Risk Management Automation: Revolutionizing Business Resilience

In this industry traditional management methods always struggle to address these complex array of risks effectively.

A significant shift from manual process to tech-driven solutions help organization identify, assess, and mitigate risks more efficiently.

Key topics covered include:

- Essential components of automated risk systems

- Technology integration strategies

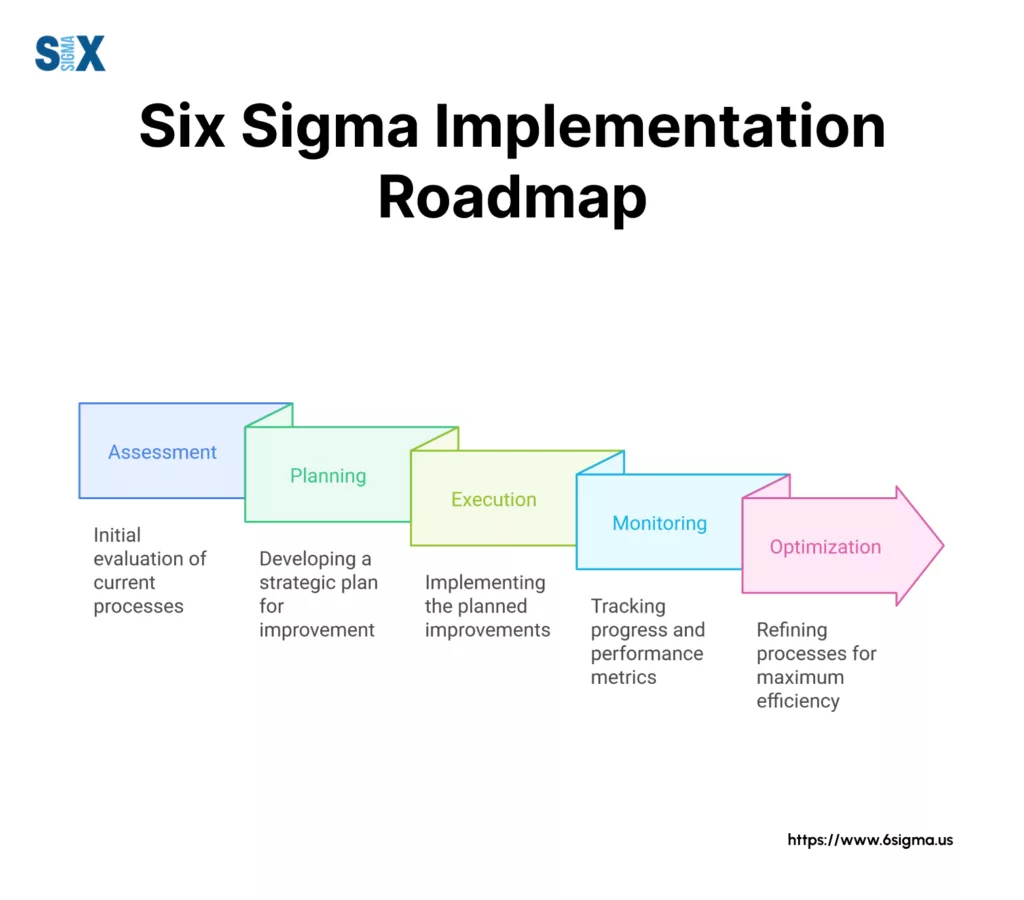

- Implementation roadmap and best practices

- Future trends shaping risk automation

What is Risk Management Automation?

Risk management automation transforms manual risk assessment and mitigation processes into streamlined, technology-driven operations.

This modern approach uses specialized software and systems to detect, evaluate, and respond to potential risks faster and more accurately than traditional methods.

