Compliance Management System: Ensuring Regulatory Adherence

Nowadays across various industries and jurisdictions companies face regulatory requirements considering their complex nature of work.

While maintaining the operational efficiency Compliance Management System (CMS) serves as the central and most important framework which helps business meet their regulatory demands.

Key Highlights

- Building blocks of successful compliance programs

- Steps to implement a CMS

- Software solutions for compliance management

- Industry-specific compliance requirements

- Latest trends shaping compliance management

What is a Compliance Management System?

Organizations use tools to meet regulatory requirements and their internal standards which is called as Compliance Management System (CMS) combining tools, processes, and controls.

This structured framework helps businesses track, monitor, and maintain compliance while reducing risks and operational inefficiencies.

Think of a CMS as the central nervous system for regulatory compliance. When new regulations emerge, the system helps organizations adapt quickly.

For instance, when GDPR took effect, organizations with robust compliance management systems could swiftly update their data handling practices and train employees on new requirements.

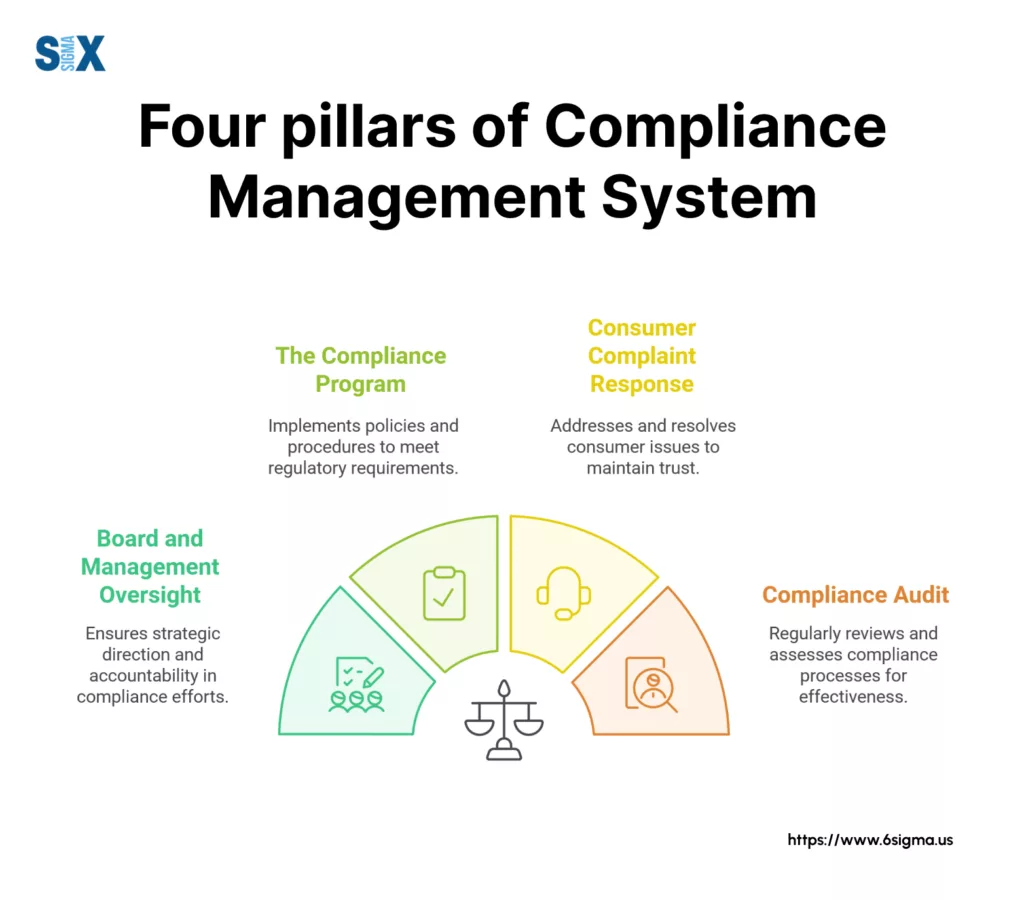

The Four Pillars of a Compliance Management System

Board and Management Oversight forms the first pillar of an effective compliance management system. The board sets compliance policies and ensures adequate resources for compliance activities.

They review regular reports on compliance status and make strategic decisions about risk tolerance.

The Compliance Program represents the second pillar, encompassing policies, procedures, and training materials.

