The 5 Essential Pillars of Risk Management: A Guide for Modern Businesses

Risk management isn’t just a safeguard—it’s a competitive advantage.

As organizations navigate an increasingly complex web of challenges, from cybersecurity threats to global pandemics, understanding and implementing robust risk management strategies has become paramount.

But what exactly is risk management, and how can businesses leverage its principles to thrive in uncertainty?

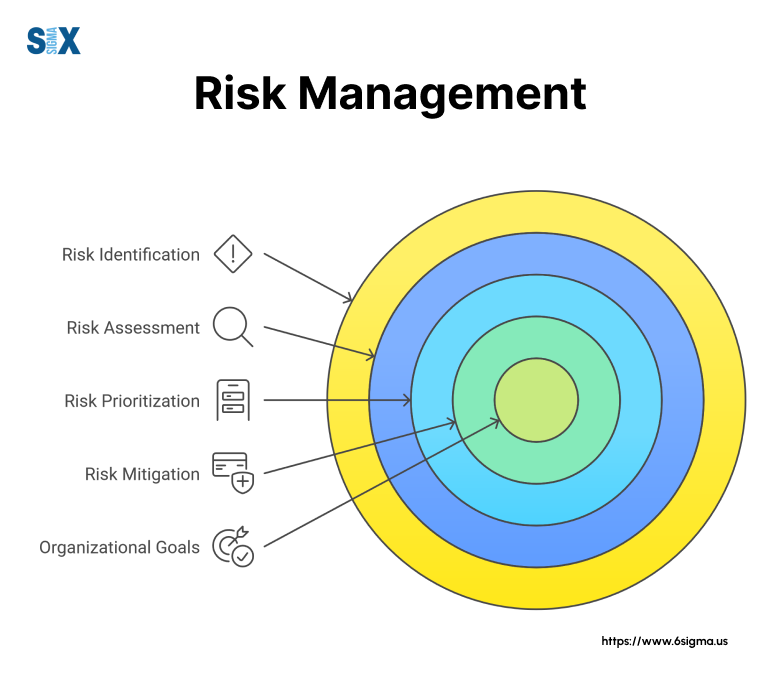

Risk management is the systematic process of identifying, assessing, and mitigating potential threats to an organization’s assets, operations, and objectives.

It’s a proactive approach that empowers businesses to anticipate challenges, minimize negative impacts, and capitalize on opportunities.

The meaning of risk management extends beyond mere damage control; it’s about creating a resilient framework that supports informed decision-making and sustainable growth.

Key Highlights

- Five essential pillars of risk management

- Practical strategies for implementation

- Addressing emerging challenges

- Fundamental components of risk management

Understanding Risk Management

Understanding risk management is crucial for organizational success.

But what is risk management, and why is it so important?

Defining Risk Management in the Modern Business Context

Risk management is the systematic process of identifying, assessing, and mitigating potential threats to an organization’s assets, operations, and objectives.

It’s not just about avoiding negative outcomes; it’s about creating a framework that enables informed decision-making and fosters resilience.

The meaning of risk management has evolved significantly over the years.

Once viewed as a defensive strategy, it’s now recognized as a key driver of business value. A well-crafted risk management strategy can:

- Protect financial stability

- Enhance operational efficiency

- Foster innovation

- Improve stakeholder confidence

For example, consider how Netflix’s risk management strategy helped them navigate the shift from DVD rentals to streaming services.

By anticipating market changes and technological advancements, they successfully transformed their business model, outpacing competitors who failed to adapt.

The Evolving Landscape of Business Risks

The risk management landscape is constantly changing, presenting new challenges for businesses.

Today’s risk management framework must account for:

- Digital transformation risks

- Cybersecurity threats

- Geopolitical uncertainties

- Climate change impacts

- Pandemic-related disruptions

An example of a risk management strategy that addresses these evolving challenges is the implementation of robust cybersecurity measures.

However, it’s important to note that simply installing antivirus software is not an example of a comprehensive risk management strategy.

Consider the case of Equifax, which suffered a massive data breach in 2017.

Their failure to update a critical security patch exemplifies how poor risk management can lead to catastrophic consequences.

This incident underscores the importance of a holistic approach to risk management in a project or across an entire enterprise.

Recent data from the World Economic Forum’s Global Risks Report 2023 highlights the changing nature of business risks.

Cybersecurity, climate action failure, and infectious diseases now rank among the top global risks, emphasizing the need for adaptive risk management strategies.

To effectively navigate this complex risk landscape, organizations need a comprehensive risk management plan that encompasses:

- Regular risk assessments

- Scenario planning

- Robust incident response procedures

- Continuous monitoring and adaptation

By embracing these elements, businesses can develop a proactive approach to risk management, turning potential threats into opportunities for growth and innovation.