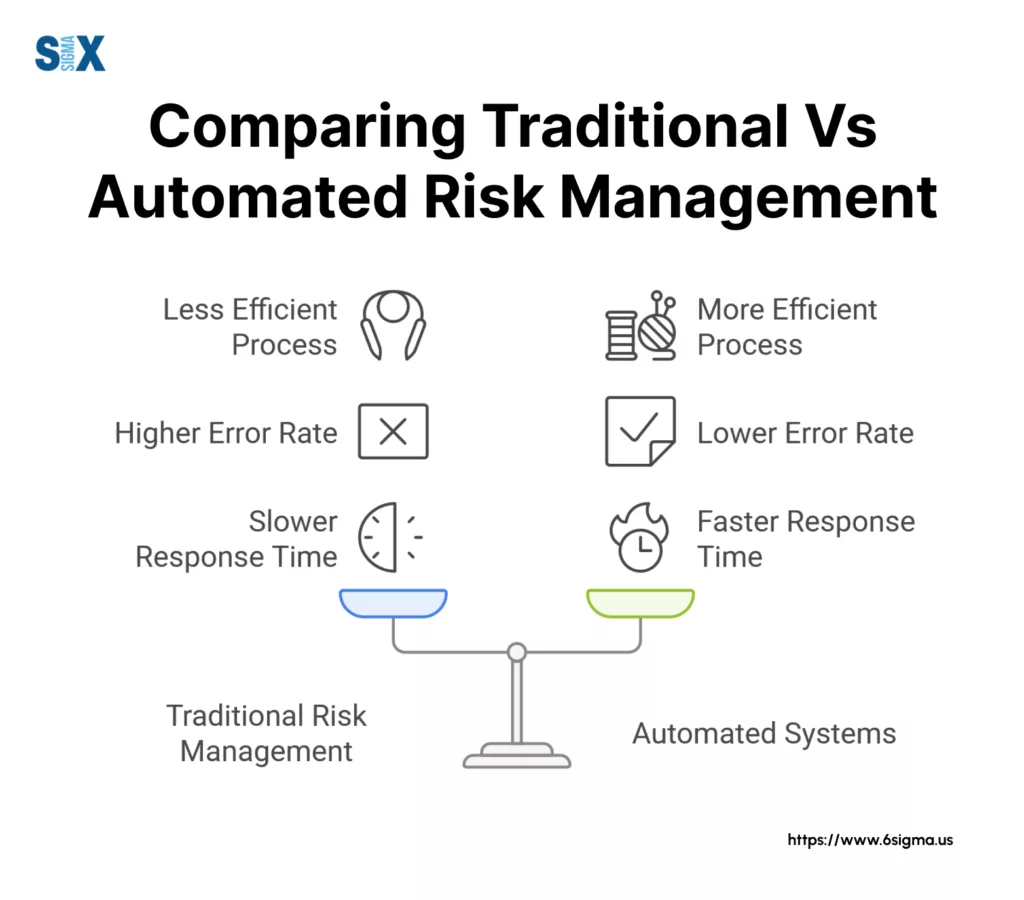

Traditional vs. Automated Risk Management

Traditional risk management relies heavily on manual processes, periodic assessments, and human judgment.

Teams often spend countless hours gathering data, updating spreadsheets, and creating reports. This approach frequently leads to delayed responses and missed warning signs.

In contrast, automated risk management systems operate continuously, processing vast amounts of data in real-time.

They can instantly flag potential issues, track regulatory changes, and maintain detailed audit trails. This shift from reactive to proactive risk management helps organizations stay ahead of emerging threats.

Learn how to identify and prevent failures before they occur with our FMEA certification course.

Technology’s Role in Risk Process Automation

Modern risk management automation systems leverage several key technologies:

- Advanced analytics engines process risk data and identify patterns

- Machine learning algorithms adapt to new risk patterns

- API integrations connect various data sources and systems

- Automated workflow tools streamline risk response procedures

The Reality of Automated Risk Assessment

Yes, risk assessment can be automated, but with important considerations.

While automation excels at processing data and identifying known risk patterns, human expertise remains crucial for interpreting complex scenarios and making strategic decisions.

The most effective approach combines automated systems’ efficiency with human insight and judgment.

