Operational Risk Management: A Guide for Modern Businesses 2024

One in three companies has faced major operational disruptions in just the last five years. We’re talking about losses that run into billions.

Be it cybersecurity breaches to supply chain failures, these incidents highlight a critical truth.

Operational risk management (ORM) isn’t just a regulatory requirement; it’s a business imperative for survival and success.

Key Highlights

- The essential components of a robust ORM framework

- Step-by-step processes for identifying and assessing operational risks

- Cutting-edge tools and technologies transforming risk management

- Industry-specific strategies and best practices

- Case studies of successful ORM implementation

What is Operational Risk Management?

Operational Risk Management (ORM) is a systematic, comprehensive framework for identifying, assessing, and controlling risks that could impair an organization’s ability to achieve its objectives.

Unlike traditional risk management approaches that focus primarily on financial or market risks, ORM addresses the full spectrum of operational vulnerabilities that organizations face in their daily activities.

Definition and Core Concepts

Operational risk management encompasses the potential losses resulting from inadequate or failed internal processes, people, systems, or external events.

This definition, established by the Basel Committee on Banking Supervision, has become the global standard across industries.

The primary objective of operational risk management is to protect organizational value while ensuring business continuity and regulatory compliance.

Key components of an effective ORM framework include:

- Risk Identification: Systematic process of recognizing and documenting potential operational risks

- Risk Assessment: Evaluation of risk probability and potential impact

- Control Implementation: Development and deployment of risk mitigation strategies

- Monitoring and Review: Continuous evaluation of control effectiveness and risk evolution

What distinguishes operational risks from other risk types is their inherent complexity and diversity.

While financial risks often involve quantifiable metrics, operational risks can include:

- Human Error: Processing mistakes, skill gaps, or intentional violations

- System Failures: IT outages, cybersecurity breaches, or software bugs

- Process Inefficiencies: Workflow bottlenecks or inadequate controls

- External Events: Natural disasters, supplier failures, or regulatory changes

The Evolution of Operational Risk Management

The concept of operational risk management has evolved significantly over the past decades.

Initially focused primarily on preventing fraud and ensuring basic operational continuity, modern ORM has transformed into a sophisticated discipline that leverages advanced technologies and data analytics.

Historical Development:

- 1990s: Early focus on basic operational controls and fraud prevention

- 2000s: Introduction of Basel II framework and formal ORM requirements

- 2010s: Integration of technology and data-driven approaches

- Present: Emergence of AI-powered risk analytics and predictive modeling

Today’s operational risk management model incorporates:

- Advanced Analytics: Machine learning algorithms for risk prediction

- Real-time Monitoring: Continuous assessment of risk indicators

- Integrated Frameworks: Holistic approach to risk management

- Automated Controls: Technology-enabled risk mitigation

The regulatory industry has also shaped ORM’s evolution, with frameworks like Basel III and various industry-specific regulations requiring organizations to maintain robust operational risk management programs.

These regulatory influences have led to standardized approaches while allowing flexibility for organization-specific adaptations.

The Operational Risk Management Framework

A robust operational risk management framework serves as the foundation for effectively managing and mitigating operational risks across an organization.

This structured approach ensures consistency in risk identification, assessment, and control while enabling organizations to maintain regulatory compliance and optimize business performance.

Key Components of Operational Risk Management (ORM)

The operational risk management framework consists of several interconnected components that work together to create a comprehensive risk management solution:

Governance Structure

- Board oversight and senior management commitment

- Clear roles and responsibilities

- Risk committees and reporting lines

- Independent risk management function

Policies and Procedures

- Documented risk management policies

- Standard operating procedures

- Control documentation

- Escalation protocols

Risk Assessment Methodology

- Risk identification techniques

- Risk scoring and prioritization methods

- Impact and likelihood assessment

- Risk appetite and tolerance levels

Reporting Mechanisms

- Regular risk reporting schedules

- Key Risk Indicators (KRIs)

- Dashboard development

- Stakeholder communication protocols

Implementation Guidelines

Successfully implementing an operational risk management framework requires careful planning and execution:

Setting Up the Framework:

Assessment Phase

- Evaluate current risk management practices

- Identify gaps and areas for improvement

- Define scope and objectives

- Determine resource requirements

Design Phase

- Develop policies and procedures

- Create risk assessment templates

- Establish governance structure

- Define reporting requirements

Implementation Phase

- Train staff on new procedures

- Deploy risk management tools

- Establish monitoring mechanisms

- Begin risk assessment activities

Resource Allocation:

- Human Resources: Dedicated risk management team

- Technology: Risk management software and tools

- Training: Staff development programs

- Budget: Adequate funding for implementation

Success Metrics:

- Risk reduction percentages

- Control effectiveness ratings

- Incident response times

- Cost savings from risk prevention

- Regulatory compliance scores

Best Practices for Framework Implementation:

- Ensure senior management buy-in

- Start with pilot programs

- Regular framework reviews

- Continuous improvement cycles

- Integration with existing business processes

The operational risk management model should be flexible enough to adapt to changing business environments while maintaining consistency in risk management practices.

