitigation plan is identifying potential threats. In my experience, this is where many organizations falter. They either overlook critical risks or get bogged down trying to identify every possible scenario.

Here are some effective methods I’ve used for risk identification:

- Brainstorming sessions: I often facilitate these with cross-functional teams to capture diverse perspectives.

- SWOT analysis: This helps identify internal and external factors that could pose risks.

- Process mapping: When I worked with Motorola, we used this technique to uncover operational risks in their supply chain.

- Historical data analysis: Past incidents can provide valuable insights into potential future risks.

Remember, the goal isn’t to identify every conceivable risk but to focus on those most likely to impact your objectives significantly.

Risk Analysis and Evaluation

Once risks are identified, the next step is to analyze and evaluate them. This is where my background in statistics comes into play.

To assess the likelihood and potential impact of risks, I typically use:

- Probability and impact matrices: These visual tools help prioritize risks based on their likelihood and potential consequences.

- Expected Monetary Value (EMV) analysis: This quantitative technique helps calculate the potential financial impact of risks.

- Failure Mode and Effects Analysis (FMEA): I’ve found this particularly useful in manufacturing environments, like when I worked with Seagate on improving their production processes.

The key is to use a consistent methodology to prioritize risks objectively. This ensures you’re focusing your mitigation efforts where they’ll have the most significant impact.

Developing Risk Mitigation Strategies

With risks identified and prioritized, it’s time to develop mitigation strategies. In my workshops on risk mitigation, I always emphasize the four primary approaches:

- Avoid: Eliminate the risk by changing plans or removing the risk source.

- Reduce: Minimize the probability or impact of the risk.

- Transfer: Shift the risk to a third party (e.g., insurance).

- Accept: Acknowledge the risk and be prepared to manage its consequences if it occurs.

The strategy you choose depends on the nature of the risk and your organization’s risk tolerance. For instance, when I worked with Intel on a new product launch, we used a combination of reduction strategies for technical risks and transfer strategies for market risks.

Implementing and Monitoring Risk Mitigation Plans

Developing strategies is only half the battle. The real challenge lies in implementation and ongoing monitoring. Here’s the approach I’ve used successfully across numerous projects:

- Assign clear ownership: Each risk should have a designated owner responsible for its mitigation.

- Set measurable targets: Define what success looks like for each mitigation strategy.

- Establish review cycles: Regular check-ins help ensure strategies are working as intended.

- Be prepared to adapt: As I always tell my clients, risk mitigation is not a “set it and forget it” process. You need to be ready to adjust your strategies as circumstances change.

Remember, effective risk mitigation isn’t about eliminating all risks—that’s simply not possible in today’s dynamic business environment.

Instead, it’s about understanding your risks, prioritizing them effectively, and implementing strategies that align with your business objectives. With practice and the right tools, you can turn potential threats into opportunities for growth and innovation.

Ready to implement robust risk mitigation plans in your organization? Our Lean Six Sigma Black Belt course provides advanced training in:

- Developing comprehensive risk management frameworks

- Implementing and monitoring risk mitigation strategies

- Leading organizational change for effective risk management

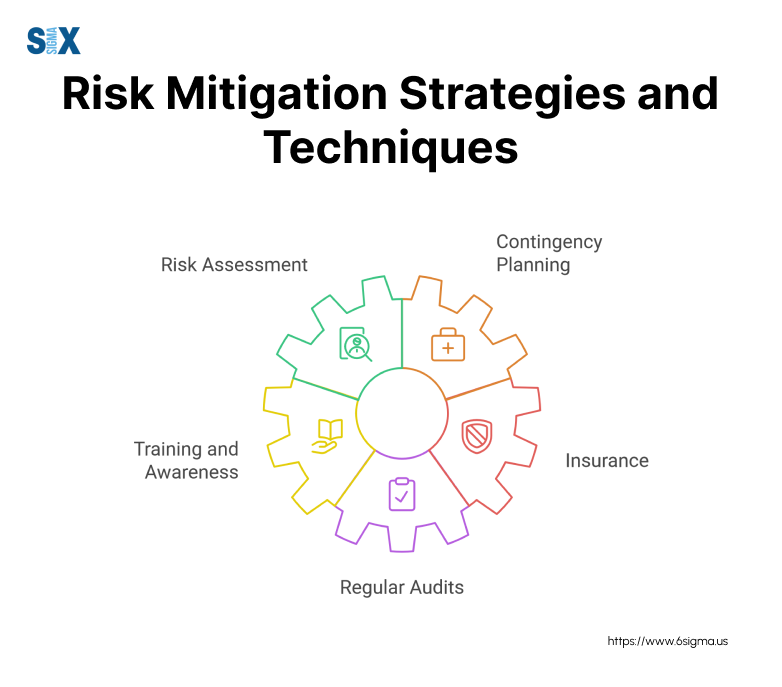

Risk Mitigation Strategies and Techniques

I’ve developed and refined a comprehensive toolkit of risk mitigation techniques. Let me share some of the most effective strategies I’ve encountered and implemented.

