Expected Monetary Value (EMV): Calculation, Analysis, and Application in Project Management

In modern risk management and decision-making processes, Expected Monetary value (EMV) stands a one of the fundamental tool.

This statistical method helps organizations evaluate potential outcomes of business decisions by combining probability calculations with financial impacts.

For project managers and business leaders, particularly those with a background strengthened by a six sigma certification, EMV serves as a reliable metric to assess risks and opportunities in quantifiable terms.

Key Highlights

- EMV Formula and Basic Calculation Methods

- Risk Assessment Through EMV Analysis Tools

- Project Management Applications of EMV

- Examples of EMV Calculations

What is Expected Monetary Value?

Expected monetary value represents a statistical tool that measures potential outcomes in financial terms by combining probability with monetary impact.

This calculation method helps organizations evaluate risks and opportunities in their decision-making processes.

Risk management professionals and business leaders use EMV to transform uncertain scenarios into concrete financial figures.

The Core Elements of EMV

The expected monetary value formula consists of two main components: probability and impact. Probability measures the likelihood of an event occurring, expressed as a percentage between 0% and 100%.

Impact represents the financial consequence of that event, which can be either positive (gain) or negative (loss). When these components combine, they create a clear financial picture of potential outcomes.

For example, if a project has a 30% chance of generating $100,000 in revenue, the expected monetary value would be $30,000 (0.30 x $100,000).

This calculation provides decision-makers with a realistic view of potential financial outcomes.

Understanding the EMV Formula

The expected monetary value formula follows this structure:

EMV = Probability × Impact

This straightforward calculation yields the weighted average of all possible outcomes.

When multiple scenarios exist, the formula expands to include each possibility:

Total EMV = (P1 × I1) + (P2 × I2) + (P3 × I3)

Learn to analyze trends and make data-driven decisions with confidence with Statistics and Graphical Analysis course.

What EMV Reveals About Business Decisions

EMV calculations tell decision-makers several crucial pieces of information. First, they show the average expected outcome of a decision when repeated many times.

Second, they help compare different options by providing a standardized measurement of potential value. Third, they assist in setting appropriate budget reserves for risk management.

Risk management professionals use EMV to:

- Evaluate project alternatives

- Set contingency budgets

- Compare investment opportunities

- Assess potential risks and rewards

Business executives find EMV particularly valuable when making strategic decisions about resource allocation, project selection, and risk mitigation strategies.

The numerical nature of EMV provides clear, objective data for stakeholder presentations and decision justification.

Practical Application in Decision-Making

EMV guides organizations through complex decisions by providing quantifiable data. When choosing between multiple project approaches or investment opportunities, EMV calculations offer objective comparisons.

EMV is frequently used alongside process improvement frameworks taught in programs such as Lean Fundamentals, to optimize project outcomes.

This mathematical approach, a core principle emphasized in six sigma certification programs, removes emotional bias from decision-making and provides a solid foundation for risk assessment.

For instance, when evaluating two potential projects, Project A might show an EMV of $50,000 while Project B shows $75,000.

While other factors influence the final decision, these EMV calculations provide clear financial metrics for comparison.

Calculating Expected Monetary Value

The process of calculating expected monetary value follows a structured approach that ensures accurate risk assessment and decision-making.

Organizations need reliable calculations to evaluate potential outcomes and make informed business choices.

Step-By-Step EMV Calculation Guide

First, identify all possible outcomes for the decision or scenario under consideration. Each outcome needs both a probability percentage and a monetary value assigned to it.

For example, a new product launch might have three potential outcomes: success, moderate performance, or failure.

Next, determine the probability of each outcome occurring.

These probabilities must total 100%. Market research, historical data, and expert opinions help establish these percentages.

For the product launch example:

- Success: 30% probability

- Moderate performance: 50% probability

- Failure: 20% probability

Then, assign monetary values to each outcome.

These values represent the financial impact:

- Success: +$200,000

- Moderate performance: +$50,000

- Failure: -$100,000

Finally, multiply each probability by its corresponding monetary value and sum the results:

EMV = (0.30 × $200,000) + (0.50 × $50,000) + (0.20 × -$100,000) = $60,000 + $25,000 – $20,000 = $65,000

EMV Calculator Tools and Resources

Modern EMV calculators streamline these calculations and reduce human error. Excel spreadsheets offer basic EMV calculation capabilities through simple formulas.

Specialized risk management software provides more sophisticated tools with additional features like sensitivity analysis and scenario modeling.

Several online EMV calculators offer free access to basic calculations.

These tools typically include:

- Input fields for multiple scenarios

- Automatic probability validation

- Clear result visualization

- Export capabilities for reports

Turn complex data into clear insights with Minitab – Start your journey in graphical analysis today.

Common EMV Calculation Pitfalls

Many organizations face challenges when calculating expected monetary value. The most frequent errors include:

Probability Miscalculation: Ensuring probabilities sum to 100% proves challenging when multiple scenarios exist. Regular validation checks help prevent this error.

