Enterprise Risk Management: Strategies for Business Resilience | ERM Guide

Enterprise Risk Management (ERM) has become an essential strategic tool for organizations.

ERM provides a structured framework for identifying, assessing, and mitigating risks across all levels of an organization, enabling businesses to make informed decisions and protect their assets.

By integrating risk management into strategic planning and daily operations, ERM helps companies not only safeguard against potential threats but also capitalize on opportunities for growth and innovation.

Key Highlights

- Comprehensive framework for managing diverse organizational risks

- Integration of risk assessment with strategic planning

- Risk identification and mitigation strategies across business units

- Implementation of risk controls and monitoring systems

- Development of key risk indicators for effective reporting

- Adoption of industry standards and best practices

Understanding Enterprise Risk Management

Enterprise Risk Management (ERM) is a comprehensive approach to managing risks across an organization.

Defining Enterprise Risk Management (ERM) and its Importance

Enterprise Risk Management is a structured, organization-wide approach to identifying, assessing, and managing potential risks that could impact a company’s ability to achieve its objectives.

ERM goes beyond traditional risk management by considering risks across all departments and functions, providing a holistic view of an organization’s risk landscape.

The importance of ERM lies in its ability to help organizations:

- Proactively identify and mitigate potential threats

- Align risk management with strategic goals

- Improve decision-making processes

- Enhance stakeholder confidence

- Optimize resource allocation

By implementing ERM, companies can better prepare for uncertainties and capitalize on opportunities, ultimately improving their overall performance and resilience.

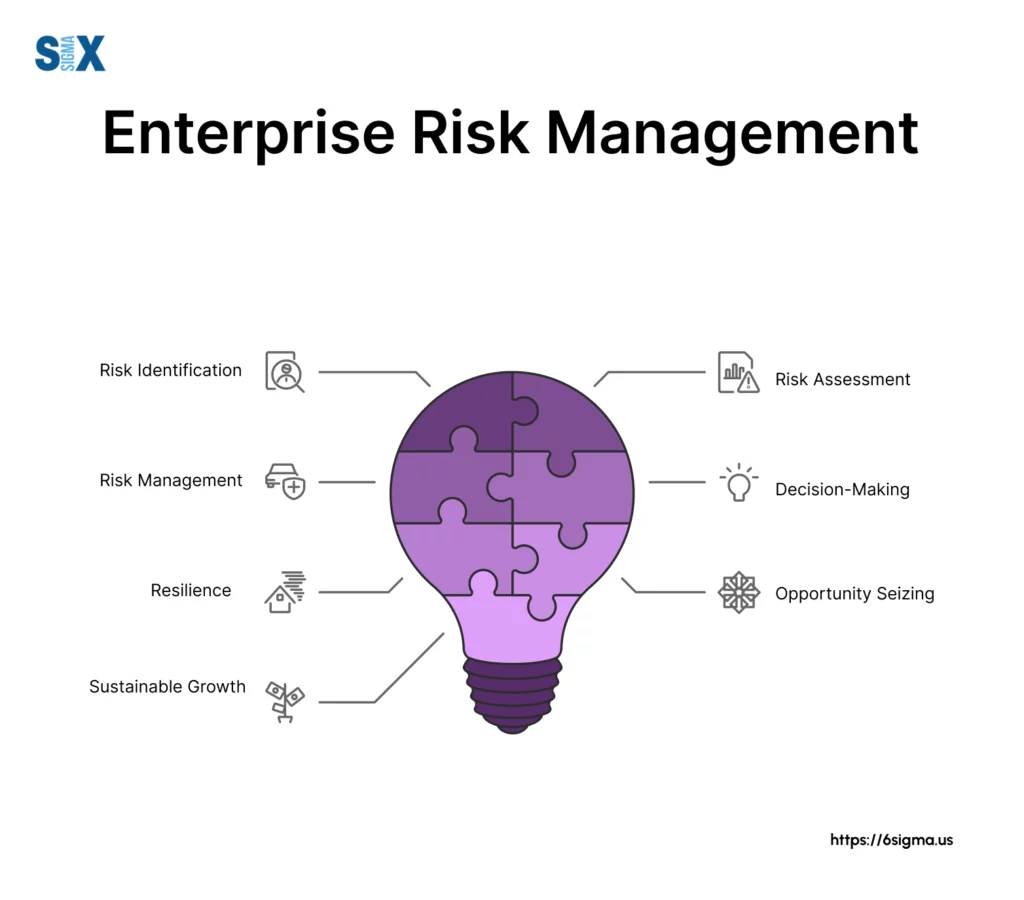

Key Components of an Enterprise Risk Management (ERM) Framework

An effective ERM framework consists of several critical components:

- Risk Governance: Establishing clear roles, responsibilities, and accountability for risk management across the organization.

