Risk Management Tools: Mastering Techniques for Project Success

Risk management can mean the difference between project success and costly failure.

Mastering risk management tools and techniques is essential for navigating uncertainties and safeguarding your organization’s future.

Both traditional methodologies and cutting-edge software solutions are designed to identify, assess, and mitigate risks across various industries.

Key Highlights

- A curated list of 15-20 essential risk management tools and techniques

- Step-by-step guides for implementing key project management risk tools

- Comparisons of manual approaches vs. risk management tools software

- Industry-specific applications, including third-party risk management tools

- Emerging trends in operational risk management tools, such as AI and machine learning

Understanding Risk Management Tools

Mastering risk management tools and techniques is crucial for project success.

Whether you’re a seasoned project manager or new to the field, understanding the fundamentals of risk management is essential for navigating uncertainties and achieving your project goals.

Defining Risk Management in Project Contexts

Risk management in project management is the systematic process of identifying, analyzing, and responding to potential threats or opportunities that may impact project objectives.

It’s a critical component of project planning and execution, involving the use of various risk management tools for project management to minimize negative impacts and maximize positive outcomes.

Project management risk tools are designed to help teams:

- Identify potential risks early in the project lifecycle

- Assess the likelihood and impact of these risks

- Develop strategies to mitigate or capitalize on risks

- Monitor and control risks throughout the project

The Risk Management Process: A Step-by-Step Overview

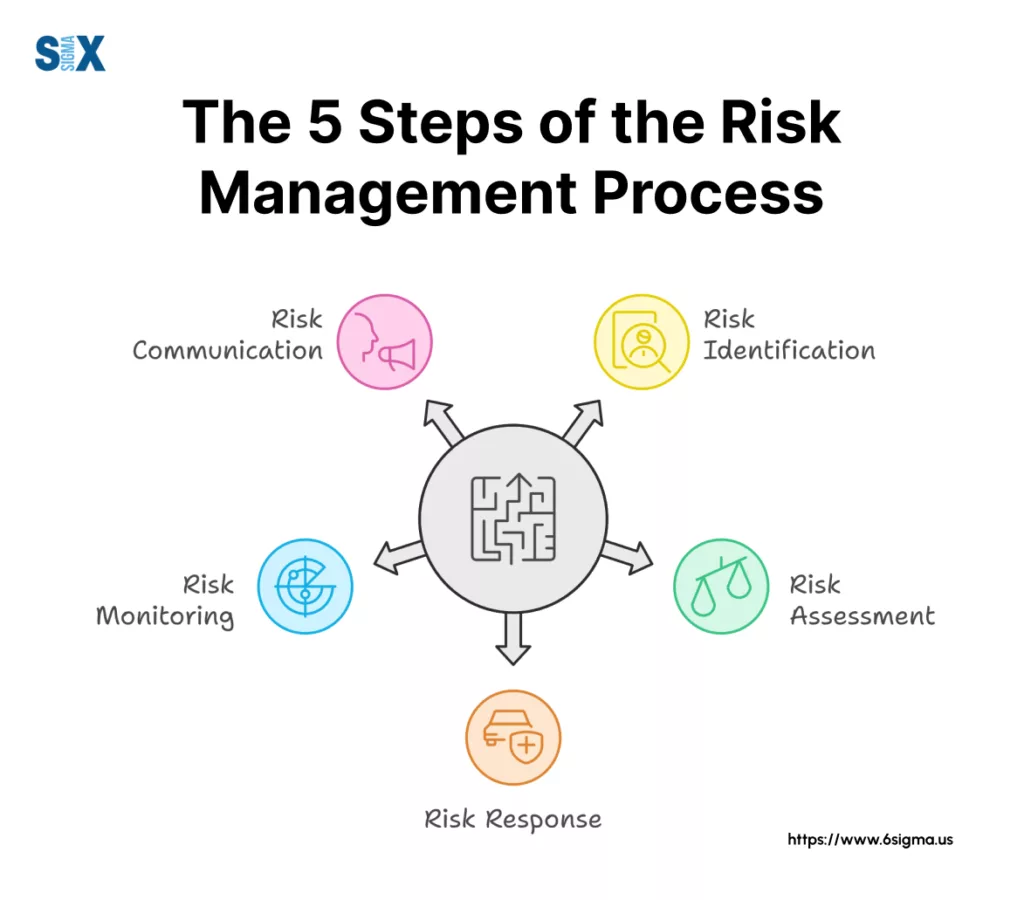

The risk management process typically involves five key steps, each supported by specific risk management tools in project management:

- Risk Identification: Using techniques like brainstorming, checklists, and historical data analysis to identify potential risks.

