Strategic Risk Management: A Comprehensive Guide to Safeguarding Your Business Future

Risks are a big part of any successful organization.

Managing risks requires a thorough understanding and nuances that directly have an impact on business operations and outcomes.

What is Strategic Risk Management?

The ability to identify, assess, and manage risks to drive core business ops, strategic decisions, and sustainable growth is strategic risk management.

Key reasons why strategic risk management is crucial:

1. Rapid Technological Evolution

Strategic risk management helps organizations stay ahead of technological disruptions rather than playing catch-up.

2. Global Market Interconnectivity

It provides the framework to anticipate and respond to these global challenges effectively.

3. Stakeholder Expectations

Stakeholders are demanding more, they want to see companies being proactive in managing threats and opportunities, and not just react.

Types of Strategic Risks: Real-World Examples

Each type presents unique challenges that require specific approaches to manage effectively.

Market Risks

Market risks can reshape entire industries. Implementing a strategic risk management framework helps them identify new market opportunities while gradually transitioning their product portfolio.

Technological Risks

Technological risks are particularly challenging. Develop a comprehensive risk assessment model that helps stay ahead of technological changes.

Regulatory Risks

Regulatory changes can create substantial strategic risks. Develop a strategic risk management approach to anticipate potential regulatory changes, allowing you to adapt the R&D pipeline proactively rather than reactively.

Reputational Risks

Reputational risks have become increasingly critical. Develop strategic risk management frameworks that specifically address reputation management. For example, implement a comprehensive risk monitoring system to help protect market position.

Competitive Risks

Competitive risks often emerge unexpectedly. This approach helps maintain market leadership by anticipating and responding to these new competitive threats.

Transform Potential Risks into Opportunities!

Master Failure Mode Effects Analysis (FMEA), a powerful tool for identifying and preventing business process failures. Learn how to create comprehensive risk assessment frameworks that protect your organization’s future.

Strategic vs. Operational Risks: A Critical Distinction

Strategic risks typically:

- Impact long-term business objectives and company direction

- Require board-level attention and strategic responses

- Often arise from external factors and market dynamics

- Have broader, more far-reaching consequences

In contrast, operational risks usually:

- Affects day-to-day operations and processes

- Can be managed at departmental levels

- Typically arise from internal factors

- Have more localized impacts

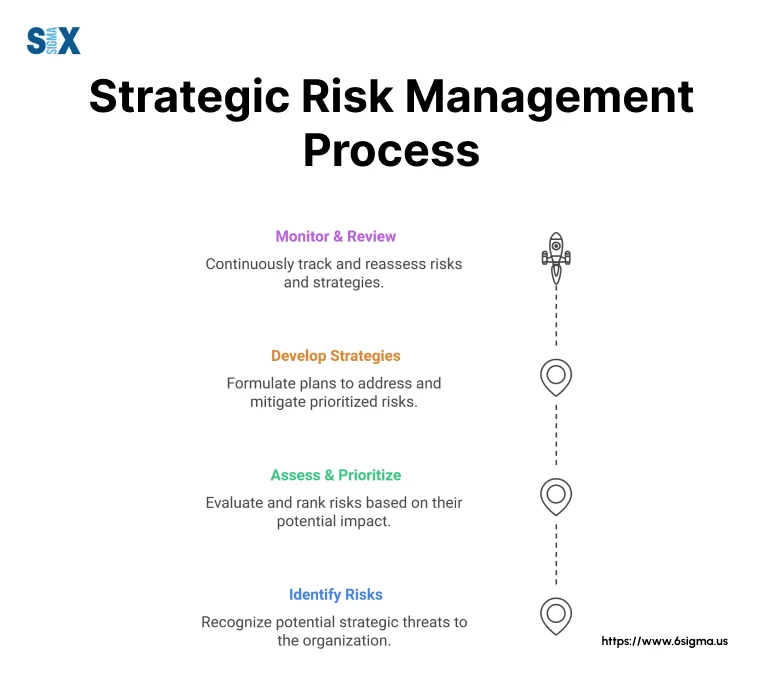

The Strategic Risk Management Process

Let’s look at a comprehensive approach to strategic risk management that can consistently deliver results.

Identification of Strategic Risks

The first critical step in strategic risk management is the proper identification of potential risks. You need to have a systematic approach that combines quantitative analysis with qualitative insights.