Incomplete Scenario Analysis: Missing potential outcomes skews results significantly. Risk managers should conduct thorough scenario planning before calculations begin.

Monetary Value Estimation: Inaccurate financial impact estimates lead to unreliable EMV results. Organizations need robust methods for estimating monetary values of outcomes.

Data Quality Issues: Poor quality historical data or unreliable probability estimates reduce EMV accuracy. Regular data validation and updates maintain calculation reliability.

To combat pitfalls like these, employing rigorous techniques is crucial. Mastering root cause analysis can significantly improve the quality of inputs for EMV calculations by identifying underlying issues affecting probability and impact assessments.

Best Practices for EMV Calculations

Successful EMV calculations require consistent methodology and careful attention to detail. Document all assumptions and data sources used in calculations.

Teams trained with a Six Sigma White Belt certification or a Six Sigma Yellow Belt certification gain foundational skills in data quality validation, reducing common EMV calculation errors.

Regular reviews and updates ensure calculations remain relevant as conditions change.

Involve subject matter experts when estimating probabilities and monetary values.

Their expertise improves the accuracy of inputs and helps identify potential scenarios that might otherwise be overlooked.

Use sensitivity analysis to test how changes in probability or impact affect the final EMV.

This analysis reveals which variables most significantly influence results and deserve extra attention during data collection and validation.

Expected Monetary Value Analysis in Risk Management

Risk management professionals rely on expected monetary value analysis to transform uncertain scenarios into measurable financial metrics.

This quantification method enables organizations to evaluate risks systematically and make data-driven decisions about risk response strategies.

Integrating EMV into a broader framework of operational efficiency can enhance its impact. Understanding Lean fundamentals provides context for how EMV fits within efforts to streamline processes and eliminate waste, ultimately improving the scenarios being analyzed.

EMV as a Risk Quantification Tool

Expected monetary value serves as a primary tool for converting risk assessments into financial terms. Organizations use EMV calculations to prioritize risks based on their potential financial impact.

This numerical approach helps risk managers allocate resources effectively and justify risk management investments to stakeholders.

For instance, when evaluating cybersecurity risks, EMV analysis might reveal that a potential data breach with a 15% probability and $1 million impact has an EMV of $150,000.

This calculation helps security teams prioritize protection measures and set appropriate budget levels.

Integration with Risk Management Techniques

EMV analysis works alongside other risk management tools to create a robust risk assessment framework.

Risk matrices benefit from EMV calculations by adding financial context to risk ratings. Decision trees incorporate EMV to evaluate different risk response paths and their potential outcomes.

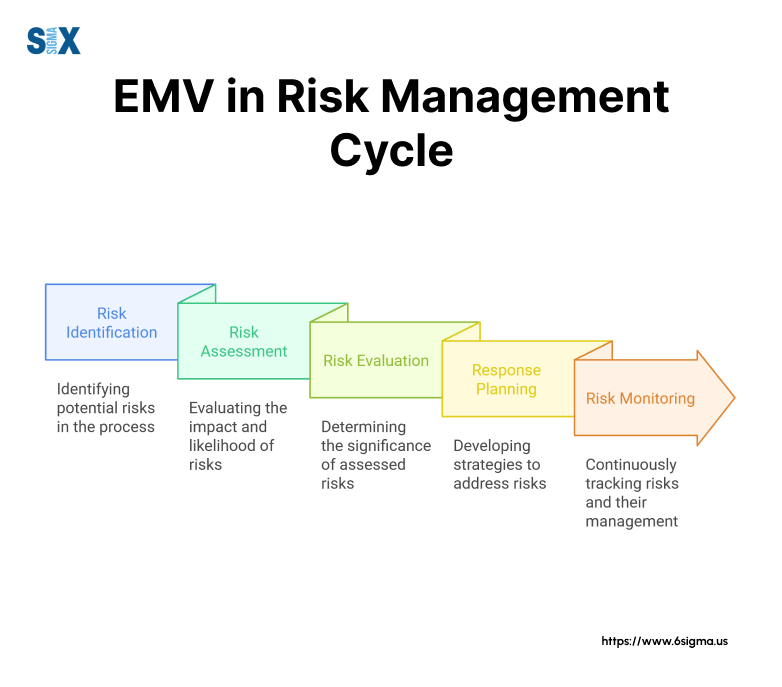

The integration process typically follows these stages:

- Risk identification through standard risk assessment methods

- Initial qualitative analysis using risk matrices

- EMV calculations for significant risks

- Integration of EMV results into risk response planning

- Monitoring and updating of EMV calculations as conditions change

Transform your risk assessment skills with our Cause and Effect Matrix certification program.

Combining EMV with Other Risk Tools

Risk managers enhance their analysis by combining EMV with:

Risk Registers: EMV calculations add financial metrics to risk tracking documents, helping prioritize risks more effectively.

Scenario Analysis: EMV provides numerical backing for different scenario outcomes, strengthening the analysis.