- Risk Assessment: Identifying and evaluating potential risks that could impact the organization’s objectives.

- Risk Appetite: Defining the level of risk the organization is willing to accept in pursuit of its goals.

- Risk Response: Developing and implementing strategies to address identified risks.

- Control Activities: Implementing policies and procedures to ensure risk responses are carried out effectively.

- Information and Communication: Ensuring relevant risk information is communicated to appropriate stakeholders.

- Monitoring: Continuously evaluating the effectiveness of the ERM process and making necessary adjustments.

These components work together to create a comprehensive risk management strategy that aligns with the organization’s overall objectives.

Differences Between Traditional and Enterprise Risk Management

Traditional risk management and Enterprise Risk Management differ in several key aspects:

- Scope: Traditional risk management often focuses on specific areas or departments, while ERM takes a holistic, organization-wide approach.

- Integration: ERM is integrated into strategic planning and decision-making processes, whereas traditional risk management may be treated as a separate function.

- Risk View: Traditional approaches often view risks as purely negative, while ERM recognizes that some risks can present opportunities for growth and innovation.

- Responsibility: In traditional models, risk management is often the responsibility of a single department. ERM involves all levels of the organization in risk management efforts.

- Reporting: ERM typically involves more comprehensive and frequent risk reporting to senior management and the board of directors.

By adopting an ERM approach, organizations can move beyond siloed risk management practices and develop a more comprehensive and strategic view of risk.

Want to know in detail about Enterprise Risk Management? Get your ERM concepts and their importance clear with Lean Six Sigma Yellow Belt