Build a stronger foundation in risk management? Our Yellow Belt course equips you with essential tools to identify and mitigate risks effectively.

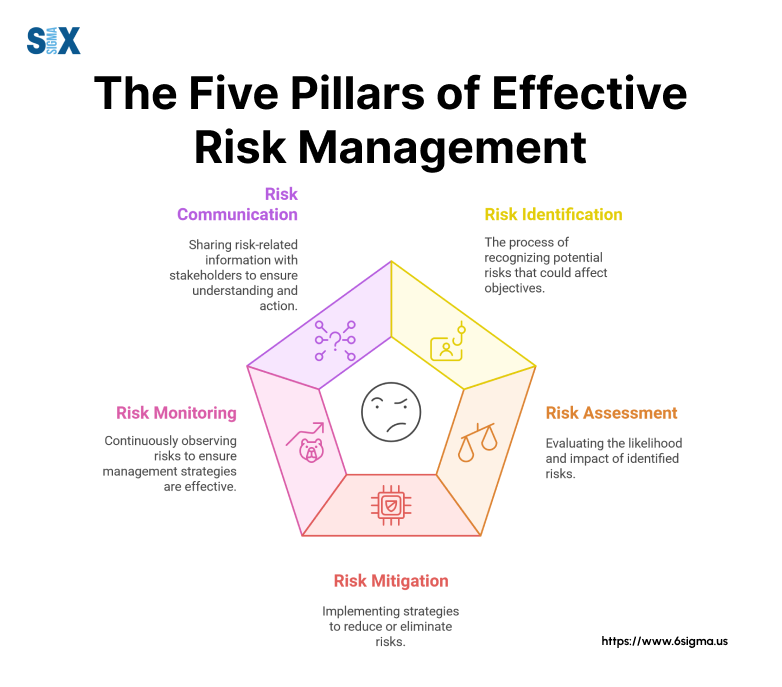

The Five Pillars of Effective Risk Management

In risk management understanding and implementing the five pillars of risk management is crucial for developing a robust risk management framework.

These pillars form the backbone of any comprehensive risk management plan and are essential for businesses.

Pillar 1: Risk Identification and Assessment

The first step in any risk management process is identifying and assessing potential risks.

This involves a systematic approach to recognizing threats that could impact an organization’s objectives. Risk identification techniques include:

- SWOT analysis

- Brainstorming sessions

- Historical data review

- Expert interviews

Once identified, risks are assessed using various methodologies to determine their potential impact and likelihood.

A comprehensive risk register is then created to document and prioritize these risks.

For example, a multinational corporation like General Electric conducts an annual risk identification process that involves input from all business units globally.

This process helps them identify emerging risks and reassess existing ones in light of changing market conditions.

Pillar 2: Risk Mitigation and Control

After identifying and assessing risks, the next pillar focuses on developing strategies to mitigate these risks and implement control measures.

This is where the rubber meets the road in operational risk management.

Key risk mitigation strategies include:

- Risk avoidance

- Risk reduction

- Risk transfer

- Risk acceptance

An example of a risk management strategy is implementing robust cybersecurity measures to mitigate the risk of data breaches.

However, it’s important to note that simply hoping a risk won’t occur is not an example of a risk management strategy.

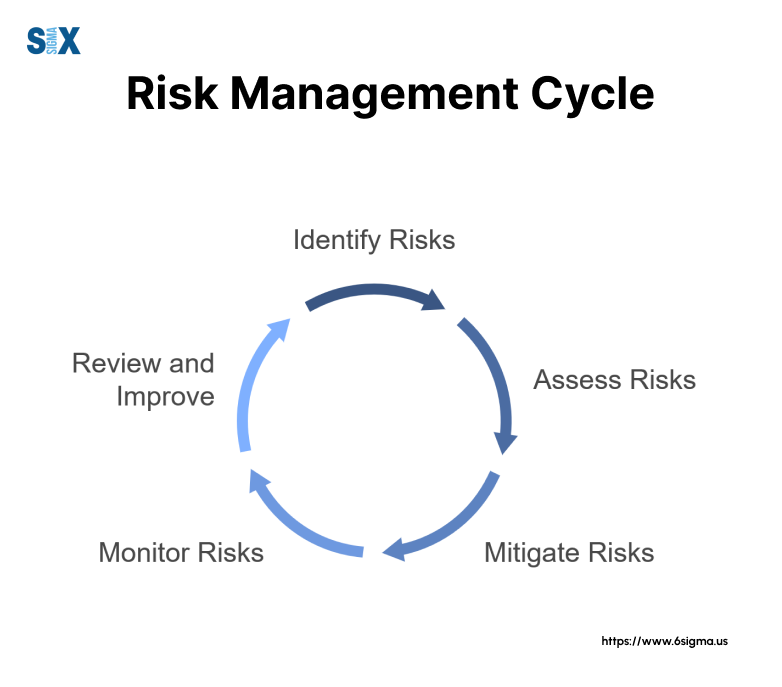

Pillar 3: Risk Monitoring and Review

The risk management process doesn’t end with implementation. Ongoing monitoring and periodic reviews are crucial for maintaining an effective risk management framework.