This includes documented processes for handling sensitive data, conducting risk assessments, and responding to compliance violations.

Consumer Complaint Response serves as the third pillar.Organizations must track, address, and learn from customer feedback about potential compliance issues.

Banks, for example, use this feedback to identify and fix problems with their lending practices before regulators get involved.

Compliance Audit stands as the fourth pillar, providing regular checks on the effectiveness of compliance efforts.

These audits help identify gaps in processes and controls while ensuring the organization stays aligned with changing regulations.

Learn how to analyze complex compliance challenges that traditional process improvements can’t solve.

Examples of a Compliance Management System in Action

Healthcare organizations implement compliance management systems to protect patient information under HIPAA.

Their systems include access controls for medical records, staff training programs, and incident response procedures for potential data breaches.

Compliance management systems are used by financial institutions to meet banking regulations.

To maintain proper documentation for loans and ensure fair practices these systems help them keep track of this transactions for suspicious activities.

Technology companies rely on compliance management systems to manage multiple data protection requirements.

Their systems track where customer data resides, who has access to it, and how it’s protected across different jurisdictions.

Manufacturing firms implement compliance management systems to meet environmental and safety regulations.

These systems monitor emissions, track safety incidents, and ensure proper handling of hazardous materials.

Technology in Modern Compliance Systems

Today’s compliance management systems leverage automation and artificial intelligence to streamline compliance tasks.

Automated monitoring tools flag potential violations in real-time, while AI helps analyze patterns in compliance data to predict and prevent issues.

Software solutions now integrate with existing business systems to collect compliance evidence automatically.

This reduces manual work and improves accuracy in compliance reporting. For example, HR systems automatically track required employee training, while IT systems monitor system access and security controls.

Gain practical tools to analyze and improve your compliance metrics with Green Belt BootCamp

This foundation in compliance management systems enables organizations to build effective compliance programs that adapt to new requirements while maintaining operational efficiency.