Automated risk assessment tools handle:

- Data collection and organization

- Initial risk scoring and categorization

- Regulatory compliance monitoring

- Risk trend analysis and reporting

However, risk professionals must still:

- Define risk assessment criteria

- Evaluate complex risk scenarios

- Make final decisions on risk responses

- Update risk assessment parameters

This balanced approach to risk management automation delivers the best results, combining technological efficiency with human expertise to create more robust risk management processes.

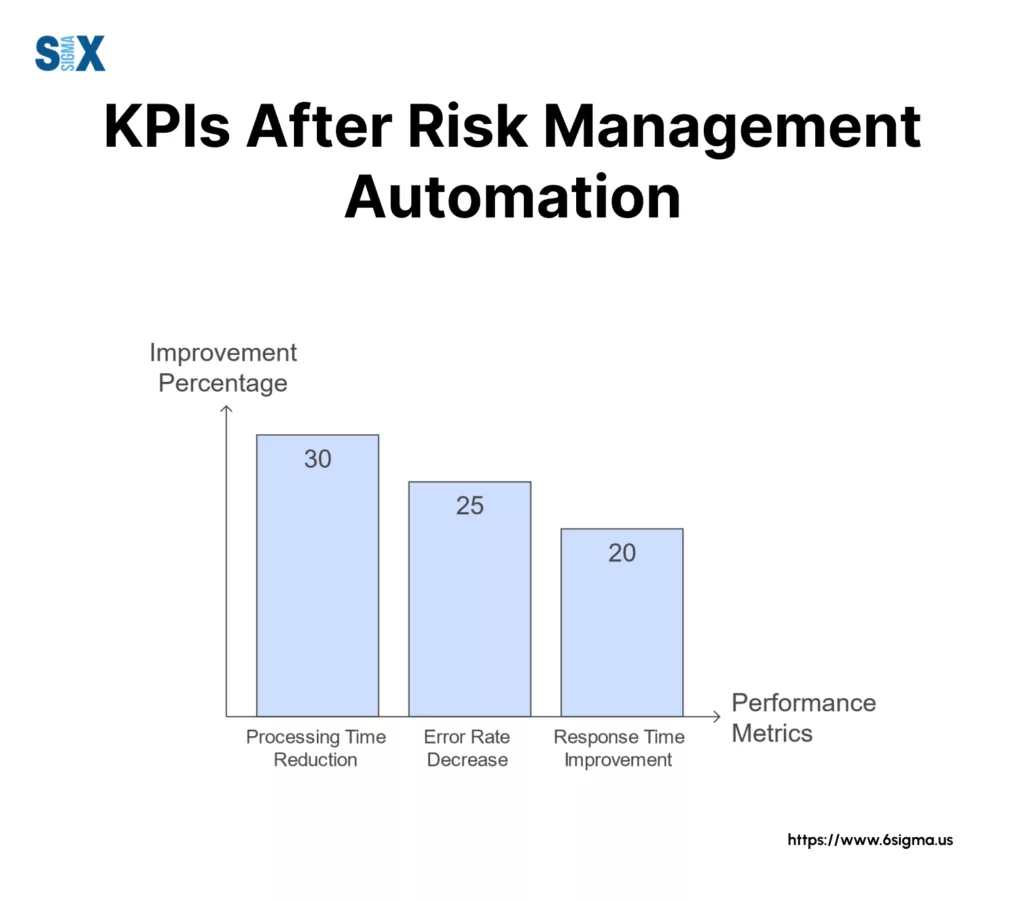

Key Benefits of Risk Management Automation

Organizations that automate risk management processes gain significant advantages.

These benefits directly impact operational efficiency, decision-making quality, and bottom-line results.

Efficiency and Accuracy Improvements

Automating risk management eliminates many time-consuming manual tasks that often lead to errors. Teams no longer need to spend hours updating spreadsheets or cross-referencing data sources.