This pillar involves:

- Tracking Key Risk Indicators (KRIs)

- Utilizing risk monitoring tools

- Conducting regular risk reviews

For instance, tech giant Microsoft employs continuous risk monitoring systems that analyze millions of data points in real-time.

This approach helped them prevent a potential major data breach in 2021 by identifying and addressing a vulnerability before it could be exploited.

Pillar 4: Risk Reporting and Communication

Effective risk reporting and communication are essential components of a comprehensive risk management plan.

This pillar focuses on:

- Developing clear risk reporting frameworks

- Implementing stakeholder communication strategies

- Ensuring transparency in risk disclosure

Salesforce, for example, has been lauded for its transparent approach to risk reporting.

Their annual risk disclosure not only meets regulatory requirements but also provides stakeholders with a clear understanding of the company’s risk landscape and management strategies.

Pillar 5: Risk Governance and Culture

The final pillar of risk management focuses on establishing a strong risk governance structure and fostering a risk-aware culture throughout the organization. This includes:

- Defining the board’s role in risk oversight

- Developing clear risk appetite statements

- Building a risk-aware organizational culture

Netflix’s transformation from a DVD rental company to a streaming giant is a testament to the power of a strong risk governance culture.

By fostering a culture that embraces calculated risks, they were able to pivot their business model successfully in the face of technological disruption.

By implementing these five pillars of risk management, organizations can develop a comprehensive approach to identifying, assessing, and managing risks.

This not only helps in protecting against potential threats but also in identifying opportunities for growth and innovation.

Here’s a table summarizing the five pillars of risk management and their key components:

| Pillar | Key Components |

|---|---|

| 1. Risk Identification | – Recognizing potential risks – Risk categorization (strategic, financial, operational, etc.) – Sources of risk (internal and external factors) |

| 2. Risk Assessment | – Risk analysis (qualitative and quantitative) – Likelihood and impact assessment – Risk prioritization based on severity |

| 3. Risk Mitigation | – Developing strategies to manage risks – Risk response options (avoidance, reduction, sharing, acceptance) – Implementation of control measures |

| 4. Risk Monitoring and Reporting | – Tracking identified risks and emerging threats – Key risk indicators (KRIs) – Regular reporting to stakeholders |

| 5. Risk Governance and Culture | – Establishing risk management policies and procedures – Setting risk appetite and tolerance levels – Fostering a risk-aware organizational culture |

This structure helps organizations systematically manage risks and align them with their objectives.

Remember, effective risk management is not about eliminating all risks, but about making informed decisions in the face of uncertainty.

By embracing these pillars, organizations can build resilience and thrive in an increasingly complex business environment.

Take your risk management skills to the next level. Our Green Belt course provides advanced tools to analyze and mitigate complex risks across all five pillars.

Implementing a Robust Risk Management Framework

Implementing a robust risk management framework is crucial for organizations seeking to effectively manage risks and capitalize on opportunities.

This process involves developing a comprehensive risk management plan and overcoming common challenges in implementation.