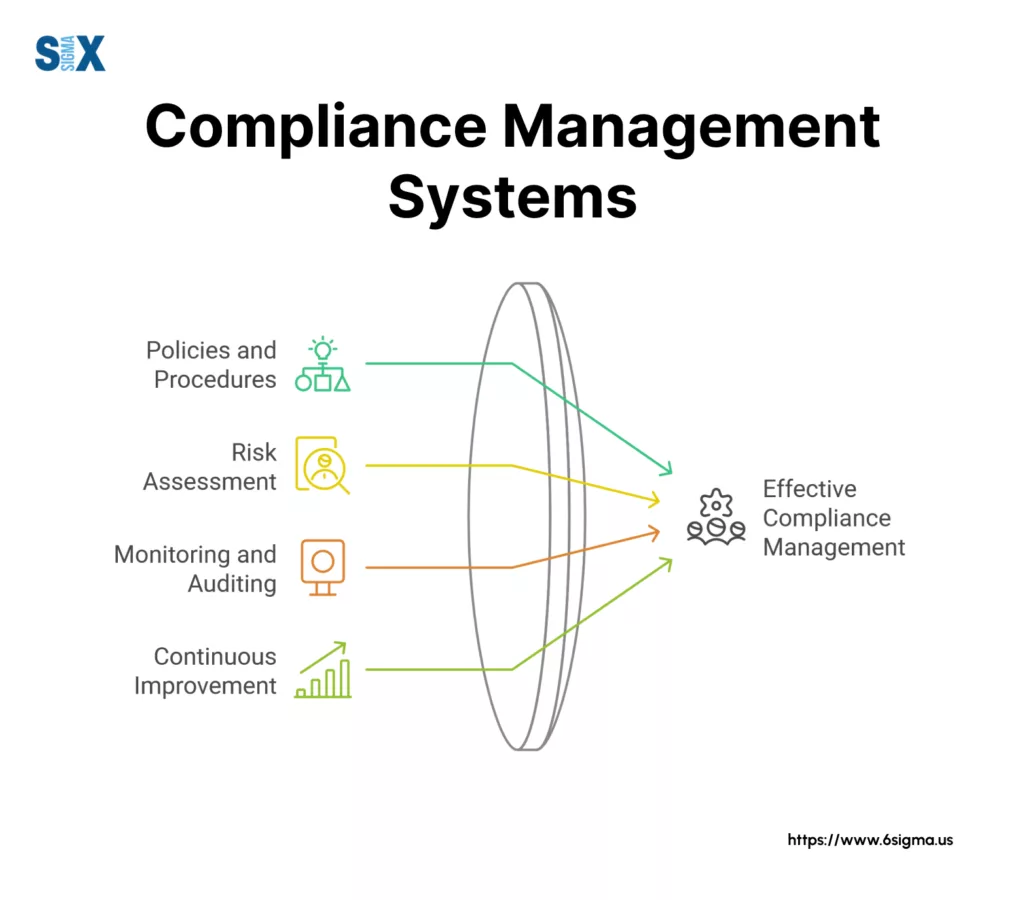

Components of an Effective Compliance Management System

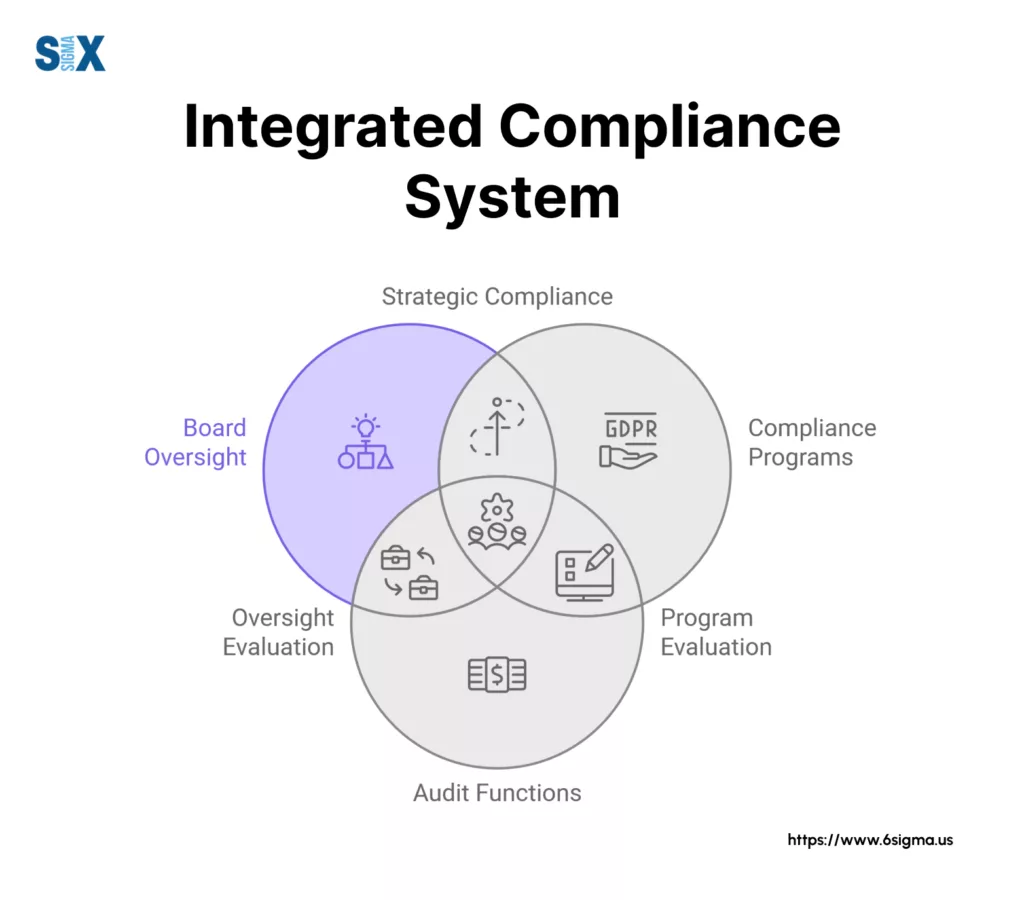

Board and Management Oversight

The board of directors plays a crucial role in shaping an organization’s compliance management system.

They establish risk tolerance levels, approve compliance policies, and ensure adequate resources for compliance activities.

For example, when implementing new data privacy regulations, the board determines investment levels in technology and staffing to meet requirements.

Senior management translates board directives into actionable compliance strategies.

They develop specific policies, assign responsibilities to department heads, and monitor progress through regular reporting.

A retail bank’s management team might create detailed procedures for handling customer data based on board-approved privacy policies.

