Mastering Payoff Matrices: Power of Strategic Decision-Making Tools

Navigating intricacy and choosing prudently hold prime significance. Fortunately, payoff matrix emerge as potent sense-makers.

Through over two decades guiding transformational change, I’ve witnessed matrices’ gifts firsthand time and again across various terrains.

Essentially, these visual organizers furnish structured comprehension beyond instinct.

By mapping options and their effects, matrices illuminate the nuanced interweaving amid counterpart actions and reverberations – aiding intelligent navigation.

Originating from strategy analyses, matrices now uplift diverse domains beyond their theoretical roots.

Their knack for bringing clarity amid complexity and furnishing prudent guidance merits respect.

Ultimately, matrices empower optimized decisions driving continual progressions – whether navigating cooperation/competition waters or resolving production dilemmas beneficially.

By reflecting on such proven decision-aiding, ponder matrices’ value wherever intricate choice-points present.

Key Highlights

- A payoff matrix is a powerful decision-making tool that visually represents the potential outcomes of strategic choices made by multiple parties.

- It originated from game theory but has found widespread applications across various industries, including product management, business strategy, risk assessment, and resource allocation.

- The key components of a payoff matrix are the players (decision-makers), strategic choices, and potential outcomes or payoffs.

- Payoff matrices help decision-makers understand the interplay between different parties’ actions and their corresponding consequences.

- They provide a structured approach to analyzing complex scenarios, identifying optimal strategies, and making informed decisions.

- Advanced concepts like Nash equilibrium, dominant strategies, coordination games, and mixed strategies enhance the analytical depth of payoff matrix analysis.

- Practical applications include feature prioritization, risk assessment, resource allocation, stakeholder analysis, and decision optimization.

- Best practices involve addressing incomplete information, combining payoff matrices with other decision-making tools, conducting sensitivity analyses, and considering ethical implications.

- Payoff matrices offer a data-driven framework for strategic decision-making, with emerging applications in areas like AI integration and collaborative decision-making.

Introduction to Payoff Matrix: A Powerful Decision-Making Tool

A payoff matrix visualizes the potential outcomes of strategic choices, a principle central to methodologies like Six Sigma, with Six Sigma certification emphasizing the use of such structured frameworks to enhance problem-solving capabilities.

It provides a structured framework for analyzing the interplay between different players’ actions and the corresponding payoffs or consequences, allowing for informed and data-driven decision-making.

The Origins of Payoff Matrix in Game Theory

The concept of payoff matrices finds its roots in game theory, a branch of mathematics that studies strategic decision-making situations involving multiple players with potentially conflicting interests.

Game theorists developed payoff matrices as a tool to model and analyze the outcomes of various strategic interactions, such as competitive games, negotiations, and economic scenario.

Key Components: Players, Strategic Choices, and Outcomes

The key components of a payoff matrix are the players (decision-makers), the strategic choices available to each player, and the potential outcomes or payoffs resulting from the combination of those choices.

Players can be individuals, teams, companies, or any entity involved in decision-making. Strategic choices represent the available actions or strategies that each player can choose.

Outcomes or payoffs are the consequences or results associated with each combination of choices, often expressed as numerical values representing profits, losses, benefits, or any relevant measure of success or utility.

Creating and Interpreting Payoff Matrix

Building a payoff matrix is a structured process that involves several key steps:

- Identify the players or decision-makers involved in the scenario.

- List the strategic choices or actions available to each player.

- Determine the potential outcomes or payoffs resulting from each combination of choices.

- Organize the choices and outcomes in a grid or matrix format, with rows representing the choices of one player and columns representing the choices of the other player(s).

- Fill in the matrix with the corresponding payoffs for each combination of choices.