The process should involve:

Environmental Scanning

Combining market analysis with trend forecasting provides the most comprehensive view of potential risks. This approach helps identify emerging competitive threats from new market entrants before they materialize.

Stakeholder Analysis

Engaging with stakeholders at all levels is crucial. It can help discover significant strategic risks by speaking with front-line employees – something that hadn’t been visible from the executive level.

Assessment and Prioritization with Strategic Risk Management

Once risks are identified, the next crucial step is assessment and prioritization.

Risk Impact Analysis

Implement a quantitative risk assessment model that helps measure both the likelihood and potential impact of strategic risks. This approach typically involves:

- Probability Assessment: Using statistical modeling to estimate risk likelihood

- Impact Evaluation: Measuring potential financial and operational impacts

- Time Horizon Analysis: Considering both short-term and long-term implications

Risk Prioritization Matrix

Implement a modified risk prioritization matrix that accounts for both quantitative metrics and qualitative factors. This approach has proven particularly effective in helping organizations allocate their risk management resources more efficiently.

Development of Risk Response Strategies

Developing appropriate response strategies requires a balance between proactive and reactive measures.

Risk Mitigation Strategies

Develop a comprehensive approach to risk mitigation that includes:

- Prevention strategies based on root cause analysis

- Containment measures for when risks materialize

- Recovery plans for post-risk scenarios

Contingency Planning

Develop a strategic risk management framework that includes detailed response plans for various scenarios, ensuring the organization can respond quickly to emerging threats.

Want to Embed Risk Management into Your Design Processes?

Our DFSS Green Belt program teaches you advanced risk management techniques, from Voice of Customer deployment to comprehensive design scorecards.

Monitoring and Review with Strategic Risk Management

Many organizations fail to maintain effective monitoring systems for their strategic risks. Developed a continuous monitoring framework that included:

Regular Risk Reviews

Implement quarterly risk assessment meetings where key stakeholders would review and update their risk profiles. This practice helps organizations stay ahead of emerging threats and opportunities.

Key Risk Indicators (KRIs)

Develop meaningful KRIs that provide early warning signals for potential strategic risks. This approach proves particularly valuable in rapidly changing industries.

Implementation Challenges and Solutions

Here are some common obstacles and solutions:

Cultural Resistance

Resistance to change is a significant barrier. To address this, develop a change management approach that focuses on demonstrating early wins and building buy-in across all organizational levels.

Resource Constraints

You should scale strategic risk management processes appropriately. Develop a streamlined approach to maintain effectiveness while requiring fewer resources.

Integration with Existing Systems

Integrate strategic risk management with existing business processes rather than treating it as a separate function. This approach helps ensure sustainable risk management practices.

The Strategic Risk Management Framework: A Six Sigma Approach to Protecting Your Business

Success lies in the details of how these frameworks are structured and executed. Here’s a comprehensive approach that combines Six Sigma principles with practical risk management strategies.

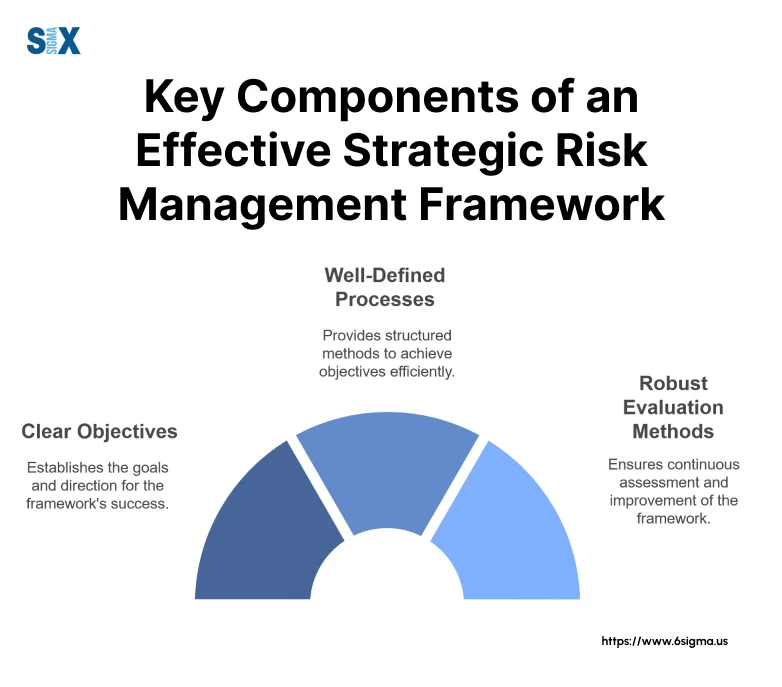

Key Components of an Effective Framework

I discovered that the most effective frameworks share certain critical elements.