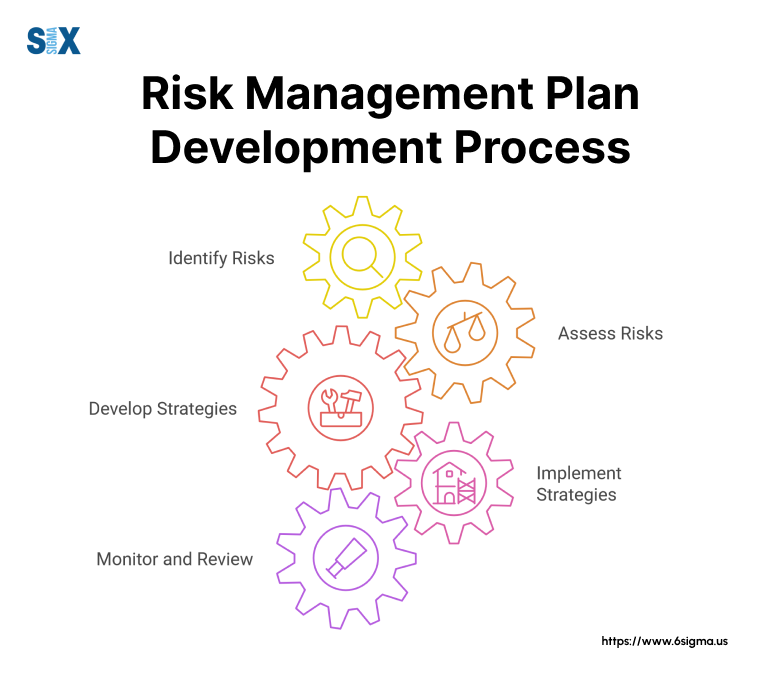

Developing a Comprehensive Risk Management Plan

A well-crafted risk management plan is the cornerstone of effective enterprise risk management. Here’s a step-by-step guide to developing a comprehensive risk management plan:

- Define objectives and scope

- Identify potential risks

- Assess and prioritize risks

- Develop risk response strategies

- Allocate resources

- Implement control measures

- Monitor and review

When creating your plan, it’s essential to align it with your business objectives.

For example, a tech startup might prioritize risks related to intellectual property and rapid scaling, while a manufacturing company might focus more on operational risks and supply chain disruptions.

A successful mid-sized company, Acme Corp, used the following template for their risk management plan:

- Executive Summary

- Risk Assessment Matrix

- Risk Response Strategies

- Resource Allocation Plan

- Monitoring and Review Schedule

- Communication Plan

Data shows that companies with formal risk management plans are 20% more likely to achieve their business objectives compared to those without such plans.

This underscores the importance of planning and risk management in today’s volatile business environment.

Overcoming Common Challenges in Risk Management Implementation

Implementing a risk management strategy can be challenging. Here are some common obstacles and strategies to overcome them:

- Resistance to change: Foster a risk-aware culture through education and communication.

- Resource constraints: Prioritize risks and allocate resources based on potential impact.

- Lack of senior management buy-in: Demonstrate the ROI of risk management through case studies and data.

For instance, Global Industries faced significant resistance when implementing their new risk management framework.

They overcame this by conducting workshops that demonstrated how effective risk management could drive innovation and growth, not just prevent losses.

As a risk management consultant, I once worked with a company that struggled with resource allocation for their risk management initiatives.

We developed a prioritization matrix that helped them focus on high-impact, high-probability risks first.

This approach not only improved their risk management effectiveness but also demonstrated clear value to senior management, securing their buy-in for future initiatives.

Remember, implementing a robust risk management framework is not a one-time event but an ongoing process. It requires continuous monitoring, review, and adaptation to remain effective.

By following these steps and learning from real-world examples, you can develop and implement a risk management plan that not only protects your organization from potential threats but also positions it to seize opportunities and drive growth.

lead transformative risk management strategies with our Black Belt course empowers you to implement robust frameworks and drive organizational excellence.

Conclusion

From risk identification and assessment to governance and culture, each pillar plays a crucial role in building a comprehensive risk management strategy.

The meaning of risk management extends far beyond mere damage control. It’s a proactive approach that empowers organizations to anticipate challenges, seize opportunities, and drive sustainable growth.

By implementing a thorough risk management process, businesses can enhance their resilience, improve decision-making, and ultimately achieve their strategic objectives.

Remember, effective risk management is not about eliminating all risks – which is neither possible nor desirable in a dynamic business environment.

Instead, it’s about understanding, managing, and leveraging risks to create value.

Whether you’re developing a risk management plan for a specific project or implementing enterprise-wide risk management strategies, the principles we’ve discussed apply across the board.

With increasing focus on digital risks, ESG factors, and agile methodologies, your risk management approach must also adapt.

Stay informed about emerging trends, regularly reassess your risk management framework, and be prepared to pivot your strategies as needed.

We encourage you to take a critical look at your current risk management practices. Are you effectively addressing all five pillars?

Consider implementing the strategies we’ve discussed and leveraging the tools and templates provided.

Remember a robust risk management isn’t just a safeguard – it’s a competitive advantage.

By mastering the five pillars of risk management, you’re not just protecting your organization; you’re positioning it for long-term success.

Take the first step today. Assess your current approach, identify areas for improvement, and start building a more resilient, risk-aware organization.

SixSigma.us offers both Live Virtual classes as well as Online Self-Paced training. Most option includes access to the same great Master Black Belt instructors that teach our World Class in-person sessions. Sign-up today!

Virtual Classroom Training Programs Self-Paced Online Training Programs