Building a Strong Compliance Program

The compliance program forms the operational backbone of a compliance management system. This includes written policies, procedures, and standards that guide daily activities.

Financial institutions maintain detailed lending procedures to ensure fair lending practices and prevent discrimination.

Employee training represents another vital element of the compliance program. Regular training sessions keep staff updated on regulatory requirements and internal policies.

Healthcare organizations conduct quarterly HIPAA training to ensure staff understand patient privacy requirements.

Risk assessment processes help identify potential compliance gaps. Organizations evaluate their operations against regulatory requirements and industry standards to spot areas needing attention.

Technology companies regularly assess their systems against security standards to maintain data protection compliance.

Managing Consumer Complaints Effectively

A robust consumer complaint response system serves as an early warning mechanism for compliance issues.

Organizations must track, categorize, and analyze complaints to identify patterns that might indicate systemic problems.

For instance, multiple complaints about account charges might reveal issues with fee disclosure practices.

The complaint handling process should include:

- Clear procedures for receiving and documenting complaints

- Designated staff responsible for investigation and resolution

- Regular reporting to management on complaint trends

- Documentation of corrective actions taken

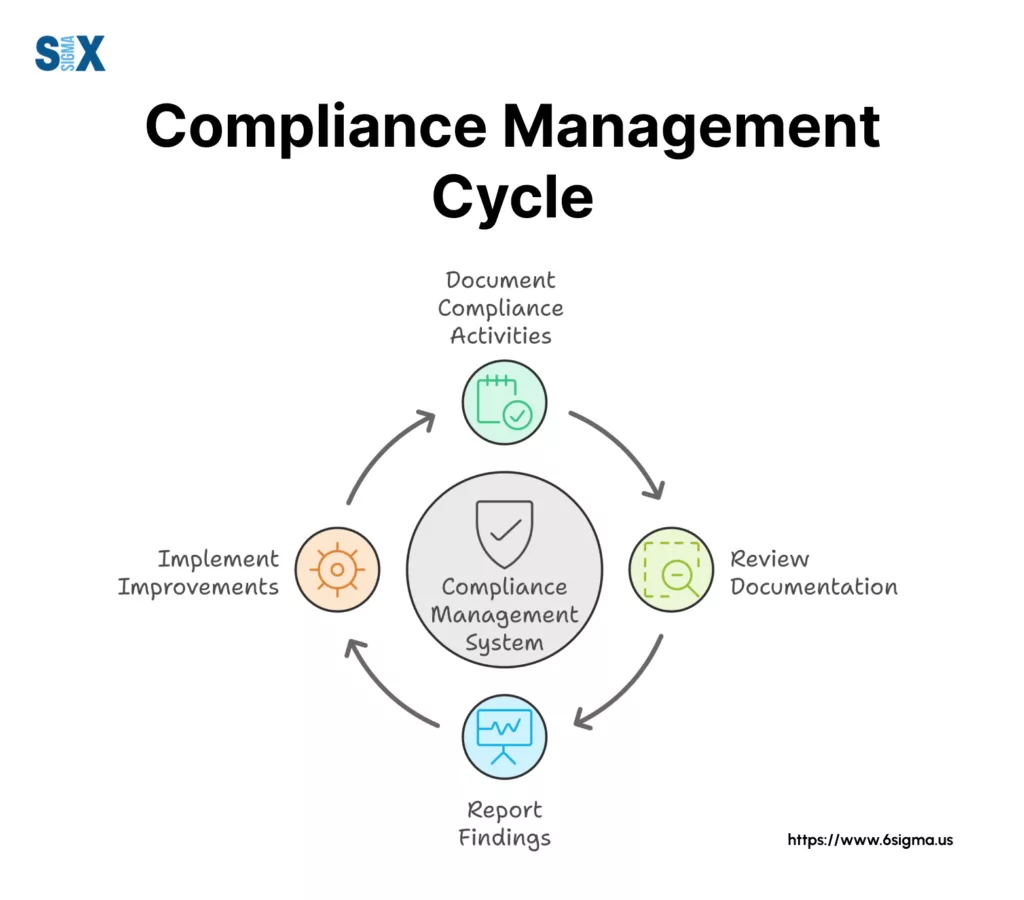

Conducting Thorough Compliance Audits

Regular compliance audits verify the effectiveness of the compliance management system.