Real-Time Risk Monitoring Capabilities

Modern risk automation tools provide instant visibility into potential threats and vulnerabilities. Rather than waiting for periodic risk assessments, organizations can monitor their risk profile continuously.

This real-time capability enables quick responses to emerging risks and helps prevent minor issues from escalating into major problems.

Better Decision-Making Through Data

Risk management automation transforms raw data into actionable insights. Decision-makers receive clear, data-driven recommendations based on current risk assessments.

This enhanced visibility helps leaders make more informed choices about risk mitigation strategies and resource allocation.

Cost and Resource Benefits

The financial benefits of automating risk management extend beyond direct cost savings. Organizations typically see:

- 40% reduction in compliance-related costs

- 50% decrease in time spent on routine risk assessments

- 30% improvement in resource utilization

- Significant reduction in audit preparation time

Scaling Risk Management Operations

As organizations grow, their risk management needs become more complex. Automated systems scale easily to accommodate increased data volumes, new risk types, and additional compliance requirements.

This scalability ensures that risk management capabilities grow alongside the business without requiring proportional increases in staff or resources.

Does Automation Actually Reduce Risk?

Yes, automation reduces risk in several ways. First, it minimizes human error in risk assessment and monitoring processes.

Second, it enables faster identification and response to potential threats. Third, it ensures consistent application of risk management protocols across the organization.

However, the effectiveness of risk reduction depends on proper implementation and ongoing management of the automation system. Organizations must:

- Configure systems to align with specific risk management needs

- Regularly update risk assessment parameters

- Train staff to use automation tools effectively

- Maintain human oversight of automated processes

The most successful risk management strategies combine automated efficiency with human expertise.

While automation handles routine tasks and data processing, risk professionals focus on strategic analysis and complex decision-making.

Maximize your organization’s efficiency by learning systematic approaches to identify and eliminate process waste.

