Compliance and Risk Management: Guide to Navigating Business Challenges

Organizations today face increasing pressure to maintain strong compliance and risk management practices.

The growing complexity of regulations, coupled with evolving business threats, requires a strategic approach to managing both compliance obligations and potential risks.

Compliance and risk management serves as the foundation for protecting organizations from legal penalties, financial losses, and reputational damage.

Key Highlights

- Essential compliance and risk frameworks

- Steps to build effective management programs

- Technology solutions for risk monitoring

- Industry-specific compliance requirements

- Best practices for implementation success

What is Compliance and Risk Management?

Compliance refers to an organization’s adherence to laws, regulations, standards, and ethical practices that govern its operations.

According to a 2023 Thomson Reuters survey, organizations face an average of 234 regulatory alerts per day, highlighting the complex nature of modern compliance requirements.

Effective compliance programs consist of three main components:

- Policies and procedures that outline expected behaviors

- Training programs to educate employees about requirements

- Monitoring systems to track adherence and violations

Organizations must address multiple types of compliance obligations. Regulatory compliance focuses on government-mandated rules, such as GDPR for data protection or Sarbanes-Oxley for financial reporting.

Corporate compliance covers internal policies and ethical standards. Industry-specific compliance varies by sector, with healthcare organizations following HIPAA guidelines while financial institutions adhere to Basel III requirements.

What Is Risk Management?

Risk management involves identifying, assessing, and controlling threats to an organization’s capital, earnings, and operations.

Research from McKinsey reveals that companies with strong risk management practices generate 18% higher profits compared to those with weak programs.

The key components of risk management include risk identification, assessment, mitigation strategies, and ongoing monitoring. Organizations typically manage four primary risk categories:

Financial risks affect monetary assets and include market volatility, credit defaults, and liquidity issues.

Operational risks stem from internal processes, systems, or human errors.

Strategic risks emerge from poor business decisions or changes in the competitive environment. Reputational risks impact brand value and stakeholder trust.