- Risk Analysis: Employing qualitative and quantitative methods to assess the probability and impact of identified risks.

- Risk Prioritization: Ranking risks based on their potential impact on project objectives.

- Risk Response Planning: Developing strategies to address prioritized risks, including avoidance, mitigation, transfer, or acceptance.

- Risk Monitoring and Control: Continuously tracking identified risks and implementing response plans as needed.

Why Proactive Risk Management Matters: Real-World Impact

Implementing effective risk management tools and techniques can significantly impact project outcomes.

Consider this case study: A mid-sized IT company implementing a new customer relationship management (CRM) system used project risk management tools to identify potential issues early on.

By utilizing a risk register and probability-impact matrix, they were able to:

- Anticipate and mitigate data migration challenges

- Plan for user adoption resistance

- Allocate resources more effectively

As a result, the project was completed on time and within budget, with a 95% user adoption rate within the first month.

By embracing risk management tools and techniques, project managers can:

- Improve decision-making through data-driven insights

- Enhance stakeholder confidence and communication

- Increase project resilience and adaptability

- Optimize resource allocation and cost management

As we delve deeper into specific risk management tools software and methodologies in the following sections, remember that the key to success lies in consistently applying these principles throughout your project lifecycle.

Whether you’re dealing with IT risk management tools or broader enterprise risk management tools, the foundational concepts remain the same.

Ehance your risk management skills with our Yellow Belt course provides essential tools to identify and mitigate risks effectively.

Essential Risk Management Tools and Techniques

Having a robust toolkit of risk management tools and techniques is crucial for success.

These risk management tools for project management help teams identify, assess, and respond to potential threats and opportunities effectively.

Risk Identification Tools

Brainstorming and SWOT Analysis

Brainstorming is a collaborative technique used to generate a comprehensive list of potential risks.

When combined with a SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis, it becomes a powerful risk management tool for identifying both internal and external factors that could impact your project.

Pros:

- Encourages creative thinking

- Involves diverse perspectives

Cons:

- Can be time-consuming

- May generate irrelevant ideas

Step-by-Step Guide:

- Assemble a diverse team

- Clearly define the project scope

- Conduct a brainstorming session to list potential risks

- Categorize risks using the SWOT framework

- Refine and prioritize the identified risks

- Delphi Technique – The Delphi technique is a structured communication method used to gather expert opinions on potential risks anonymously. This risk management tool is particularly useful for complex projects or when dealing with sensitive issues.

Pros:

- Reduces bias and groupthink

- Provides expert insights

Cons:

- Can be time-consuming

- Relies heavily on expert availability

Root Cause Analysis

Root Cause Analysis (RCA) is a problem-solving method used to identify the underlying causes of potential risks.

This technique is essential for addressing the source of risks rather than just their symptoms.

Pros:

- Addresses fundamental issues

- Prevents recurring problems

Cons:

- Can be resource-intensive

- May uncover complex, interconnected issues

Risk Assessment and Analysis Tools

Probability and Impact Matrix

The Probability and Impact Matrix is a visual tool used to assess and prioritize risks based on their likelihood of occurrence and potential impact on the project.

This risk management tool is essential for focusing resources on the most critical risks.

Pros:

- Provides clear risk prioritization

- Easy to understand and communicate

Cons:

- Can oversimplify complex risks

- Subjective scoring may lead to inconsistencies

Step-by-Step Guide:

- List identified risks

- Assess the probability of each risk occurring (Low, Medium, High)

- Evaluate the potential impact of each risk (Low, Medium, High)

- Plot risks on the matrix

- Prioritize risks based on their position in the matrix

Risk Data Quality Assessment

This technique evaluates the quality and reliability of data used in risk analysis. It’s crucial for ensuring that risk management decisions are based on accurate and relevant information.

Pros:

- Improves decision-making accuracy

- Identifies data gaps

Cons:

- Can be complex and time-consuming

- Requires specialized knowledge

Monte Carlo Simulation

Monte Carlo Simulation is a sophisticated risk management tool software that uses statistical modeling to predict various project outcomes based on different risk scenarios.

Pros:

- Provides quantitative risk analysis

- Accounts for multiple variables and uncertainties

Cons:

- Requires specialized software and expertise

- Can be computationally intensive

Risk Response Planning Tools

Risk Register

A risk register is a comprehensive document that lists all identified risks, their assessments, and planned responses.