Proactive Risk Mitigation Strategies

Proactive risk mitigation is all about anticipating and preventing risks before they occur. It’s a principle I’ve championed throughout my career, from my early days at 3M to my current role leading SixSigma.us.

Some key proactive strategies include:

- Risk avoidance: This involves changing plans to eliminate risk. For instance, when I worked with Intel on a new product launch, we decided to delay the release to avoid potential quality issues.

- Risk reduction: This strategy aims to reduce the probability or impact of a risk. During my time at Motorola, we implemented robust quality control measures to mitigate production defects.

- Risk transfer: This involves shifting the risk to a third party. Insurance is a classic example, but in my work with tech companies, I’ve also seen this applied through strategic partnerships and outsourcing agreements.

Remember, proactive strategies aim to address risks before they become problems. As I often tell my workshop participants, “An ounce of prevention is worth a pound of cure”.

Reactive Risk Mitigation Strategies

While proactive strategies are ideal, we can’t always prevent every risk. That’s where reactive strategies come in. These are the plans we put in place to respond quickly and effectively when risks do materialize.

Key reactive strategies include:

- Contingency planning: This involves developing predetermined responses to specific risk events. In my work with Xerox, we created detailed contingency plans for various supply chain disruptions.

- Crisis management: This strategy focuses on managing the fallout from unexpected events. I recall a project where we had to quickly implement a crisis management plan due to a sudden regulatory change.

- Adaptive project management: This involves continuously adjusting project plans based on emerging risks. It’s an approach I’ve found particularly effective in fast-paced industries like technology and finance.

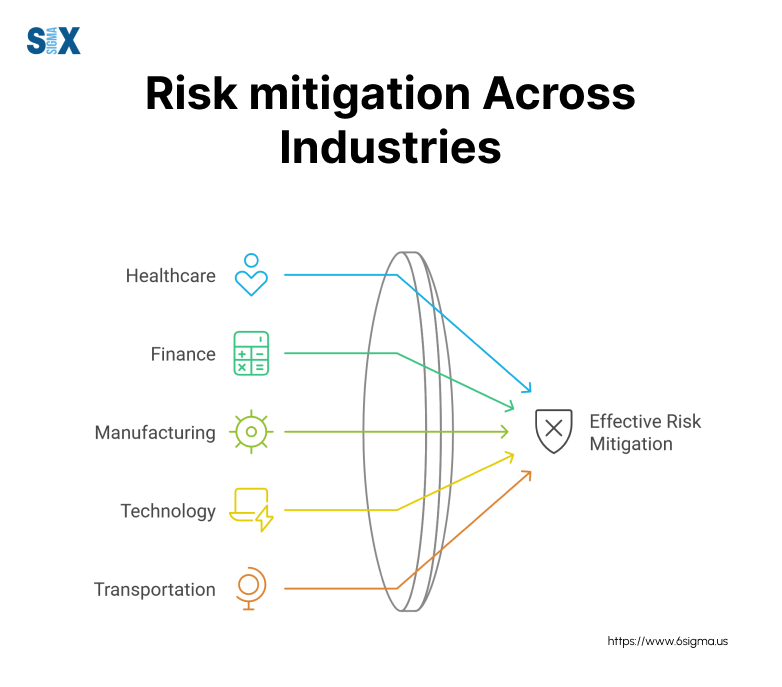

Industry-Specific Risk Mitigation Strategies

Over the years, I’ve learned that while general risk mitigation principles apply across industries, effective implementation often requires industry-specific approaches.

In finance, for example, I’ve worked on developing sophisticated models for market risk mitigation. In healthcare, my focus has often been on patient safety and regulatory compliance risks. And in technology, I’ve helped companies mitigate risks associated with rapid innovation and obsolescence.

One case study that stands out is my work with a major pharmaceutical company. We implemented a risk mitigation strategy that combined rigorous quality control measures with an adaptive clinical trial design.

This approach not only improved patient safety but also significantly reduced the time and cost of bringing new drugs to market.

Emerging Techniques in Risk Mitigation

The field of risk mitigation is constantly evolving, and I’m always excited to explore and implement new techniques. Some of the most promising developments I’ve seen include:

- AI and Machine Learning: These technologies are revolutionizing risk prediction and assessment. In a recent project with a global manufacturing firm, we used machine learning algorithms to predict equipment failures, allowing for preemptive maintenance and significant cost savings.