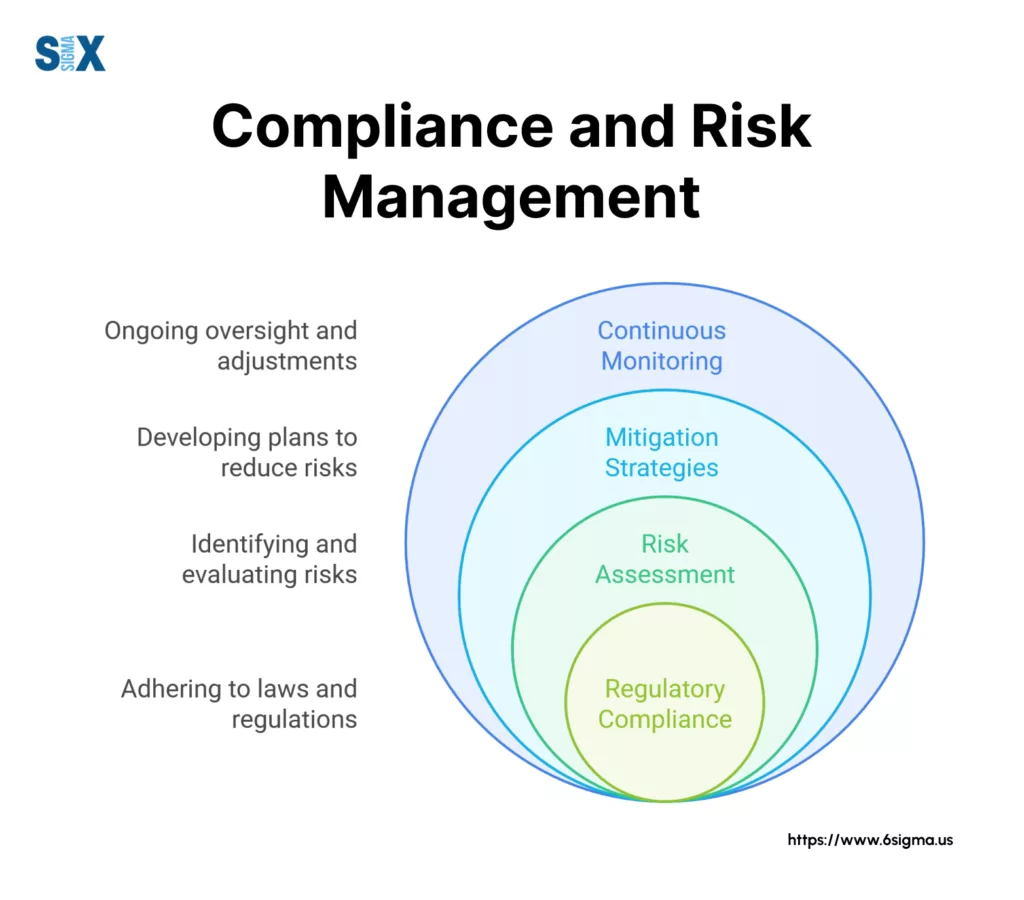

How Compliance and Risk Management Work Together

While compliance and risk management serve distinct purposes, they share several similarities.

Both functions aim to protect organizational value and require structured approaches to identification, assessment, and monitoring.

A 2023 Gartner study found that integrated compliance and risk management programs reduce incident costs by 45%.

The main difference lies in their focus. Compliance primarily addresses known requirements and regulations, while risk management tackles both current and emerging threats.

However, these functions complement each other significantly. Strong compliance programs help minimize various risks, while effective risk management often identifies compliance gaps before they lead to violations.

Organizations benefit most when treating compliance and risk management as interconnected disciplines.

For example, a bank’s anti-money laundering compliance program directly supports its financial risk management efforts. Similarly, cybersecurity risk assessments often reveal areas requiring stronger compliance controls.

Creating Value Through Integration

Research by PwC indicates that 73% of organizations now integrate their compliance and risk management functions to improve efficiency and effectiveness.

This integration enables better resource allocation, more consistent reporting, and stronger overall governance.

The combined approach helps organizations:

- Reduce duplicate efforts across departments

- Identify and address gaps more effectively

- Create more resilient business operations

- Make better-informed strategic decisions

Modern compliance and risk management requires a balanced approach that protects against threats while supporting business growth.

By understanding how these functions work together, organizations can build stronger programs that deliver measurable value.