These audits examine policies, procedures, and actual practices to ensure alignment with regulatory requirements.

Manufacturing companies conduct environmental compliance audits to verify emissions control systems meet regulatory standards.

Internal audits provide ongoing monitoring of compliance activities. These reviews help identify issues before they become serious problems.

External audits offer independent verification of compliance efforts and often satisfy regulatory requirements.

Technology Integration in Modern Compliance Management System

Modern compliance management systems leverage technology to streamline operations. Automated monitoring tools track compliance metrics in real-time, while workflow systems manage policy reviews and approvals.

A pharmaceutical company might use automated systems to track product testing compliance throughout the development process.

Data analytics tools help identify compliance trends and potential issues. These tools analyze patterns in compliance data to predict problems before they occur.

Financial institutions use analytics to detect suspicious transactions that might indicate compliance violations.

Documentation and Reporting Requirements

Effective documentation proves essential for demonstrating compliance to regulators and stakeholders. Organizations must maintain records of:

- Policy reviews and updates

- Training completion records

- Audit findings and corrective actions

- Consumer complaint resolutions

- Board and management oversight activities

Regular reporting keeps stakeholders informed about compliance status and emerging issues. Reports should provide clear metrics on compliance activities and highlight areas requiring attention.

This information helps boards and management teams make informed decisions about compliance resources and priorities.

This structured approach to compliance management helps organizations maintain regulatory compliance while operating efficiently.

Benefits and Importance of a Compliance Management System

A compliance management system serves as the first line of defense against regulatory violations and their costly consequences.

Organizations that implement robust compliance systems identify potential risks before they escalate into serious issues.

For example, banks using advanced compliance systems detect suspicious transactions early, preventing money laundering violations that could result in hefty fines.

The systematic approach to risk management through a CMS helps organizations stay ahead of regulatory changes.

When new regulations emerge, companies with established compliance systems adapt quickly.

Healthcare providers with effective compliance management programs smoothly implemented telehealth regulations during recent healthcare delivery changes.