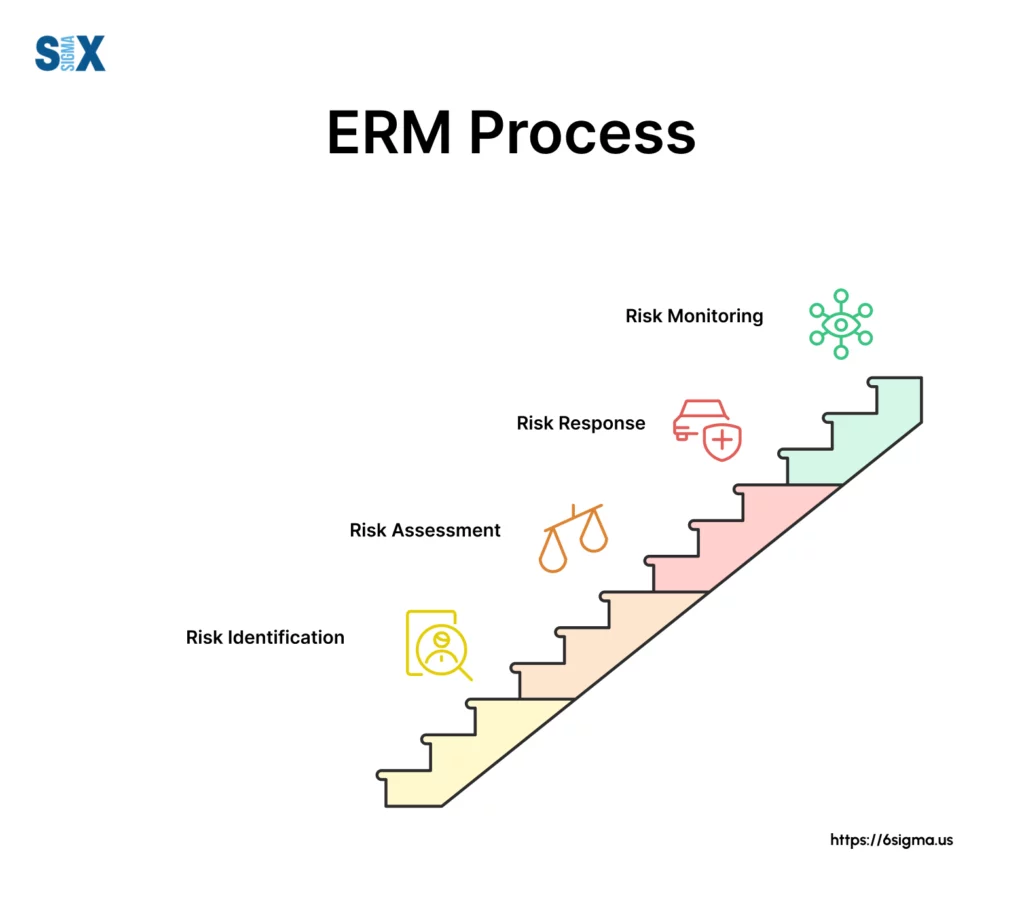

The Enterprise Risk Management Process

The ERM process is a systematic approach to identifying, assessing, and managing risks across an organization.

Risk Identification Techniques

Effective risk identification is crucial for a successful ERM program. Some common techniques include:

- Brainstorming sessions: Gathering input from employees across different departments to identify potential risks.

- SWOT analysis: Evaluating the organization’s strengths, weaknesses, opportunities, and threats to identify risk areas.

- Process mapping: Analyzing business processes to identify potential points of failure or vulnerability.

- External data analysis: Reviewing industry trends, economic indicators, and regulatory changes to identify emerging risks.

- Scenario planning: Developing hypothetical scenarios to identify potential risks and their impacts.

- Risk surveys: Conducting surveys among employees, customers, or industry experts to gather insights on potential risks.

By employing a combination of these techniques, organizations can create a comprehensive risk inventory that serves as the foundation for their ERM efforts.

Conducting Thorough Risk Assessments

Once risks are identified, the next step is to assess their potential impact and likelihood. This involves:

- Quantitative analysis: Using numerical data and statistical methods to estimate the potential financial impact of risks.

- Qualitative analysis: Evaluating risks based on subjective criteria, such as reputational impact or alignment with organizational values.

- Risk mapping: Plotting risks on a matrix to visualize their relative importance based on impact and likelihood.

- Root cause analysis: Identifying the underlying causes of risks to develop more effective mitigation strategies.

- Interdependency analysis: Evaluating how different risks may interact or compound each other.

A thorough risk assessment helps organizations prioritize their risk management efforts and allocate resources effectively.

Developing Effective Risk Mitigation Strategies with Enterprise Risk Management

After assessing risks, organizations need to develop strategies to address them. Common risk mitigation strategies include:

- Risk avoidance: Eliminating the activity or process that gives rise to the risk.

- Risk reduction: Implementing controls or procedures to reduce the likelihood or impact of the risk.

- Risk transfer: Shifting the risk to a third party through insurance or contractual agreements.

- Risk acceptance: Deciding to accept the risk if its potential impact is within the organization’s risk appetite.

- Risk optimization: Seeking opportunities to turn risks into potential advantages for the organization.

The choice of strategy depends on the nature of the risk, its potential impact, and the organization’s risk appetite.

Implementing and Monitoring Risk Controls

Once risk mitigation strategies are developed, organizations need to implement and monitor risk controls:

- Control design: Developing specific policies, procedures, or systems to address identified risks.

- Control implementation: Putting the designed controls into practice across relevant areas of the organization.

- Control testing: Regularly evaluating the effectiveness of implemented controls.

- Continuous monitoring: Using technology and data analytics to monitor risk indicators in real-time.

- Periodic review: Conducting regular assessments of the overall risk management process and making necessary adjustments.

Effective implementation and monitoring of risk controls ensure that the ERM process remains dynamic and responsive to changing business conditions.

Types of Risks Addressed by Enterprise Risk Management (ERM)

Enterprise Risk Management covers a wide range of risks that organizations face.

Understanding these different risk categories is essential for developing a comprehensive ERM strategy.

Strategic and Operational Risks

Strategic risks are those that affect an organization’s ability to achieve its long-term objectives. These may include:

- Market shifts

- Competitive pressures

- Technological disruptions

- Changes in customer preferences

Operational risks, on the other hand, relate to the day-to-day functioning of the organization. Examples include:

- Supply chain disruptions

- Equipment failures

- Human errors

- Process inefficiencies

ERM helps organizations identify and manage both strategic and operational risks, ensuring that short-term operations align with long-term goals.

Financial and Compliance Risks with Enterprise Risk Management

Financial risks encompass factors that could impact an organization’s financial stability and performance. These may include:

- Market volatility

- Credit risks

- Liquidity issues

- Foreign exchange fluctuations

Compliance risks relate to the potential for legal or regulatory violations. Examples include:

- Changes in industry regulations

- Data privacy laws

- Environmental regulations

- Labor laws

ERM frameworks help organizations stay ahead of financial and compliance risks by integrating risk management with financial planning and regulatory monitoring.