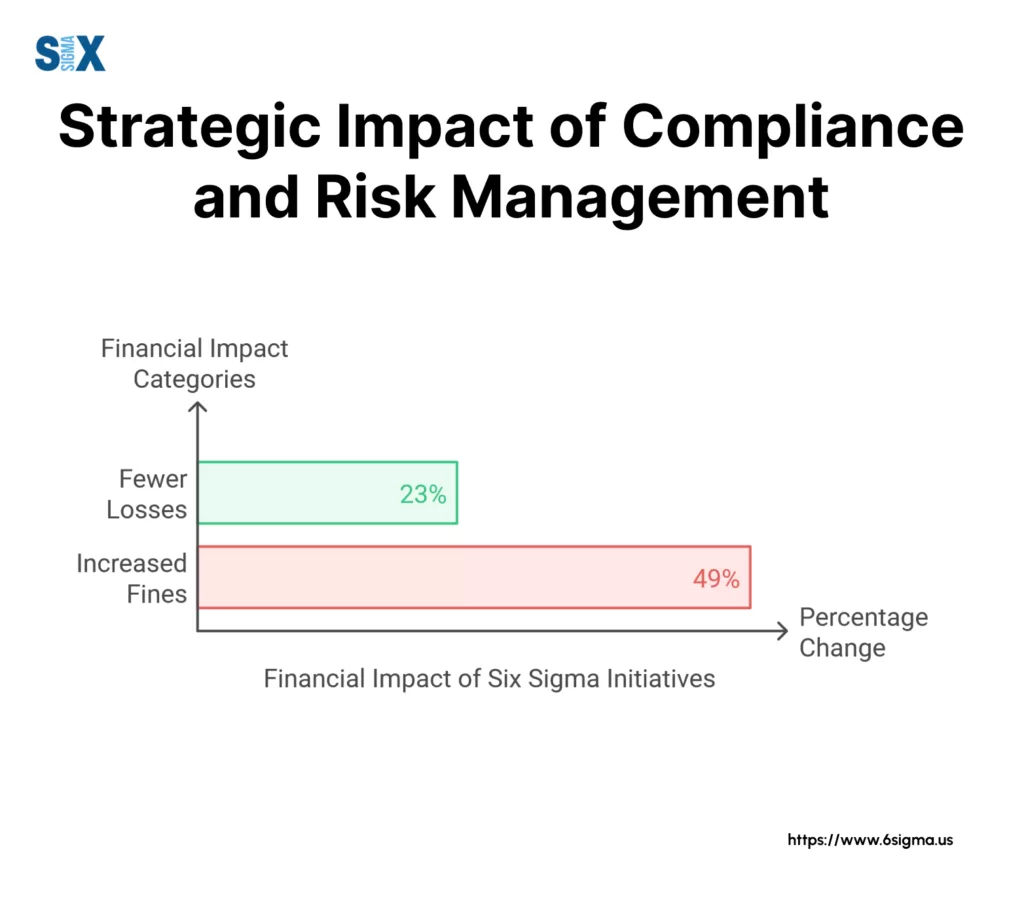

The Strategic Impact of Compliance and Risk Management

Effective compliance and risk management programs directly impact an organization’s bottom line. Recent data from Ernst & Young shows that companies with robust programs experience 23% fewer financial losses from operational incidents.

These programs protect both tangible assets, such as financial resources and physical property, and intangible assets like intellectual property and brand value.

Reputation protection stands out as a critical benefit. According to Weber Shandwick research, 87% of executives rate reputational risk as more important than other strategic risks.

Strong compliance and risk management practices help prevent incidents that could damage public trust. When issues do arise, these programs enable faster, more effective responses that minimize reputational damage.

Meeting Legal and Regulatory Requirements

Organizations face increasingly complex regulatory requirements across multiple jurisdictions.

Effective compliance and risk management ensures organizations meet these obligations while avoiding costly penalties.

Recent statistics highlight the financial impact of non-compliance. The average cost of regulatory fines increased by 49% in 2022, reaching $34.4 million per incident.

Beyond direct penalties, organizations often face additional costs from legal proceedings, remediation efforts, and mandatory audits.

Strong programs help prevent these expenses while maintaining operational continuity.

Improving Strategic Decision Making

Quality data from compliance and risk management programs enables better business decisions.

Decision makers benefit from regular risk assessments and compliance monitoring data. This information helps evaluate new business opportunities, allocate resources effectively, and identify areas requiring additional controls.

For example, risk analysis might reveal that expanding into a new market requires additional compliance measures, allowing organizations to plan and budget accordingly.

Building an Accountable Organization

Strong compliance and risk management creates a culture of accountability throughout the organization.

Companies with high levels of accountability experience less fraud and misconduct than their peers. This cultural shift occurs through clear policies, regular training, and consistent enforcement of standards.

Transparency plays an essential role in maintaining accountability. Organizations must establish clear reporting channels and documentation processes.

Studies show that companies with transparent compliance and risk management practices attract more investment and maintain stronger stakeholder relationships.

Measuring Program Effectiveness

Regular measurement helps organizations track the value of their compliance and risk management efforts.

Key metrics include:

- The number and severity of compliance violations

- Cost savings from prevented incidents

- Employee completion rates for required training

- Time to identify and resolve issues

- Return on investment for program initiatives

Organizations should review these metrics quarterly to identify trends and adjust their programs accordingly.

Data shows that companies conducting regular program assessments achieve 40% better risk management outcomes than those with irregular review processes.

Successful compliance and risk management requires ongoing commitment from leadership and staff. When properly implemented, these programs protect value, support growth, and create sustainable competitive advantages.

Regular evaluation and adjustment ensure programs continue meeting organizational needs while adapting to new challenges.