Measurable Cost Savings

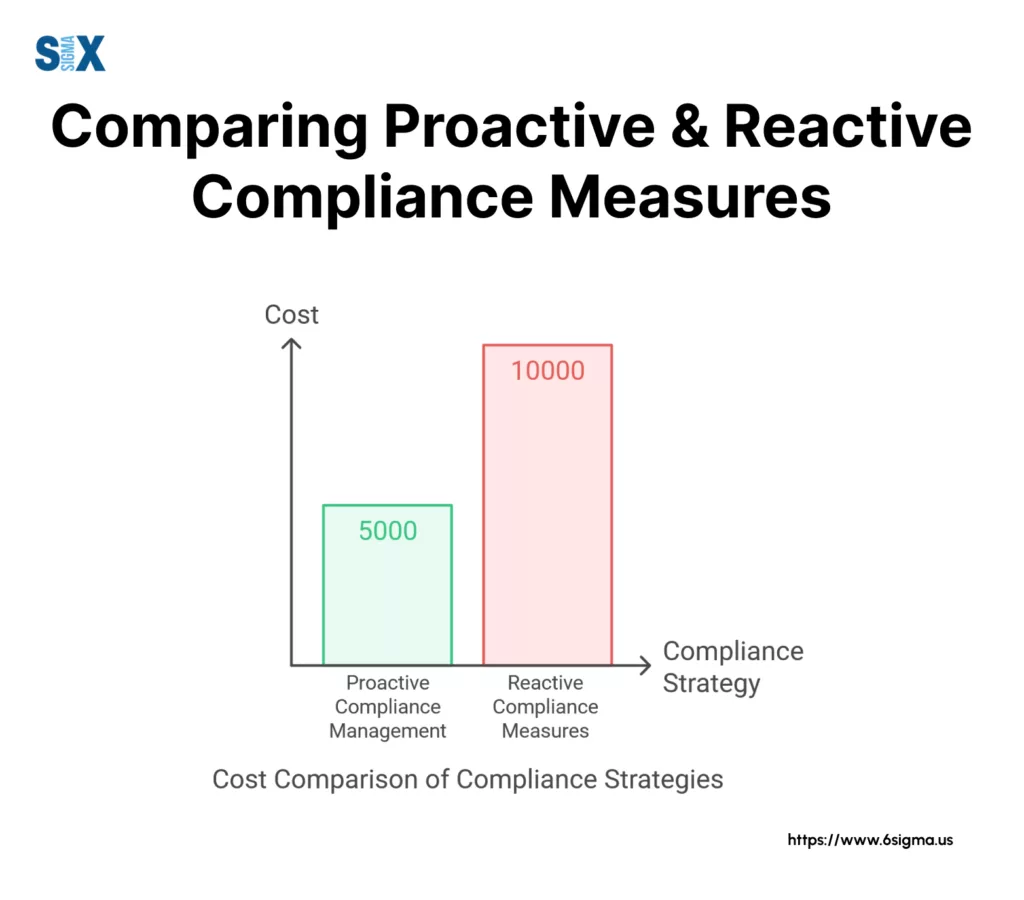

While implementing a compliance management system requires initial investment, it generates significant cost savings over time.

Organizations avoid expensive fines and penalties through proper compliance monitoring. A single compliance violation can cost millions in fines, legal fees, and operational disruptions.

Prevention proves less expensive than correction. Regular compliance monitoring catches issues when they’re small and manageable.

Financial institutions save substantial amounts by identifying and fixing documentation errors before regulatory audits occur.

Driving Operational Efficiency with a Compliance Management System

Well-designed compliance management systems streamline business processes while maintaining regulatory adherence.

Automated compliance workflows reduce manual work and minimize errors.

Technology companies use compliance management tools to automate data privacy checks, saving countless hours of manual review time.

Standardized procedures through compliance management create clear guidelines for employees. This clarity reduces confusion, speeds up decision-making, and improves productivity.

Manufacturing firms report faster production times when compliance requirements integrate seamlessly with operational procedures.

Building Trust and Reputation

Organizations with strong compliance management systems build trust with stakeholders. Customers feel confident their data and interests receive proper protection.

Healthcare organizations that demonstrate consistent HIPAA compliance attract more patients and partnerships.

Regulatory compliance becomes a competitive advantage. Companies showcase their compliance achievements to win new business.

Government contractors leverage their compliance management systems to secure contracts requiring strict regulatory adherence.

Employee Engagement and Culture

A robust compliance management system creates a culture of accountability and ethical behavior.

Employees understand their roles in maintaining compliance and feel empowered to raise concerns. Financial services firms report higher employee satisfaction when clear compliance guidelines exist.

Regular training through compliance management programs keeps employees updated and engaged.

This knowledge reduces workplace stress and increases job satisfaction. Retail organizations notice improved customer service when employees clearly understand compliance requirements.

Future-Proofing Operations with a Compliance Management System

Modern compliance management systems help organizations prepare for evolving regulations. They provide flexibility to adapt to new requirements without major disruptions.

Technology firms using advanced compliance systems quickly adjusted to new international data protection laws.

The data collected through compliance management enables better strategic planning. Organizations identify trends and prepare for future regulatory changes.

Manufacturing companies use compliance data to plan facility upgrades that meet upcoming environmental regulations.

Measurable Performance Improvements

Organizations track specific benefits through their compliance management systems:

- Reduced audit findings year over year

- Decreased compliance-related incidents

- Faster response times to regulatory changes

- Improved stakeholder satisfaction scores

- Lower compliance-related operational costs

These tangible improvements demonstrate the value of investing in compliance management.