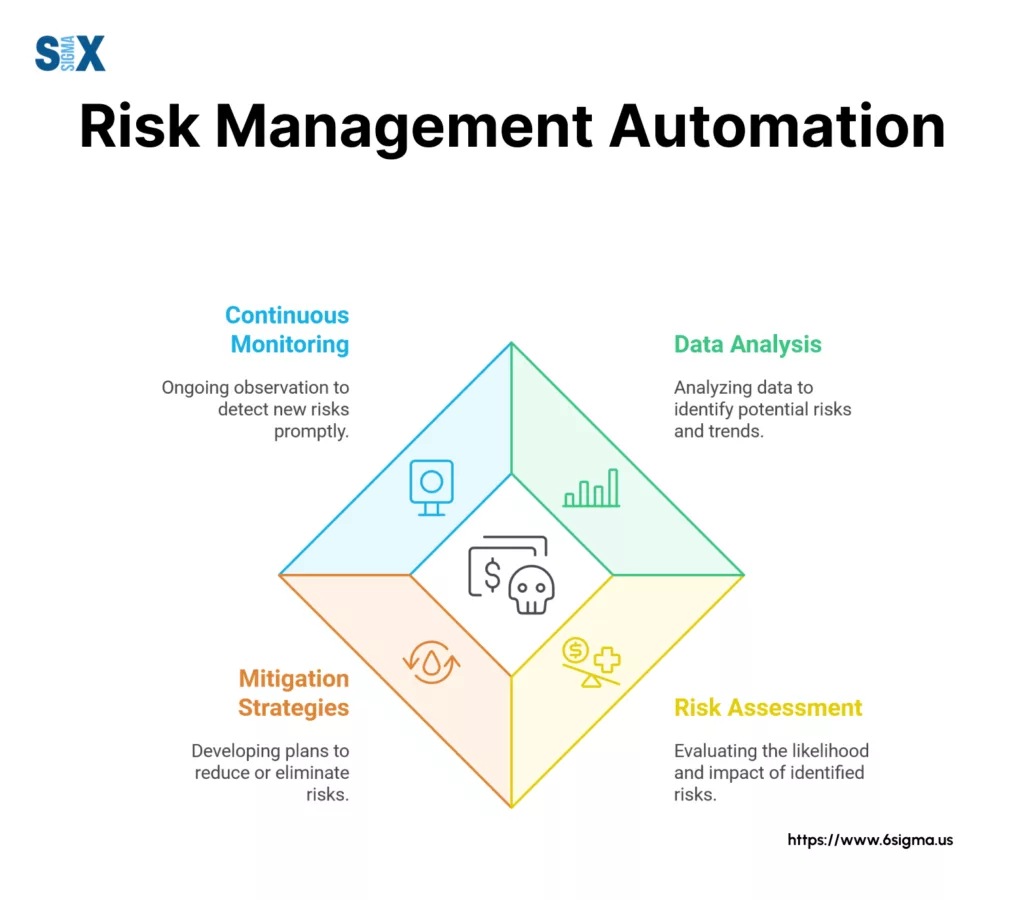

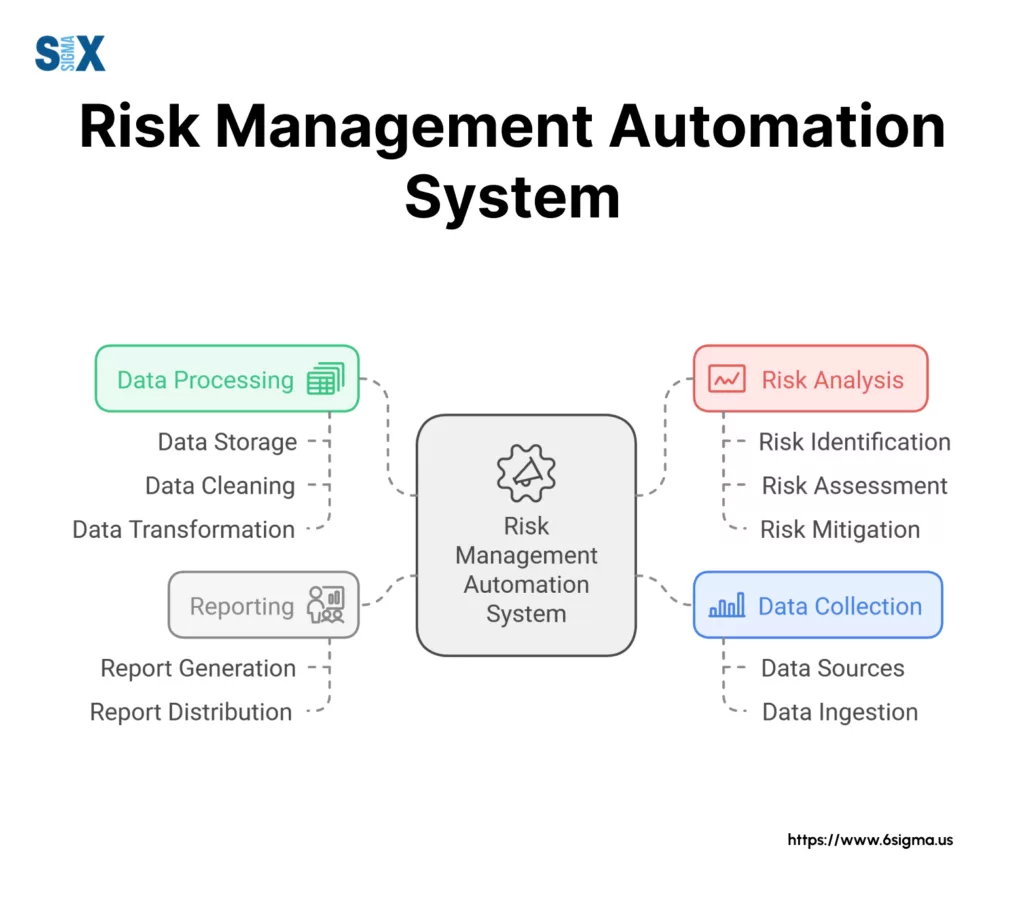

Essential Components of Risk Management Automation Systems

Modern risk management automation software consists of several interconnected components that work together to create an effective risk management framework.