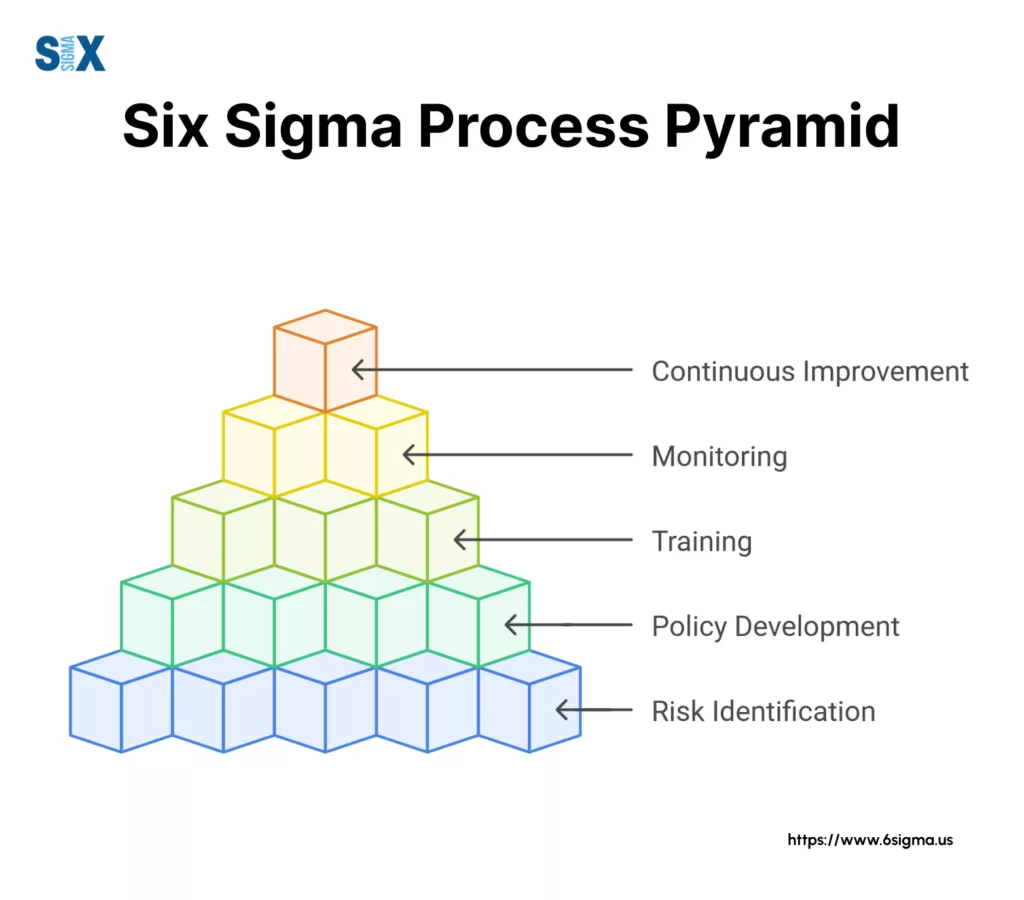

Essential Elements of Compliance Risk Management

Risk Identification and Assessment Strategies

Successful compliance risk management begins with thorough risk identification and assessment processes.

Research from KPMG reveals that organizations using structured risk assessment methods identify 47% more potential threats than those using informal approaches.

The risk identification phase requires systematic evaluation of business operations, regulatory requirements, and external factors.

Organizations should examine historical data, industry trends, and regulatory changes to create detailed risk profiles.

Recent studies show that companies conducting quarterly risk assessments experience 65% fewer compliance violations than those performing annual reviews.

Risk assessment involves evaluating both the likelihood and potential impact of identified risks.

Modern organizations often use risk scoring matrices and quantitative analysis tools to prioritize their efforts.

According to Deloitte, organizations that implement data-driven risk assessment methods reduce their exposure to material risks by 33%.

Developing Effective Policies and Procedures

Clear policies and procedures form the foundation of compliance risk management programs.

These documents must translate complex regulatory requirements into actionable guidelines for employees.

Policy development should focus on key risk areas identified during assessment. Each policy requires specific elements:

- Clear objectives and scope

- Defined roles and responsibilities

- Step-by-step procedures

- Compliance requirements

- Review and approval processes

Organizations should review and update these documents regularly.