Cybersecurity and Technology Risks

In today’s digital age, cybersecurity and technology risks are increasingly critical. These may include:

- Data breaches

- Cyberattacks

- System failures

- Technology obsolescence

ERM approaches help organizations develop comprehensive strategies to protect their digital assets and maintain technological resilience.

Emerging Risks in the Modern Business Environment

The business landscape is constantly evolving, giving rise to new and emerging risks.

Some examples include:

- Climate change and environmental risks

- Geopolitical instability

- Pandemic-related disruptions

- Artificial intelligence and automation risks

ERM frameworks must be flexible enough to identify and address these emerging risks, helping organizations stay prepared for future challenges.

Implementing an Enterprise Risk Management Program

Implementing an effective ERM program requires a structured approach and commitment from all levels of the organization.

Establishing Risk Governance and Oversight

Effective risk governance is the foundation of a successful ERM program. This involves:

- Defining roles and responsibilities: Clearly outlining who is responsible for various aspects of risk management.

- Establishing a risk committee: Creating a dedicated group to oversee the ERM process and report to the board of directors.

- Developing a risk management policy: Creating a formal document that outlines the organization’s approach to risk management.

- Setting risk appetite and tolerance levels: Defining the amount and type of risk the organization is willing to accept.

- Ensuring board oversight: Involving the board of directors in risk governance and strategic risk decisions.

By establishing clear governance structures, organizations can ensure that ERM is integrated into all levels of decision-making.

Creating a Risk-Aware Organizational Culture with Enterprise Risk Management

A strong risk culture is essential for the success of an ERM program. Steps to create a risk-aware culture include:

- Leadership commitment: Demonstrating top-down support for risk management initiatives.

- Employee training and awareness: Providing regular training on risk management principles and practices.

- Encouraging open communication: Creating channels for employees to report potential risks without fear of reprisal.

- Integrating risk considerations into decision-making: Ensuring that risk assessment is part of all major business decisions.

- Rewarding risk-aware behavior: Recognizing and incentivizing employees who contribute to effective risk management.

A risk-aware culture helps ensure that ERM becomes an integral part of the organization’s DNA rather than just a compliance exercise.

Integrating Enterprise Risk Management (ERM) with Strategic Planning

To maximize its value, ERM should be closely integrated with the organization’s strategic planning process.

This involves:

- Aligning risk management with organizational objectives: Ensuring that risk management efforts support the achievement of strategic goals.

- Incorporating risk considerations into strategy formulation: Using risk insights to inform strategic decisions and resource allocation.

- Scenario planning: Using risk assessments to develop and evaluate different strategic scenarios.

- Risk-adjusted performance metrics: Incorporating risk considerations into performance measurement and evaluation.

- Regular strategy reviews: Conducting periodic reviews of the strategy in light of evolving risk landscapes.

By integrating ERM with strategic planning, organizations can make more informed decisions and better balance risk and opportunity.

Leveraging Risk Management Software and Tools

Technology plays a crucial role in modern ERM programs.

Key considerations include:

- Risk management information systems: Implementing software to centralize risk data and facilitate reporting.

- Data analytics tools: Utilizing advanced analytics to identify trends and patterns in risk data.

- Automated risk monitoring: Implementing systems for real-time monitoring of key risk indicators.

- Collaboration platforms: Using technology to facilitate communication and information sharing across the organization.

- Simulation and modeling tools: Employing software to model potential risk scenarios and their impacts.

By leveraging appropriate technology solutions, organizations can enhance the efficiency and effectiveness of their ERM efforts.

Measuring and Reporting on Enterprise Risk Management (ERM) Effectiveness

To ensure the ongoing success of an ERM program, organizations need to establish robust measurement and reporting processes.

This enables continuous improvement and demonstrates the value of ERM to stakeholders.

Developing Key Risk Indicators (KRIs)

Key Risk Indicators (KRIs) are metrics used to monitor and measure the level of risk in an organization. Effective KRIs should:

- Be aligned with organizational objectives

- Provide early warning of potential risk events

- Be measurable and quantifiable

- Be actionable and linked to specific risk responses

Examples of KRIs might include:

- Employee turnover rates (for human capital risk)

- Cybersecurity breach attempts (for information security risk)

- Customer complaint rates (for reputational risk)

- Vendor delivery times (for supply chain risk)

Developing a comprehensive set of KRIs helps organizations track their risk exposure over time and make informed decisions about risk management priorities.