It’s a fundamental risk management tool used throughout the project lifecycle.

Pros:

- Centralizes risk information

- Facilitates ongoing risk monitoring

Cons:

- Requires regular updates

- Can become unwieldy for large projects

Decision Tree Analysis

Decision Tree Analysis is a graphical tool that maps out different decision paths and their potential outcomes, including associated risks and rewards.

Pros:

- Visualizes decision consequences

- Supports quantitative analysis

Cons:

- Can become complex for multi-layered decisions

- Requires accurate probability estimates

Expected Monetary Value (EMV) Analysis

EMV Analysis is a quantitative technique used to calculate the average outcome of scenarios involving uncertainty.

It’s particularly useful for financial risk assessment.

Pros:

- Provides a numerical basis for decision-making

- Accounts for both positive and negative outcomes

Cons:

- Relies heavily on accurate probability estimates

- May not account for non-financial factors

By mastering these essential risk management tools and techniques, project managers and business leaders can significantly enhance their ability to navigate uncertainties and drive project success.

Whether you’re using traditional project management risk tools or advanced risk management tools software, the key is to apply these techniques consistently and adapt them to your specific project needs.

Take your risk management skills to the next level. Our Green Belt course equips you with advanced tools to analyze and mitigate complex risks.

Software-Based Risk Management Solutions

Risk management tools software has revolutionized how organizations approach risk management.

These advanced solutions offer powerful capabilities that go beyond traditional manual methods, providing real-time insights and streamlined processes for managing risks effectively.

Comparing Manual vs. Software-Based Approaches

While manual risk management techniques have their place, software-based solutions offer significant advantages:

- Efficiency: Risk management tools software automates time-consuming tasks, allowing teams to focus on strategic decision-making.

- Real-time monitoring: Software solutions provide up-to-date risk data, enabling quicker responses to emerging threats.

- Collaborative features: Cloud-based platforms facilitate team collaboration and information sharing across departments.

- Advanced analytics: Many IT risk management tools incorporate AI and machine learning for predictive risk analysis.

- Scalability: Software solutions can easily adapt to growing organizational needs and increasing data volumes.

Top Risk Management Software Tools

Let’s explore some popular risk management tools software that cater to various organizational needs:

- LogicManager: An enterprise risk management tool that offers a holistic approach to risk assessment and mitigation.

- Resolver: Provides comprehensive operational risk management tools with robust reporting capabilities.

- Metricstream: Offers integrated solutions for governance, risk, and compliance management.

- Riskonnect: A cloud-based platform that specializes in third-party risk management tools and enterprise risk management.

Here’s a comparison table of the top risk management software listed:

| Feature/Software | LogicManager | Resolver | MetricStream | Riskonnect |

|---|---|---|---|---|

| Overview | Holistic enterprise risk management tool | Comprehensive operational risk management with robust reporting | Integrated solutions for governance, risk, and compliance management | Cloud-based platform specializing in third-party and enterprise risk |

| Core Focus | Enterprise risk management, policy management, compliance | Operational risk, incident management, audit, IT risk | Governance, risk management, compliance | Third-party risk management, enterprise risk management |

| Reporting Capabilities | Advanced reporting features | Robust reporting capabilities | Customizable dashboards and reporting | Flexible reporting with data visualization |

| Deployment | Cloud-based or on-premises | Cloud-based | Cloud-based, on-premises, and hybrid | Cloud-based |

| Third-Party Risk | Provides tools for third-party risk assessment | Basic third-party risk management capabilities | Comprehensive third-party risk management capabilities | Specializes in third-party risk management |

| Compliance Management | Strong compliance and regulatory management | Integrated compliance management | Advanced compliance features and GRC integration | Effective compliance management with third-party data integration |

| Ease of Use | User-friendly interface, customizable workflows | Intuitive UI, easy to implement | Customizable but may have a steeper learning curve | User-friendly with drag-and-drop functionality |

| Customization | Highly customizable workflows and templates | Configurable workflows and dashboards | Extensive customization options for workflows and reports | Customizable workflows and risk assessment templates |

| Integration | Integrates with various business tools (HR, finance systems, etc.) | Integrates with multiple data sources and business applications | Supports integrations with various enterprise systems | Extensive integrations with third-party applications |

| Scalability | Scalable for small to large enterprises | Suitable for mid to large enterprises | Designed for large enterprises with complex needs | Suitable for enterprises of all sizes |

Each software has its strengths, making them suitable for different organizational needs based on factors like deployment preferences, customization capabilities, and focus areas (e.g., compliance, third-party risk).