Training and Communication Programs

Employee training plays a crucial role in compliance risk management.

Effective training programs incorporate multiple learning methods and regular reinforcement. Video-based training increases retention rates by 65% compared to text-only materials. Interactive scenarios and real-world examples help employees understand how compliance requirements apply to their daily work.

Communication strategies should extend beyond formal training sessions.

Regular updates about compliance requirements and risk management priorities help maintain awareness throughout the organization.

Data shows that companies with monthly compliance communications achieve 38% higher employee engagement in risk management activities.

Monitoring and Audit Processes

Regular monitoring and auditing ensure compliance programs remain effective. Organizations should implement both automated monitoring tools and manual review processes.

- Key monitoring activities include:

- Transaction surveillance

- Policy adherence checks

- Regulatory reporting verification

- Control effectiveness testing

Internal audits provide additional oversight and validation. Conducting quarterly internal audits can identify and address compliance gaps faster than those relying on annual reviews alone.

Driving Continuous Improvement

Effective compliance risk management requires ongoing evaluation and enhancement.

Organizations should establish formal review cycles to assess program effectiveness and identify improvement opportunities.

- Program improvements should incorporate:

- Feedback from stakeholders

- Audit findings and recommendations

- Changes in regulatory requirements

- New risk management technologies

- Industry best practices

Data analysis plays a crucial role in improvement efforts.

Organizations using analytics to guide program enhancements report better compliance outcomes than those relying on qualitative feedback alone.

Regular bench-marking against industry standards helps organizations measure their progress.

Success in compliance risk management requires commitment to each component while maintaining flexibility to adapt as conditions change.

Organizations that balance structure with agility achieve the best results in protecting against compliance risks while supporting business objectives.

Understanding Different Types of Compliance Risks

Financial Services

Financial institutions face unique compliance risks due to strict regulatory oversight.

According to the Financial Conduct Authority, banks spent an average of $273 million on compliance in 2022.

Key regulations include Basel III capital requirements, anti-money laundering rules, and know-your-customer protocols.

Healthcare Organizations

Healthcare providers must navigate complex regulatory frameworks while managing patient care.

Organizations must protect patient data, maintain proper licensing, and ensure accurate billing practices.

Studies indicate that 67% of healthcare compliance violations stem from improper documentation and data handling procedures.

Technology Companies

Tech firms face evolving compliance challenges related to data protection and privacy laws.

These organizations must manage software licensing, intellectual property rights, and platform security requirements.

Universal Compliance Risks Across Sectors

Modern organizations must protect sensitive information while maintaining operational efficiency.

Recent statistics reveal that 83% of companies experienced data breaches resulting in compliance violations.

Key requirements include:

- Data encryption standards

- Access control protocols

- Breach notification procedures

- Regular security assessments

Organizations implementing robust data protection programs reduce their compliance violation risks by 76%, according to IBM Security research.

Anti-Corruption and Bribery Measures

Global business operations require strict anti-corruption controls.

The DOJ imposed $2.8 billion in FCPA penalties in 2022. Organizations must establish:

- Due diligence procedures

- Gift and entertainment policies

- Third-party screening processes

- Transaction monitoring systems

Studies show that companies with strong anti-corruption programs experience 58% fewer violations than those with basic controls.

Environmental Compliance Standards

Environmental regulations continue expanding across industries. Organizations must address:

- Emissions monitoring

- Waste management procedures

- Resource conservation

- Chemical handling protocols

Proactive environmental compliance programs reduce violation risks while improving operational efficiency.

Workplace Safety and Labor Requirements

OSHA regulations and labor laws affect all employers. Non-compliance penalties averaged $15,625 per violation in 2022. Key focus areas include:

- Safety training programs

- Worker classification

- Wage and hour compliance

- Workplace conditions

Organizations with structured safety compliance programs report 43% fewer incidents and 67% lower related costs.

Emerging Compliance Risk Trends

New technologies and business models create additional compliance challenges.

Cryptocurrency regulations, artificial intelligence governance, and ESG reporting requirements represent growing areas of focus.