Risk Reporting and Communication with Enterprise Risk Management

Effective risk reporting and communication are crucial for keeping stakeholders informed and engaged in the ERM process.

Key aspects include:

- Regular risk reports: Providing periodic updates on the organization’s risk profile and ERM activities.

- Dashboard visualization: Using visual tools to present risk information in an easily digestible format.

- Stakeholder-specific reporting: Tailoring risk reports to the needs of different stakeholders, such as the board, executives, and operational managers.

- Timely escalation processes: Establishing clear protocols for communicating critical risk information to decision-makers.

- Transparent communication: Ensuring that risk information is shared openly and consistently across the organization.

Effective risk reporting helps maintain transparency, supports informed decision-making, and demonstrates the value of the ERM program to stakeholders.

Continuous Improvement of the ERM Process

ERM is not a one-time initiative but an ongoing process that requires continuous improvement. Key steps include:

- Regular program assessments: Conducting periodic reviews of the ERM program’s effectiveness.

- Benchmarking: Comparing the organization’s ERM practices against industry standards and best practices.

- Feedback loops: Incorporating lessons learned from risk events and near-misses into the ERM process.

- Adapting to change: Regularly updating the ERM framework to address new risks and changing business conditions.

- Encouraging innovation: Fostering a culture that encourages new ideas and approaches to risk management.

By continuously improving the ERM process, organizations can ensure that their risk management practices remain relevant and effective in an ever-changing business environment.

Enterprise Risk Management (ERM) Best Practices and Standards

To ensure the effectiveness of their ERM programs, organizations often turn to established frameworks and standards.

These provide guidance on best practices and help standardize risk management approaches across industries.

Overview of COSO ERM Framework

The Committee of Sponsoring Organizations of the Treadway Commission (COSO) ERM Framework is one of the most widely recognized and adopted ERM standards.

Key aspects of the COSO framework include:

- Integration with strategy and performance

- Enhanced alignment between performance and ERM

- Focus on all levels of the entity

- Emphasis on decision-making

The COSO framework provides a comprehensive approach to ERM that can be adapted to organizations of various sizes and industries.

ISO 31000 Risk Management Standards

The International Organization for Standardization (ISO) 31000 provides principles and guidelines for effective risk management.

Key features of ISO 31000 include:

- Principles-based approach

- Flexibility for various organizational contexts

- Focus on creating and protecting value

- Emphasis on continual improvement

ISO 31000 offers a more flexible approach compared to COSO, making it adaptable to a wide range of organizations and risk management needs.

Industry-Specific Risk Management Approaches

Many industries have developed specific risk management standards tailored to their unique challenges.

Examples include:

- Financial services: Basel III for banking, Solvency II for insurance

- Healthcare: HIPAA risk assessment requirements

- Information technology: NIST Cybersecurity Framework

- Energy: API RP 1173 for pipeline safety management systems

Organizations should consider industry-specific standards alongside general ERM frameworks to develop a comprehensive risk management approach.

Know ERM best practices and standards with Root Cause Analysis

Conclusion

Enterprise Risk Management has evolved from a compliance-focused activity to a strategic imperative for organizations of all sizes and industries.

By adopting a comprehensive ERM approach, businesses can not only protect themselves from potential threats but also identify opportunities for growth and innovation.

As we’ve explored in this article, effective ERM requires a structured framework, strong governance, a risk-aware culture, and the integration of risk considerations into strategic decision-making.

The use of technology, particularly AI and data analytics, is increasingly central to modern ERM practices, enabling more sophisticated risk identification, assessment, and monitoring.

Looking to the future, ERM will continue to evolve, adapting to new challenges such as climate change, geopolitical instability, and rapid technological advancements.

By viewing ERM as a continuous journey of improvement rather than a destination, organizations can build the resilience and agility needed to navigate the risks and opportunities of the 21st century.

Effective enterprise risk management will be a key differentiator between those organizations that merely survive and those that truly thrive.

SixSigma.us offers both Live Virtual classes as well as Online Self-Paced training. Most option includes access to the same great Master Black Belt instructors that teach our World Class in-person sessions. Sign-up today!

Virtual Classroom Training Programs Self-Paced Online Training Programs