Monte Carlo Simulations: These simulations use EMV calculations to model multiple risk scenarios and their potential impacts.

Limitations of EMV Analysis

While valuable, expected monetary value analysis has several important limitations that risk managers must consider.

The accuracy of EMV calculations depends heavily on the quality of probability estimates and impact assessments. Poor data leads to unreliable results.

EMV analysis also assumes rational decision-making based purely on financial outcomes. This assumption might not hold in situations where non-financial factors play crucial roles.

Organizations must consider reputational impacts, regulatory requirements, and other qualitative factors alongside EMV calculations.

Time sensitivity presents another challenge. EMV calculations typically provide static snapshots of risk scenarios.

Regular updates become necessary as market conditions, threat landscapes, and business objectives evolve.

Overcoming EMV Analysis Challenges

Organizations can address these limitations through several strategies:

Regular Data Updates: Maintain current probability and impact estimates through ongoing market analysis and risk assessments.

Multiple Perspective Analysis: Consider both quantitative EMV results and qualitative risk factors when making decisions.

Sensitivity Testing: Analyze how changes in probability and impact estimates affect EMV calculations to understand result reliability.

Documentation: Record all assumptions and data sources used in EMV calculations to ensure transparency and enable future updates.

Advanced Concepts and Considerations in EMV

Expected monetary value calculations become more nuanced as scenarios grow complex.

Decision-makers must understand these advanced concepts to apply EMV effectively in sophisticated business environments.

Interpreting EMV Results: Higher vs. Lower Values

The interpretation of expected monetary value depends on the context of the decision.

Generally, a higher positive EMV indicates a more favorable outcome in opportunity scenarios. However, when evaluating risks, a lower negative EMV suggests less potential loss.

Consider two investment options:

Project A: EMV = +$50,000

Project B: EMV = +$75,000

While Project B shows a higher EMV, other factors like resource requirements and strategic alignment require consideration.

The EMV serves as one decision criterion rather than the sole determining factor.

EMV Versus Alternative Decision Criteria

Expected monetary value represents one of several decision-making tools available to business leaders. Organizations often combine EMV with other criteria to make well-rounded decisions.

Return on Investment (ROI): While EMV focuses on probability-weighted outcomes, ROI measures actual returns against investments. These metrics work together to provide a fuller picture of potential value.

Net Present Value (NPV): This criterion accounts for the time value of money, something EMV calculations typically ignore. Many organizations use both EMV and NPV for long-term project evaluations.

Risk Tolerance Metrics: Different organizations maintain varying risk tolerance levels. EMV results must align with established risk thresholds for effective decision-making.

Managing Complex Scenarios with Multiple Variables

Real-world situations often involve multiple interconnected variables that affect expected monetary value calculations.

These scenarios require sophisticated analysis techniques and careful consideration of variable relationships.

Sequential Decision Points: Many projects involve multiple decision points, each affecting subsequent choices. Decision trees help map these relationships and calculate compound EMV results.

For example, a product launch might include:

- Initial market entry decision

- Scaling decision based on early results

- Geographic expansion options

- Product line extension possibilities

Each decision point carries its own EMV, creating a network of interrelated values that influence the overall project EMV.

Advanced EMV Analysis Techniques

Several methods enhance basic EMV calculations for complex scenarios:

Sensitivity Analysis: This technique examines how changes in individual variables affect the overall EMV, identifying critical factors that deserve extra attention.

Scenario Modeling: Creating multiple scenarios with different variable combinations helps understand potential outcome ranges and their likelihood.

Probability Distribution Analysis: This method moves beyond simple probability estimates to consider the range and distribution of possible outcomes.

Practical Implementation Challenges

Organizations face several challenges when implementing advanced EMV analysis:

Data Inter-dependencies: Complex scenarios often involve variables that affect each other, making probability estimates more difficult.

Time Horizon Effects: Longer project time-frames introduce additional uncertainty into EMV calculations, requiring regular updates and adjustments.

Resource Constraints: Advanced analysis requires significant time and expertise, forcing organizations to balance analysis depth with practical limitations.

Future Considerations in EMV Analysis

The field of expected monetary value analysis continues to evolve. New software tools enable more sophisticated calculations and better visualization of complex scenarios.

Machine learning algorithms help improve probability estimates based on historical data and market trends.

Developing proficiency in EMV analysis and related risk management techniques is a valuable step for professionals aiming for data-driven decision-making roles.

Pursuing a Six Sigma Green Belt certification provides the foundational skills for applying such methodologies in projects, while a Six Sigma Black Belt certification equips leaders to manage complex cross-functional improvement initiatives where sophisticated tools like EMV are frequently utilized.

Organizations must stay current with these developments while maintaining focus on practical application.

The goal remains making better decisions through informed analysis, regardless of the tools and techniques employed.

SixSigma.us offers both Live Virtual classes as well as Online Self-Paced training. Most option includes access to the same great Master Black Belt instructors that teach our World Class in-person sessions. Sign-up today!

Virtual Classroom Training Programs Self-Paced Online Training Programs