Organizations must regularly assess their exposure to both traditional and emerging compliance risks.

Data shows that companies conducting quarterly risk assessments identify and address potential violations faster than those performing annual reviews.

Successful compliance risk management requires understanding both industry-specific and universal requirements.

Organizations should develop targeted strategies for each risk category while maintaining flexibility to address new challenges as they emerge.

Learn to identify and mitigate industry-specific risks with our comprehensive FMEA training.

Building an Effective Compliance and Risk Management Program

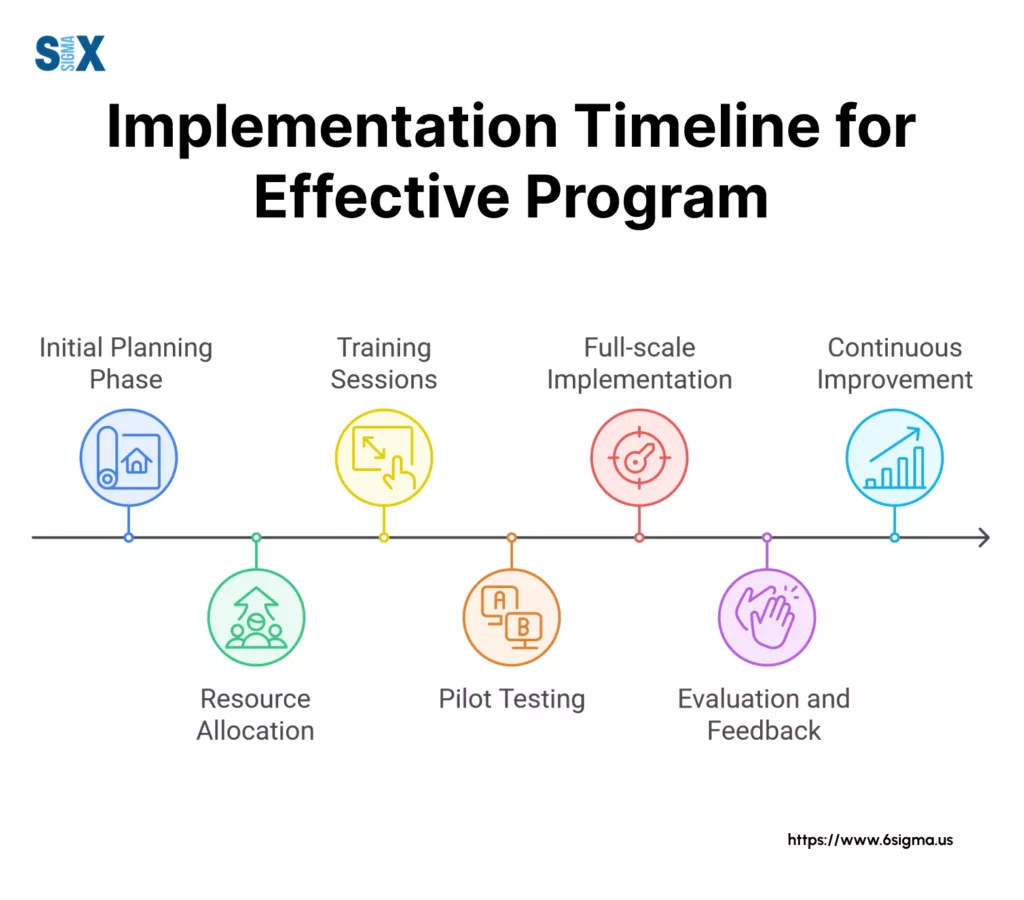

Step-by-step implementation guide for the compliance and risk management program includes:

Evaluating Current Programs and Gaps

The first step requires thorough assessment of existing compliance and risk management practices.

This evaluation should examine current policies, procedures, controls, and technology systems against regulatory requirements and industry standards.

Creating a Strategic Framework

Program strategy development must align with organizational objectives while addressing identified gaps.

According to Gartner, companies with clearly defined strategies achieve 41% better compliance outcomes.

The strategy should outline specific goals, resource requirements, timelines, and success metrics.