Integrating Risk Management Software with Existing Systems

To maximize the benefits of risk management tools software, it’s crucial to integrate them with existing project management and ERP systems.

This integration allows for:

- Seamless data flow between different organizational functions

- Consistent risk assessment across projects and departments

- Enhanced visibility of risk factors throughout the organization

When implementing risk management tools software, consider the following steps:

- Assess your current risk management processes and identify integration points

- Choose software that offers robust API capabilities for easy integration

- Involve IT teams early in the implementation process to ensure smooth data transfer

- Provide comprehensive training to staff on using the integrated systems effectively

By leveraging the power of risk management tools software and integrating them with existing systems, organizations can create a more robust and responsive risk management framework.

Industry-Specific Risk Management Applications

While risk management principles are universal, their application varies significantly across industries.

Financial Sector: Managing Market and Credit Risks

The financial industry faces complex risks related to market volatility, credit exposure, and regulatory compliance.

Enterprise risk management tools in this sector often focus on:

- Value at Risk (VaR) calculations

- Stress testing and scenario analysis

- Credit scoring models

Case Study: A major investment bank implemented advanced risk management tools software to conduct real-time stress tests on their trading portfolios.

This allowed them to adjust their positions quickly during market turbulence, reducing potential losses by 30% during a recent economic downturn.

Healthcare: Patient Safety and Regulatory Compliance

In healthcare, risk management is crucial for ensuring patient safety and maintaining regulatory compliance.

Key focus areas include:

- Clinical risk assessments

- HIPAA compliance monitoring

- Medical device safety tracking

Construction: Safety and Project Delivery Risks

The construction industry faces unique challenges related to worker safety and project execution. Risk management tools in this sector often address:

- Workplace safety assessments

- Project timeline and budget risk analysis

- Environmental impact evaluations

Case Study: A leading construction firm implemented project management risk tools that integrated safety protocols with project scheduling.

This resulted in a 60% reduction in workplace incidents and a 25% improvement in on-time project delivery.

IT: Cybersecurity and Data Protection Risks

In the rapidly evolving IT landscape, cybersecurity and data protection are paramount. IT risk management tools focus on:

- Vulnerability assessments and penetration testing

- Data breach prevention and response planning

- Compliance with data protection regulations (e.g., GDPR, CCPA)

By tailoring risk management approaches to industry-specific needs, organizations can more effectively identify, assess, and mitigate the unique risks they face.

Whether using specialized operational risk management tools or comprehensive enterprise risk management solutions, the key is to choose and implement tools that align closely with your industry’s specific risk landscape and regulatory environment.

Remember, regardless of the industry, successful risk management requires a combination of the right tools, processes, and a culture of risk awareness throughout the organization.

Want to uncover the root causes of risks in your projects? Our Root Cause Analysis course teaches you how to identify and address the underlying issues that lead to risks.

Empowering Your Organization with Effective Risk Management Tools

Throughout this comprehensive guide, we’ve explored a wide array of risk management tools and techniques essential for modern business challenges.

From traditional project management risk tools to cutting-edge risk management tools software, the importance of a robust risk management strategy cannot be overstated.

Key takeaways include:

- The critical role of risk management in project and business success

- The diverse range of risk management tools available, from simple techniques to sophisticated software solutions

- The importance of tailoring risk management approaches to specific industry needs

- The growing trend towards integrated, data-driven risk management practices

As we’ve seen, proactive risk management is not just about avoiding pitfalls; it’s about seizing opportunities and driving innovation.

By implementing the risk management tools and techniques discussed, organizations can:

- Enhance decision-making processes

- Improve project outcomes and operational efficiency

- Build resilience against unforeseen challenges

- Foster a culture of continuous improvement and risk awareness

We encourage you to take the next step in your risk management journey.

Start by assessing your current practices and identifying areas where the tools and techniques we’ve discussed can make an immediate impact.

Remember, effective risk management is an ongoing process that evolves with your organization’s needs.

By leveraging these powerful risk management tools and techniques, you’re not just managing risks – you’re positioning your organization for sustained success in an increasingly uncertain world.

Stay proactive, stay informed, and let risk management be your competitive advantage.

SixSigma.us offers both Live Virtual classes as well as Online Self-Paced training. Most option includes access to the same great Master Black Belt instructors that teach our World Class in-person sessions. Sign-up today!

Virtual Classroom Training Programs Self-Paced Online Training Programs