Understanding these elements helps organizations select and implement the right solutions for their needs.

Data Collection and Integration Framework

The foundation of any business risk management automation system lies in its data handling capabilities.

These systems collect information from multiple sources, including internal databases, external feeds, and third-party applications.

Advanced integration tools standardize this data, making it usable for risk assessment and analysis.

Organizations typically integrate data from:

- Enterprise resource planning systems

- Customer relationship management platforms

- Financial management software

- Regulatory compliance databases

- Security monitoring tools

Risk Identification and Assessment Tools

Risk management automation software employs sophisticated algorithms to identify and evaluate potential risks.

These tools analyze patterns, detect anomalies, and flag potential issues before they escalate into serious problems. The assessment components calculate risk scores based on predefined criteria and organizational risk tolerance levels.

Reporting and Dashboard Capabilities

Automated reporting tools transform complex risk data into clear, actionable insights. Modern dashboards provide real-time visibility into risk metrics, allowing stakeholders to:

- Monitor key risk indicators

- Track mitigation progress

- Review compliance status

- Access historical risk data

- Generate custom reports

Workflow and Task Automation

The workflow component of risk management automation systems handles routine tasks and processes automatically. This includes:

- Risk assessment scheduling

- Alert notification distribution

- Task assignment and tracking

- Approval process management

- Documentation updates

System Integration Architecture

Business risk management automation systems must seamlessly connect with existing enterprise software.

The integration architecture includes:

- API connections for data exchange

- Security protocols for safe data transfer

- Automated synchronization mechanisms

- Custom integration modules for legacy systems

These integrations ensure smooth data flow while maintaining data integrity and security across all connected platforms.

Each component plays a crucial role in creating a robust risk management framework.

When properly implemented, these elements work together to provide a unified view of organizational risk while streamlining risk management processes.

Transform complex data into actionable insights with our comprehensive statistics and analysis course

How to Implement Risk Management Automation Successfully

The implementation of risk management automation tools requires careful planning and execution.

This guide outlines the essential steps organizations should follow to ensure a successful transition to automated risk management processes.

Evaluating Current Risk Management Practices

Before selecting risk management automation tools, organizations must thoroughly evaluate their existing processes.

This evaluation should document current workflows, identify bottlenecks, and highlight areas where automation will deliver the most value.

The assessment phase typically takes 4-6 weeks and involves stakeholders from risk management, IT, and business operations teams.

Setting Clear Automation Objectives

Organizations need specific, measurable goals for their integrated risk management automation initiative. These objectives might include:

- Reducing risk assessment time by 50%

- Automating 80% of routine risk monitoring tasks

- Achieving real-time risk reporting capabilities

- Improving regulatory compliance tracking accuracy

The scope should clearly define which processes will be automated and which will remain manual, creating realistic expectations for all stakeholders.

Selecting Appropriate Automation Solutions

The selection of risk management automation tools should align with organizational requirements and technical capabilities. Key considerations include:

- Integration capabilities with existing systems

- Scalability to accommodate future growth

- Customization options for specific needs

- Vendor support and implementation assistance

- Total cost of ownership

System Integration and Setup Process

The integration phase requires careful coordination between IT teams and automation vendors. This process involves:

- Data mapping and migration planning

- API configuration and testing

- Security protocol implementation

- User access control setup

- Initial system configuration

Testing and Validation Procedures

Rigorous testing ensures the automated system performs as expected. Organizations should conduct:

- Unit testing of individual components

- Integration testing across systems

- User acceptance testing

- Performance testing under various scenarios

- Security and compliance validation

Managing Organizational Change

The success of risk management automation depends heavily on user adoption. A structured change management approach should include:

- Detailed training programs for all user groups

- Clear communication about system changes

- Regular feedback collection from users

- Support resources for transition periods

Optimization and Continuous Improvement

After initial implementation, organizations must focus on optimizing their automated risk management processes. Regular system reviews help identify:

- Performance bottlenecks

- New automation opportunities

- Required system updates

- Process improvement needs

The optimization phase never truly ends, as risk management automation tools and processes must evolve with changing business needs and emerging risks.