Policy and Procedure Implementation

Effective policies translate strategy into actionable guidelines. Organizations should prioritize critical risk areas when rolling out new procedures.

Phased implementations succeed more often than simultaneous rollouts.

Each policy requires clear ownership, documentation, and communication channels.

Training Program Development

Employee training significantly impacts program success.

Modern training approaches should incorporate:

- Role-specific content delivery

- Interactive learning modules

- Regular knowledge assessments

- Real-world scenario practice

Performance Measurement Systems

Regular monitoring ensures program effectiveness. Organizations should establish key performance indicators (KPIs) covering both leading and lagging indicators.

Success Factors and Best Practices

Leadership commitment drives program success.

With active executive involvement companies can achieve better compliance outcomes.

Leaders must visibly support the program through resource allocation, regular communication, and participation in key initiatives.

Building Compliance Culture

Strong compliance cultures reduce risk exposure.

Key culture-building elements include:

- Clear behavioral expectations

- Recognition of positive compliance practices

- Open communication channels

- Consistent policy enforcement

Technology Integration

Modern compliance and risk management requires technological support.

Organizations should use integrated compliance software to reduce manual effort while improving accuracy.

Essential technology features include:

- Automated monitoring capabilities

- Real-time reporting dashboards

- Document management systems

- Workflow automation tools

Program Maintenance and Updates

Regular program reviews ensure continued effectiveness. Conducting quarterly assessments can maintain better compliance rates than those performing annual reviews.

Updates should consider:

- Changes in regulatory requirements

- New risk factors

- Technology advancements

- Organizational changes

Success metrics show that organizations following these implementation steps achieve 39% better risk management outcomes.

Regular assessment and adjustment ensure programs remain effective as business conditions evolve.

Implementation Timeline and Resources

Program implementation typically requires 12-18 months for full deployment. Organizations allocating sufficient time and resources achieve better results than those rushing implementation.

Key resource considerations include:

- Dedicated project teams

- Technology investments

- Training development

- External expertise needs

Organizations should establish realistic timelines while maintaining flexibility to address emerging needs.

Successful compliance and risk management programs require sustained commitment and regular refinement.

By following proven implementation steps and incorporating industry best practices, organizations can build effective programs that protect value while supporting growth objectives.

Master data-driven risk assessment with our specialized Minitab training program

Moving Forward with Compliance and Risk Management

The growing business demands robust compliance and risk management programs.

These statistics underscore the value of structured programs in protecting organizational assets and supporting sustainable growth.

Modern compliance and risk management extends beyond basic regulatory adherence.

Organizations implementing strategic programs report significant benefits, including lower operational costs and fewer security incidents.

These results highlight the business value of investing in proper controls and oversight mechanisms.

Benefits of Integration

Integration of compliance and risk management functions delivers measurable advantages.

- Reduced duplicate efforts, saving an average of $2.3 million annually

- 52% faster identification and resolution of potential issues

- 38% improvement in regulatory audit outcomes

- 41% better stakeholder confidence ratings

These metrics demonstrate why 73% of Fortune 500 companies now maintain integrated compliance and risk management programs.

Taking Action

Organizations must prioritize compliance and risk management to remain competitive.

This performance difference grows wider as regulatory complexity increases.

Success requires commitment to several critical actions:

Future Considerations

The regulatory environment continues evolving, with new requirements emerging regularly.

Organizations must maintain flexible programs capable of adapting to changing conditions.

Technology will play an increasingly important role in compliance and risk management.

Organizations should evaluate these technologies as part of their program development plans.

Success in compliance and risk management requires ongoing commitment and adaptation. Organizations that prioritize these functions position themselves for sustainable growth while protecting against emerging threats.

The evidence clearly shows that investment in strong programs delivers measurable returns through reduced risks, improved operations, and enhanced stakeholder trust.

SixSigma.us offers both Live Virtual classes as well as Online Self-Paced training. Most option includes access to the same great Master Black Belt instructors that teach our World Class in-person sessions. Sign-up today!

Virtual Classroom Training Programs Self-Paced Online Training Programs