Understanding Payoff Matrix Results and Quadrants

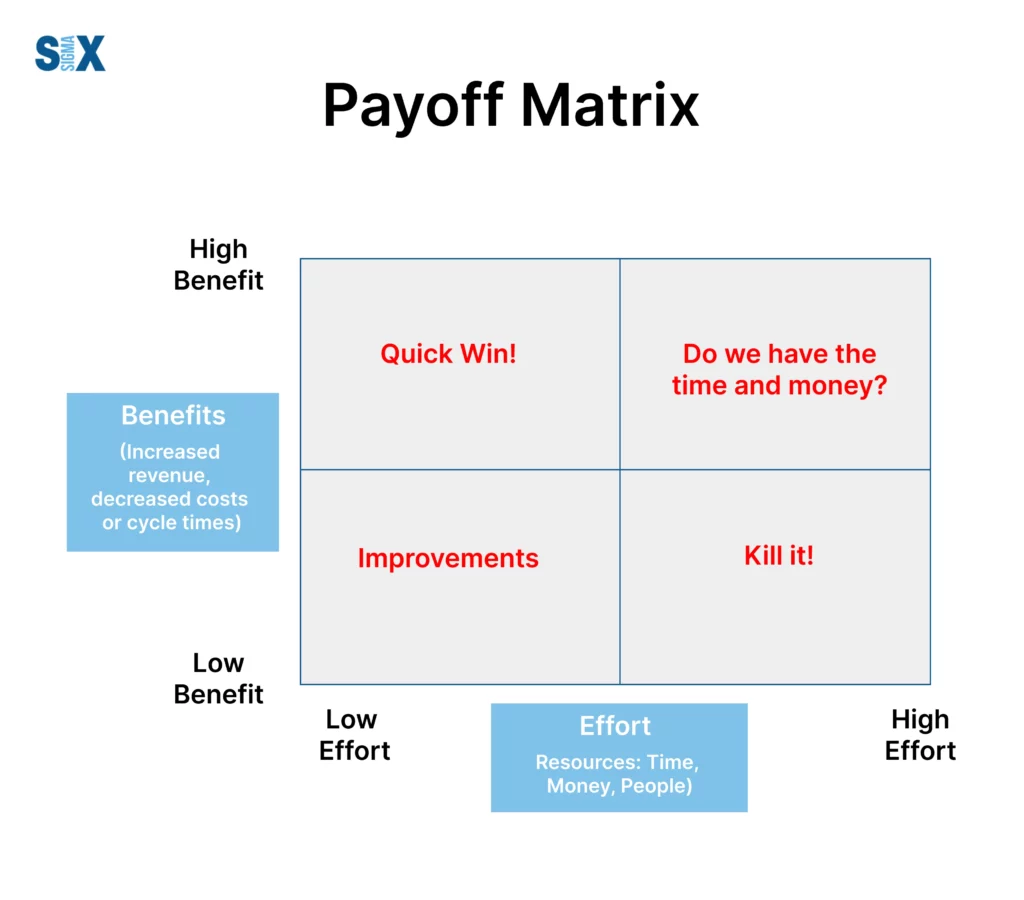

Interpreting the results of a payoff matrix involves analyzing the quadrants or cells within the matrix.

Each quadrant represents a specific combination of choices made by the players and the associated payoffs.

The payoffs can be numerical values or qualitative descriptions, depending on the nature of the scenario.

It’s important to consider the preferences and objectives of each player when evaluating the payoff matrix results.

Symmetric vs. Asymmetric Payoff Matrix

Payoff matrices can be classified as symmetric or asymmetric, depending on the relationship between the players’ payoffs:

- Symmetric Payoff Matrix: In a symmetric payoff matrix, the payoffs for each player remain the same, regardless of the choices made by other players. The resulting outcomes are identical for all players.

- Asymmetric Payoff Matrix: In an asymmetric payoff matrix, the payoffs for each player depend on the specific choices made by other players. The resulting outcomes vary significantly based on the combinations of choices made.

Practical Examples from Product Management and Business

Payoff matrices find practical applications in various business domains, including product management, strategic planning, and decision analysis.

For instance, product managers with a six sigma green belt certification routinely use payoff matrices to balance stakeholder priorities and resource constraints, ensuring data-backed feature prioritization

In business strategy, payoff matrices can help assess the outcomes of competitive actions or market entry decisions.

Advanced Concepts in Payoff Matrix Analysis

Nash equilibrium is a fundamental concept in game theory and payoff matrix analysis.

It represents a situation where no player can improve their payoff by unilaterally changing their strategy, given the strategies chosen by the other players.

In other words, it’s a stable state where each player’s strategy is the best response to the strategies of the other players.

Dominant strategies are strategies that yield the best possible outcome for a player, regardless of the choices made by the other players.

If a player has a dominant strategy, it is always optimal to choose that strategy, regardless of the other player’s actions.

Coordination Games and the Prisoners’ Dilemma

Coordination games are scenarios where players’ interests are aligned, and they benefit from cooperating.

The classic example is the Prisoners’ Dilemma, where two prisoners must decide whether to cooperate or defect, resulting in different payoffs depending on their choices.

Anti-coordination Games and Conflict Resolution

Anti-coordination games are scenarios where players’ interests conflict, and they benefit from choosing opposite strategies.

These games model situations where players compete for limited resources or engage in conflicts.