Organizations should regularly review and update their framework to incorporate:

- Emerging risks and threats

- New regulatory requirements

- Technological advancements

- Industry best practices

- Lessons learned from incidents

The Operational Risk Management (ORM) Process: A Step-by-Step Guide

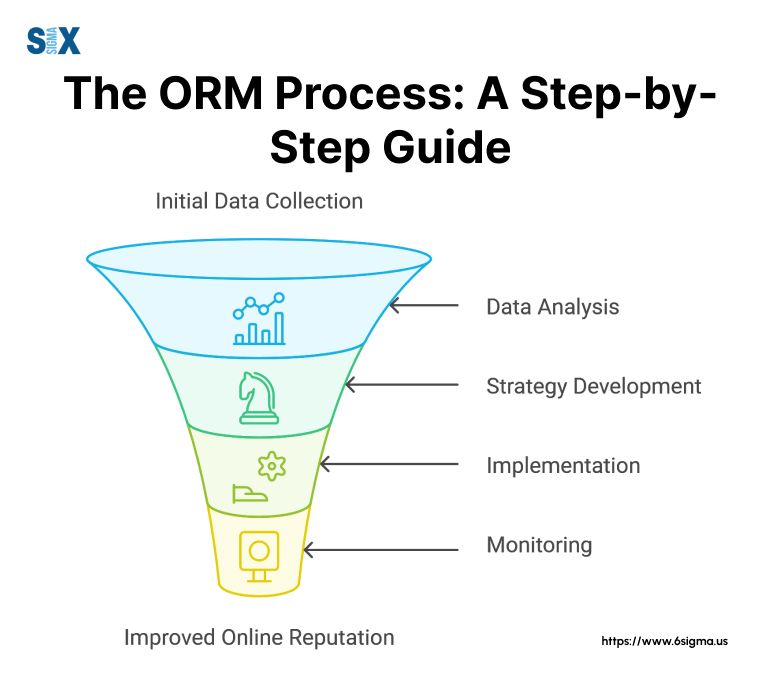

The operational risk management process follows a structured approach that enables organizations to systematically identify, assess, mitigate, and monitor risks.

This comprehensive guide breaks down each step of the process, providing practical insights and implementation strategies.

Risk Identification

The first step in the operational risk management steps involves systematically identifying potential risks across the organization. Effective risk identification utilizes multiple methods and tools:

Methods and Tools

- Bow-tie Analysis: Visualizes causes and consequences of risk events

- Process Mapping: Identifies vulnerabilities in workflows

- Brainstorming Sessions: Leverages collective expertise

- Historical Data Analysis: Reviews past incidents

- External Event Analysis: Studies industry trends

Common Risk Categories

People Risks

- Human error

- Skills gaps

- Fraudulent activities

Process Risks

- Workflow inefficiencies

- Control failures

- Documentation issues

Systems Risks

- IT failures

- Cybersecurity threats

- Data integrity issues

External Risks

- Regulatory changes

- Natural disasters

- Third-party failures

Risk Assessment

Assessment Techniques:

- Quantitative Analysis: Numerical evaluation of risks

- Qualitative Analysis: Expert judgment and experience

- Semi-quantitative: Combination of both approaches

Risk Scoring Methods

- Impact Assessment (1-5 scale)

- Probability Rating (1-5 scale)

- Risk Priority Number (RPN) = Impact × Probability

Priority Determination

- High (RPN 15-25): Immediate action required

- Medium (RPN 8-14): Planned action needed

- Low (RPN 1-7): Monitor and review

Risk Mitigation

Control Measures

- Preventive Controls: Stop risks before they occur

- Detective Controls: Identify risks when they occur

- Corrective Controls: Address risks after occurrence

Implementation Strategies

- Risk Avoidance: Eliminate risk-prone activities

- Risk Reduction: Implement controls to minimize impact

- Risk Transfer: Insurance or outsourcing

- Risk Acceptance: Accept and monitor minor risks

Monitoring Effectiveness

- Control Testing: Regular assessment of control effectiveness

- Performance Metrics: KPIs for control performance

- Feedback Loops: Continuous improvement mechanisms

Risk Monitoring and Review

Continuous Monitoring Approaches:

- Real-time Monitoring: Automated risk tracking

- Periodic Reviews: Scheduled assessments

- Event-triggered Reviews: Post-incident analysis

Performance Indicators:

- Key Risk Indicators (KRIs)

- Control Effectiveness Metrics

- Loss Event Statistics

- Near-miss Reports

Reporting Requirements:

Regular Status Reports

- Risk level changes

- Control effectiveness

- Emerging risks

Incident Reports

- Root cause analysis

- Impact assessment

- Corrective actions

Executive Summaries

- Risk trends

- Strategic implications

- Resource requirements

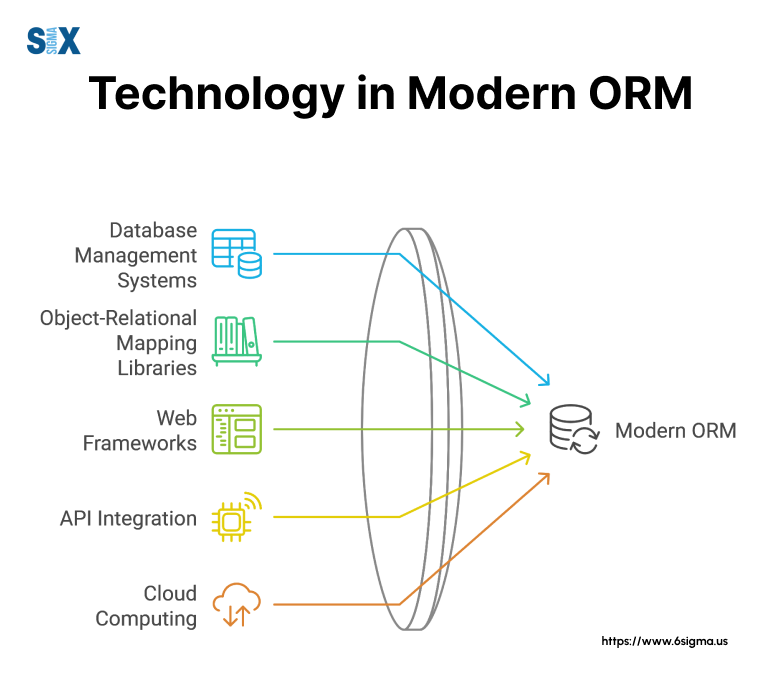

Technology in Modern Operational Risk Management (ORM)

Operational risk management has been revolutionized by technological advancements, transforming how organizations identify, assess, and mitigate risks.

Modern operational risk management solutions leverage cutting-edge technologies to provide more accurate, efficient, and proactive risk management capabilities.

Digital Transformation Impact

Artificial Intelligence and machine learning have fundamentally changed how organizations approach operational risk management.

These technologies enable predictive risk analytics, automatically identifying patterns and potential threats before they materialize into significant issues.

For instance, AI algorithms can analyze vast amounts of historical data to predict potential equipment failures or detect unusual patterns that might indicate fraudulent activities.

The automation benefits of modern operational risk management tools extend beyond basic task automation.

Advanced systems can now automatically update risk registers, generate real-time risk reports, and trigger automated responses to emerging risks.

This automation not only reduces human error but also allows risk management professionals to focus on strategic decision-making rather than routine tasks.

ORM Software Solutions

When selecting an operational risk management solution, organizations should look for several key features:

- Integration capabilities with existing systems

- Customizable risk assessment frameworks

- Automated workflow management

- Advanced analytics and reporting capabilities

- Mobile accessibility for field operations

- Scalability to accommodate growth

Implementation considerations must account for both technical and organizational factors. Success factors include:

- The software’s alignment with existing risk management processes

- User interface intuitiveness and ease of adoption

- Data security and compliance requirements

- Integration with legacy systems

- Training requirements for staff

ROI analysis for ORM technology investments should consider both quantitative and qualitative benefits.

Organizations implementing comprehensive ORM software solutions have reported:

- 40% reduction in time spent on risk assessments

- 60% improvement in risk identification accuracy

- 35% decrease in incident response times

- Significant improvements in regulatory compliance

- Enhanced stakeholder confidence

Taking Action on Operational Risk Management

A good and effective ORM stands as a cornerstone of your organizational success.

This article clears the aspects of ORM, from its basic definition to advanced implementation strategies and technological solutions.

The evolution of operational risk management from a simple compliance requirement to a strategic business imperative reflects its growing importance in protecting and creating organizational value.

Keeping in mind that many organizations face complex operational challenges, implementing this robust operational risk management framework becomes more important.

The step-by-step process we’ve outlined, combined with modern tools and technologies, provides a solid foundation for managing operational risks effectively.

Remember that successful ORM implementation requires commitment from all levels of the organization, from frontline employees to senior management.

To begin strengthening your organization’s approach to operational risk management:

- Assess your current risk management practices

- Identify gaps in your existing framework

- Develop a comprehensive implementation plan

- Invest in appropriate tools and technologies

- Foster a risk-aware culture throughout your organization

SixSigma.us offers both Live Virtual classes as well as Online Self-Paced training. Most option includes access to the same great Master Black Belt instructors that teach our World Class in-person sessions. Sign-up today!

Virtual Classroom Training Programs Self-Paced Online Training Programs