- Data Analytics and Predictive Modeling: Advanced analytics are providing unprecedented insights into risk patterns. I’ve used these techniques to help companies in various industries, from predicting consumer behavior for retailers to forecasting market trends for financial institutions.

- Blockchain Technology: While still in its early stages, blockchain has exciting potential for risk mitigation, particularly in supply chain management and financial transactions. I’m currently working on a project exploring its application in secure, transparent record-keeping for a multinational corporation.

Remember, the key to effective risk mitigation is not just knowing these strategies, but understanding how to apply them in your specific context. It’s about creating a culture of risk awareness and continuously adapting your approach as new challenges and opportunities emerge.

Best Practices for Effective Risk Mitigation

Successful risk mitigation isn’t just about implementing strategies—it’s about creating an environment where risk awareness and mitigation become second nature.

Building a Risk-Aware Culture

The foundation of effective risk mitigation is a risk-aware organizational culture. The key lesson I learned is that innovation and risk-taking were balanced with robust risk management practices.

To foster a risk-aware culture:

- Encourage open communication: Create channels for employees at all levels to report potential risks without fear of repercussions.

- Provide regular training: I’ve conducted numerous workshops on risk identification and mitigation techniques. These sessions not only enhance skills but also reinforce the importance of risk awareness.

- Lead by example: Leadership plays a crucial role. When I worked with Xerox, we saw a significant improvement in risk mitigation after top executives began actively participating in risk assessment meetings.

Remember, building a risk-aware culture is not about creating a risk-averse environment. It’s about empowering every member of your organization to identify, communicate, and address risks proactively.

Integrating Risk Mitigation with Business Processes

Risk mitigation shouldn’t be a separate function—it should be woven into the fabric of your day-to-day operations. This integration was a key focus during my work on Six Sigma deployment strategies for product and process development.

Here are some strategies for integration:

- Incorporate risk assessment into project planning: Make risk identification and mitigation planning a mandatory part of every project kickoff.

- Use risk metrics in performance evaluations: This encourages employees to take risk mitigation seriously.

- Implement cross-functional risk teams: When I worked with Intel, we created cross-departmental teams to address company-wide risks, fostering collaboration and a holistic approach to risk mitigation.

Continuous Improvement and Learning

In the dynamic world of risk mitigation, standing still means falling behind. That’s why continuous improvement and learning are crucial. This aligns perfectly with the Six Sigma methodology I’ve applied throughout my career.

To foster continuous improvement:

- Conduct regular post-mortems: After every major project or risk event, hold a session to discuss what went well and what could be improved.

- Create a risk knowledge base: During my time at HP, we developed a company-wide database of risk events and mitigation strategies, allowing teams to learn from each other’s experiences.

- Stay updated on industry trends: Attend conferences, read industry publications, and network with other risk management professionals. I’ve found my international project experiences invaluable for gaining global perspectives on risk mitigation.

Remember, effective risk mitigation is not a one-time effort—it’s an ongoing process of awareness, integration, and improvement. By following these best practices, you can create a robust risk mitigation framework that not only protects your organization but also drives innovation and growth.

Case Studies and Success Stories

I’ve had the privilege of witnessing both triumphs and failures in risk mitigation across various industries. These real-world experiences have been invaluable in shaping my approach to risk management. Let me share some of the most impactful cases I’ve encountered.

Examples of Effective Risk Mitigation

Semiconductor Manufacturing Risk Mitigation

During my work with Intel, we faced a significant challenge with their new chip manufacturing process. The risk of defects was high, potentially leading to millions in losses.

Strategy: We implemented a comprehensive risk mitigation plan that included:

- Advanced statistical process control

- Real-time monitoring systems

- Rapid response protocols for anomalies

Outcome: Defect rates were reduced by 75%, saving the company an estimated $50 million annually.

Key Takeaway: Proactive, data-driven risk mitigation strategies can have a substantial impact on both quality and the bottom line.

Supply Chain Risk Mitigation in the Automotive Industry

While consulting for a major automotive manufacturer, we identified vulnerabilities in their global supply chain.

Strategy: Our risk mitigation approach involved:

- Diversifying supplier base

- Implementing blockchain for enhanced traceability

- Developing contingency plans for key components

Outcome: When a major supplier faced a crisis, the company was able to switch to alternatives seamlessly, avoiding an estimated $100 million in potential losses.

Key Takeaway: A robust risk mitigation strategy should anticipate potential disruptions and have clear, actionable contingency plans.