Implementing a Compliance Management System: Step-by-Step Guide

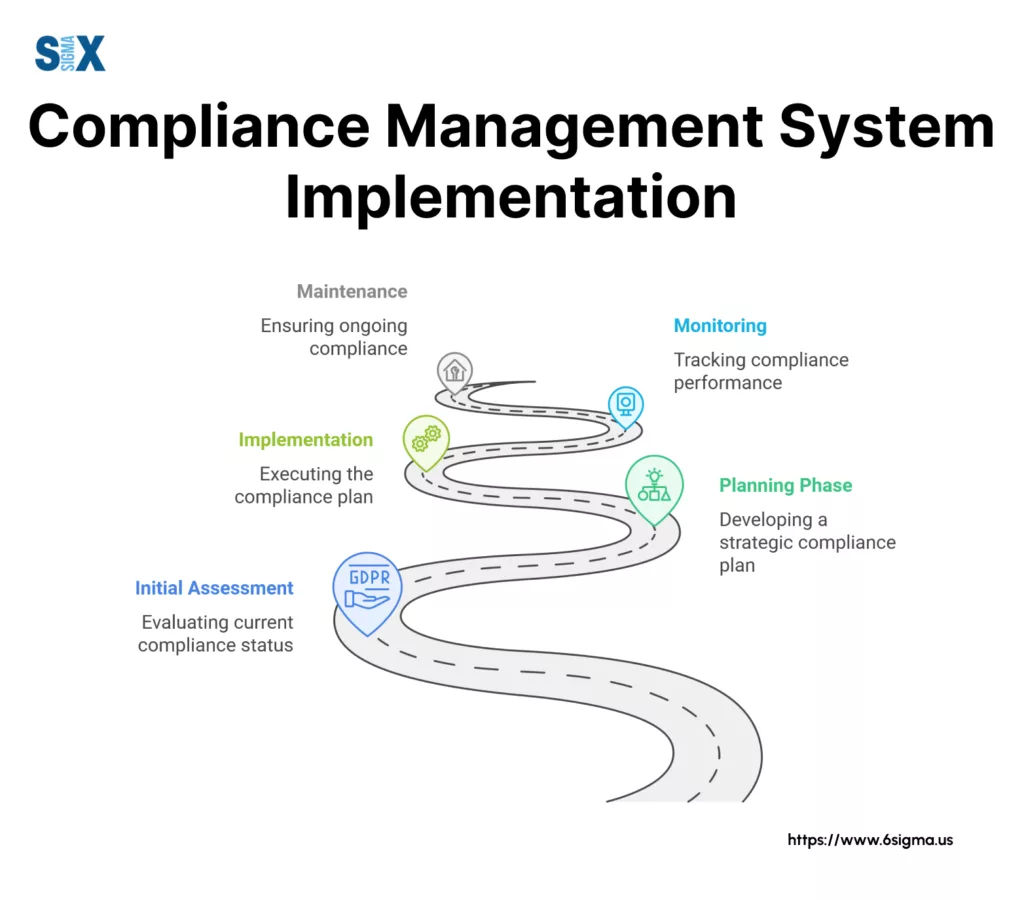

Assessing Your Current Compliance Status

The first step in implementing a compliance management system involves evaluating existing practices and gaps.

Organizations must identify applicable regulations and measure current compliance levels. A healthcare provider might start by reviewing HIPAA requirements against existing data protection measures.

Document current processes and controls during this assessment phase. This creates a baseline for measuring improvements and identifying critical gaps.

Financial institutions often discover outdated procedures during this review that require immediate updates to meet current banking regulations.

Developing Effective Compliance Policies

Create clear, actionable policies that address regulatory requirements and business objectives.

These policies should outline specific procedures for maintaining compliance while supporting operational efficiency.

Technology companies develop data handling policies that satisfy multiple international privacy regulations while enabling necessary business functions.

Policy development requires input from various departments to ensure practical implementation.

Legal teams provide regulatory interpretation, while operational staff offer insights into practical application.

Manufacturing firms involve production managers when creating environmental compliance policies to ensure realistic implementation.

Establishing Clear Roles and Responsibilities

Success depends on clearly defined ownership of compliance tasks. Assign specific responsibilities to individuals and departments based on their expertise and authority.

A retail organization might designate department managers as compliance champions responsible for implementing policies within their teams.

Create a compliance committee to oversee the program’s implementation. This group should include representatives from key departments and senior management.

They meet regularly to review progress and address challenges in managing compliance requirements.

Setting Up Monitoring and Reporting Systems

Implement tools and processes to track compliance activities and identify potential issues. Modern compliance management solutions offer automated monitoring capabilities.

Banks use automated systems to flag suspicious transactions and generate required regulatory reports.

Establish regular reporting schedules and formats. These reports should provide clear metrics on compliance status and highlight areas needing attention.

Healthcare organizations track patient data access patterns to identify potential privacy violations and demonstrate HIPAA compliance.

Building a Strong Training Program

Develop role-specific training materials that explain compliance requirements and procedures. Use practical examples and scenarios to illustrate proper compliance practices.

Technology firms create interactive training modules showing proper data handling procedures for different types of sensitive information.

Schedule regular training sessions to keep staff updated on compliance requirements. Mix different training formats to maintain engagement and effectiveness.

Manufacturing companies combine classroom sessions with hands-on practice for environmental compliance procedures.