Implementation success depends on maintaining momentum throughout all phases while ensuring each step receives proper attention and resources.

Organizations should expect the complete implementation process to take 3-6 months, depending on complexity and scope.

Selecting the Right Risk Management Automation Tools

The market offers numerous automated risk management tools, each with distinct capabilities and specializations.

Understanding the differences between these platforms helps organizations make informed decisions that align with their specific needs.

Leading Risk Management Platforms

Several platforms stand out in the risk management automation space.

- ServiceNow GRC provides enterprise-wide risk visibility and automated workflows.

- MetricStream offers advanced analytics and real-time monitoring capabilities.

- LogicManager excels in regulatory compliance automation, while IBM OpenPages focuses on integrated risk and compliance management.

Essential Features for Risk Automation

When evaluating automated risk management tools, organizations should prioritize these key features:

Risk Assessment Capabilities:

- Automated risk scoring

- Custom risk frameworks

- Real-time monitoring

- Predictive analytics

Integration Features:

- API connectivity

- Third-party data feeds

- Legacy system compatibility

- Cloud integration options

Reporting Functions:

- Customizable dashboards

- Automated report generation

- Regulatory compliance reporting

- Audit trail documentation

Understanding Automated Risk Assessment Tools

Automated risk assessment tools serve as specialized components within broader risk management platforms.

These tools analyze data patterns, identify potential risks, and generate assessments based on predefined criteria.

They eliminate manual data collection and analysis, enabling faster and more accurate risk evaluations.

Platform Comparison Matrix

The following comparison highlights key differences among major platforms:

ServiceNow GRC:

- Strong workflow automation

- Excellent enterprise integration

- Higher price point

- Best for large organizations

MetricStream:

- Advanced analytics capabilities

- Strong regulatory compliance

- Moderate pricing

- Suitable for mid to large companies

LogicManager:

- User-friendly interface

- Strong customer support

- Competitive pricing

- Ideal for growing organizations

Making the Right Choice

Organizations should consider several factors when selecting risk management automation tools:

- Budget constraints and ROI expectations

- Current technology infrastructure

- Industry-specific requirements

- Growth projections and scalability needs

- Internal technical expertise

The most effective approach involves evaluating multiple solutions through demos and trial periods before making a final decision.

This hands-on experience helps ensure the selected tool meets both current needs and future requirements.

Moving Forward With Risk Management Automation

The evolution of risk management demands a shift toward automated solutions.

Organizations that embrace risk management automation gain significant advantages in efficiency, accuracy, and strategic decision-making capabilities.

These benefits extend beyond simple cost savings to include enhanced regulatory compliance, improved risk visibility, and stronger operational resilience.

Taking Action on Risk Management

Success requires proactive risk management strategies powered by automation.

The time to evaluate and implement these solutions is now, as the complexity and speed of emerging risks continue to increase.

Organizations should begin by assessing their current risk management processes and identifying areas where automation can deliver immediate value.

The path to effective risk management automation starts with a clear understanding of organizational needs, careful selection of appropriate tools, and commitment to proper implementation.

By taking these steps, organizations position themselves to handle future challenges while maintaining competitive advantages in their respective markets.

Start your risk management automation journey today by evaluating your current processes and exploring available solutions.

The investment in automated risk management tools will pay dividends through enhanced risk visibility, improved compliance, and stronger business resilience.

SixSigma.us offers both Live Virtual classes as well as Online Self-Paced training. Most option includes access to the same great Master Black Belt instructors that teach our World Class in-person sessions. Sign-up today!

Virtual Classroom Training Programs Self-Paced Online Training Programs