Lessons from Risk Mitigation Failures

Financial Sector Cybersecurity Breach

In my work with a large financial institution, I witnessed the aftermath of a significant cybersecurity breach.

What Went Wrong: The company had underestimated the evolving nature of cyber threats and had not updated its risk mitigation strategies accordingly.

Prevention Strategy: Regular risk assessments, continuous employee training, and investment in cutting-edge cybersecurity technologies could have prevented this breach.

Key Insight: Risk mitigation strategies must evolve with the changing risk landscape. What worked yesterday may not be sufficient for tomorrow’s threats.

Pharmaceutical Product Recall

During a project with a pharmaceutical company, I observed a costly product recall due to inadequate risk mitigation in the quality control process.

What Went Wrong: The company had focused on speed-to-market at the expense of thorough risk assessment and mitigation in their production process.

Prevention Strategy: Implementing a more rigorous risk-based testing approach and enhancing cross-functional communication could have identified and addressed the issue before it escalated.

Key Insight: Effective risk mitigation requires a balance between efficiency and thoroughness. Cutting corners in risk assessment can lead to far greater costs down the line.

These case studies underscore a crucial point: risk mitigation is not a one-size-fits-all approach. It requires a deep understanding of your specific industry, constant vigilance, and the flexibility to adapt your strategies as new risks emerge.

The Future of Risk Mitigation

The future of risk mitigation is both exciting and challenging, shaped by rapid technological advancements and an increasingly interconnected global economy.

Emerging Trends in Risk Mitigation

In my recent work with tech giants and forward-thinking startups alike, I’ve observed several key trends that are reshaping risk mitigation strategies:

- AI and Machine Learning: These technologies are revolutionizing our ability to predict and respond to risks. During a recent project with a global manufacturing firm, we implemented AI-driven predictive maintenance, reducing downtime by 35% and saving millions in potential losses.

- Big Data Analytics: The sheer volume of data available today allows for more sophisticated risk modeling. I’ve been working on developing advanced analytics tools that can process vast amounts of data to identify subtle risk patterns that human analysts might miss.

- Internet of Things (IoT): Connected devices are providing real-time risk data. In a recent collaboration with an automotive company, we used IoT sensors to monitor supply chain risks, allowing for proactive mitigation of potential disruptions.

- Blockchain Technology: This is transforming how we approach risk in areas like supply chain management and financial transactions. I’m currently involved in a project exploring blockchain’s potential for enhancing transparency and reducing fraud risks in international trade.

Moreover, the growing focus on global and interconnected risks is changing how we approach risk mitigation. Climate change, geopolitical instability, and pandemics have shown us that risks don’t respect borders.

In response, I’ve been developing cross-border risk mitigation strategies that take into account these complex, interconnected threats.

Sustainability and ESG (Environmental, Social, and Governance) concerns are also becoming integral to risk mitigation. Companies are realizing that ignoring these factors can lead to significant reputational and financial risks.

I’ve been helping organizations integrate ESG considerations into their risk mitigation frameworks, ensuring they’re prepared for the challenges of a more socially and environmentally conscious market.

Preparing for Future Risks

To stay ahead in this evolving risk landscape, organizations need to be proactive and adaptable. Here are some strategies I’ve been implementing with my clients:

- Scenario Planning: We’re using advanced modeling techniques to anticipate a wide range of potential future risks. This allows organizations to develop flexible mitigation strategies that can adapt to various scenarios.

- Continuous Learning: I’m a strong advocate for creating a culture of continuous learning within organizations. This involves regular training, knowledge sharing, and staying updated on emerging risks and mitigation techniques.

- Cross-Functional Collaboration: Future risks will be complex and multifaceted. I’m helping companies break down silos and foster collaboration between different departments to create more comprehensive risk mitigation strategies.

- Leveraging Emerging Technologies: I encourage organizations to stay at the forefront of technological advancements. Whether it’s implementing AI for risk prediction or using blockchain for secure transactions, embracing these technologies can give you a significant edge in risk mitigation.

- Global Perspective: In our interconnected world, it’s crucial to have a global view of risks. I’ve been conducting international risk assessment workshops, helping organizations understand and prepare for risks from a global perspective.

As we look to the future, one thing is clear: the field of risk mitigation will continue to evolve rapidly. Organizations that can anticipate these changes, adapt their strategies, and leverage new technologies will be best positioned to thrive in an increasingly complex and uncertain business environment.

SixSigma.us offers both Live Virtual classes as well as Online Self-Paced training. Most option includes access to the same great Master Black Belt instructors that teach our World Class in-person sessions. Sign-up today!

Virtual Classroom Training Programs Self-Paced Online Training Programs