Implementing Technology Solutions for a Compliance Management System

Select and deploy appropriate compliance management software to automate key processes.

These tools should integrate with existing systems while providing necessary monitoring and reporting capabilities.

Financial institutions implement solutions that automatically track regulatory filings and deadline compliance.

Configure systems to generate early warnings for potential compliance issues. This proactive approach helps prevent violations before they occur.

Retail organizations use automated alerts to identify potential privacy breaches in customer data handling.

Establishing Review and Update Procedures

Create schedules for regular policy reviews and updates. This ensures compliance measures remain current with changing regulations and business needs.

Technology companies review data privacy policies quarterly to adapt to evolving international regulations.

Document all changes and maintain version control for policies and procedures. This creates an audit trail and helps track the evolution of compliance measures.

Healthcare providers maintain detailed records of policy updates to demonstrate ongoing HIPAA compliance efforts.

Measuring Implementation Success

Define specific metrics to evaluate the effectiveness of your compliance management system. Track key indicators such as:

- Policy adoption rates

- Training completion percentages

- Compliance violation incidents

- Audit findings

- Response times to compliance issues

Regular evaluation helps identify areas for improvement and demonstrates program value to stakeholders.

Transform data into actionable compliance insights with Process Variable Mapping

Conclusion

A robust compliance management system forms the foundation of regulatory adherence and risk management in modern organizations.

The structured approach to managing compliance requirements helps businesses avoid costly violations while improving operational efficiency

Organizations across industries demonstrate that well-implemented compliance systems deliver measurable returns on investment through reduced risks and enhanced stakeholder trust.

Success in compliance management requires ongoing commitment from leadership, clear policies and procedures, regular training, and effective monitoring systems.

The evolution of technology continues to provide new tools for automating compliance tasks and identifying potential issues before they escalate into serious problems.

Frequently Asked Questions

A. While the board of directors holds ultimate responsibility for compliance oversight, successful implementation requires participation at all levels. The compliance officer leads daily operations, department heads ensure adherence within their teams, and individual employees play crucial roles in maintaining compliance standards. For example, in financial institutions, tellers must understand and follow anti-money laundering procedures, while IT staff ensure data security compliance.

A. Effective compliance managers combine technical knowledge with strong leadership skills. They stay current with regulatory changes, communicate clearly across all organizational levels, and balance compliance requirements with business objectives. Strong analytical skills help them identify potential issues and develop practical solutions. They also build collaborative relationships with department heads to ensure smooth implementation of compliance measures.

A. Modern compliance tracking involves multiple tools and approaches. Organizations use specialized software to monitor compliance activities, generate reports, and track training completion. Regular audits verify compliance status, while automated monitoring systems provide real-time alerts about potential violations. Healthcare organizations, for instance, use automated systems to track patient data access and flag unauthorized attempts.

A. The seven essential elements include written policies and procedures, designated compliance officers, effective training programs, open communication channels, internal monitoring systems, consistent disciplinary standards, and prompt response to detected offenses. These components work together to create a strong compliance foundation. Manufacturing companies implement these elements to ensure environmental compliance across multiple facilities.

A. Organizations report significant benefits from implementing compliance management systems. These benefits include reduced regulatory violations, lower compliance-related costs, improved operational efficiency, and enhanced reputation. Financial institutions using robust compliance systems report fewer audit findings and faster response times to regulatory changes. Technology companies demonstrate stronger data protection measures and increased customer trust.

Looking Ahead: The Future of Compliance Management

The role of compliance management systems continues to evolve with advancing technology and changing regulations.

Artificial intelligence and machine learning offer new capabilities for predictive compliance monitoring.

Cloud-based solutions provide greater flexibility and scalability for growing organizations. These technological advances help organizations stay ahead of regulatory requirements while maintaining operational efficiency.

Success in today’s regulatory environment demands a proactive approach to compliance management.

Organizations that invest in strong compliance systems position themselves for sustainable growth while protecting their stakeholders’ interests.

The continued evolution of compliance management tools and practices will help organizations meet future regulatory challenges with confidence.

SixSigma.us offers both Live Virtual classes as well as Online Self-Paced training. Most option includes access to the same great Master Black Belt instructors that teach our World Class in-person sessions. Sign-up today!

Virtual Classroom Training Programs Self-Paced Online Training Programs