Analyzing anti-coordination games can provide insights into conflict resolution strategies and negotiation tactics.

Mixed Strategies and Probabilistic Analysis

In some situations, pure strategies (deterministic choices) may not lead to optimal outcomes.

Mixed strategies involve players selecting their strategies probabilistically, assigning specific probabilities to each available choice.

This approach can lead to more favorable outcomes in certain scenarios and is often used in game theory and payoff matrix analysis.

Payoff Matrix in Practice: Applications and Case Studies

In product management, payoff matrices can be invaluable tools for prioritizing features or product development initiatives based on their potential benefits and the resources required for implementation.

By mapping out the potential outcomes of various product decisions, product managers can make informed choices that align with their strategic objectives and optimize resource allocation.

Risk Assessment and Scenario Analysis

Payoff matrices can be used for risk assessment and scenario analysis in various industries.

By modeling the potential outcomes of different risk scenarios and the associated payoffs, organizations can better understand the potential impact of risks and develop effective mitigation strategies.

Combining payoff matrices with root cause analysis training enables teams to preemptively address systemic risks uncovered during scenario modeling.

Resource Allocation and Cost-Benefit Analysis with Payoff Matrix

In resource allocation and cost-benefit analysis, payoff matrices can help decision-makers evaluate the trade-offs between different investment or resource allocation options.

This approach mirrors the cost-benefit frameworks taught in six sigma certification programs, where professionals learn to quantify trade-offs and optimize resource allocation.

Stakeholder Analysis and Decision Optimization

Payoff matrices can also be used for stakeholder analysis and decision optimization.

By modeling the preferences and objectives of different stakeholders, decision-makers can identify win-win scenarios or negotiate mutually beneficial outcomes.

This approach can foster collaboration, resolve conflicts, and optimize decision-making processes.

Limitations and Best Practices for Using Payoff Matrix

While payoff matrices are powerful tools, they rely on the availability of accurate and complete information.

In many scenarios, information is often incomplete or uncertain, which can impact the accuracy of the payoffs estimated in the matrix.

To address this limitation, decision-makers should complement the use of payoff matrices with other decision-making tools, such as sensitivity analysis, scenario planning, and real-time data collection.

Combining Payoff Matrix with Other Decision-Making Tools

To create a more robust decision-making process, it is recommended to combine the insights generated by payoff matrices with other analytical tools and techniques.

These can include decision trees, utility theory, and statistical modeling, among others.

By integrating multiple decision-making tools, organizations can gain a more comprehensive understanding of the decision landscape and make more informed choices.

Sensitivity Analysis and Continuous Monitoring

Payoff matrices are static representations of decision scenarios at a given point in time.

However, situations are dynamic, and the assumptions or conditions underlying the payoff matrix may change over time.

To address this, it is essential to conduct sensitivity analyses and continuously monitor the decision environment.

By regularly reviewing and updating the payoff matrix, decision-makers can adapt their strategies and maintain optimal decision-making processes.

Ethical Considerations and Responsible Decision-Making

While payoff matrices provide a structured approach to decision-making, it is crucial to consider ethical implications and responsible decision-making practices.

Decision-makers should ensure that the payoffs and outcomes considered in the matrix align with ethical principles, social responsibilities, and stakeholder interests.

Additionally, transparency and accountability should be maintained throughout the decision-making process.

Future Directions and Emerging Applications

Payoff matrix applications continually evolve across expanding domains. Data-driven resolutions and artificial intelligence’s expanding roles envision enhancing matrices’ predictive capacity and optimized decisions.

By leveraging machine learning and predictive modeling capacities, enterprises furnish more accurate estimations factoring complexity and patterns.

AI-empowered guidance systems further ease navigation.

Bridging theoretical frameworks and practical deployments, matrices illuminate complex landscapes comprehensively. Combining rigor and real-world comprehension, prudent decisions propel strategic visions.

Collaborative styles and emerging technologies’ integrations undoubtedly birth innovations amid uncertainty.

Therefore, maintaining ethics and responsibility amid transformations proves vital navigating intricacies successfully long-term.

Ultimately, matrices prove invaluable amid changing tides, mitigating risks while grasping opportunities.

Their structured yet flexible nature for analyzing intricate scenarios and identifying optimized routes merits faithful consideration wherever strategic determinations present intricate calculations.

SixSigma.us offers both Live Virtual classes as well as Online Self-Paced training. Most option includes access to the same great Master Black Belt instructors that teach our World Class in-person sessions. Sign-up today!

Virtual Classroom Training Programs Self-Paced Online Training Programs