First and foremost is executive sponsorship. I’ve seen how crucial it is to have a top-level commitment to the strategic risk management process. This isn’t just about approval – it’s about active engagement in the risk management strategy.

The second crucial component is a clear governance structure. Develop a multi-tiered governance model that clearly defined roles, responsibilities, and decision-making authorities. This structure ensures accountability while maintaining flexibility in response to emerging risks.

Step-by-Step Implementation Process of Strategic Risk Management

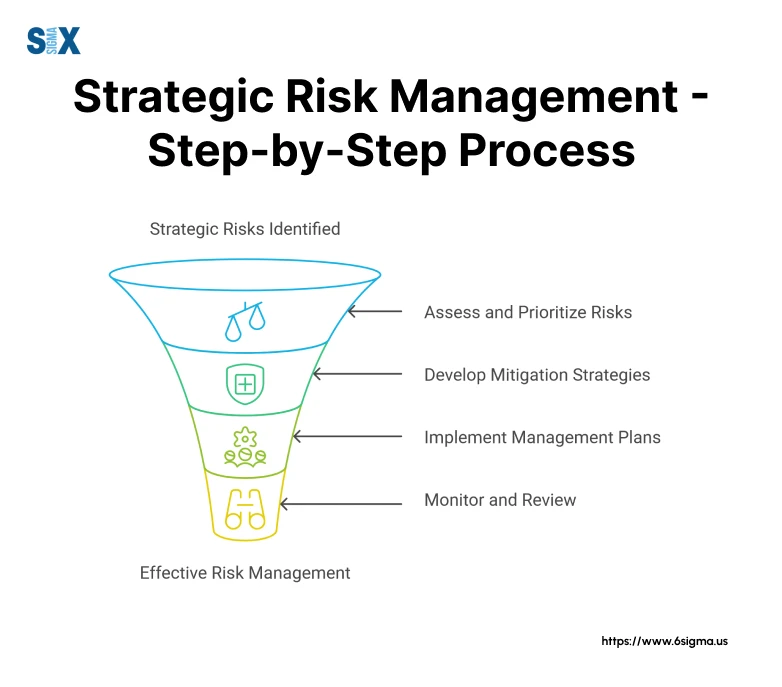

A systematic approach to strategic risk management should consistently deliver results. Here’s a step-by-step implementation process.

1. Identify Strategic Risks

The identification phase is where you need to implement a comprehensive risk identification system that combines:

- Quantitative analysis of market trends

- Qualitative insights from stakeholder interviews

- Scenario planning workshops

- Historical data analysis

2. Assessing and Prioritizing Risks

Develop a risk assessment matrix that goes beyond traditional probability-impact analysis. This framework should incorporate:

- Risk Velocity: How quickly a risk might impact the organization

- Risk Interconnectivity: How risks relate to and influence each other

- Strategic Alignment: How risks affect strategic objectives

3. Developing Risk Mitigation Strategies

Effective risk mitigation strategies must be both robust and flexible. You can develop a three-tiered approach:

- Prevention Strategies: Proactive measures to reduce risk likelihood

- Response Strategies: Immediate actions when risks materialize

- Recovery Strategies: Long-term plans for post-risk scenarios

4. Implementing Risk Management Plans

Implementation is where many organizations struggle. Develop a phased implementation approach that includes:

- Pilot Programs: Testing strategies in controlled environments

- Staged Rollout: Systematic expansion across the organization

- Continuous Feedback: Regular assessment and adjustment of plans

5. Monitoring and Reviewing Effectiveness

The monitoring phase is crucial for long-term success. Implement a comprehensive monitoring system that includes:

- Regular Performance Reviews: Quarterly assessments of risk metrics

- Adjustment Mechanisms: Processes for updating strategies based on results

- Stakeholder Feedback: Continuous input from all organizational levels

Integration of Strategic Risk Management with Business Strategy

One of the most critical lessons I’ve learned through my consulting work is the importance of integrating strategic risk management with overall business strategy. I’ve seen how isolated risk management efforts often fail to deliver value.

The integration process should include:

- Strategic Planning Alignment: Ensuring risk management supports strategic objectives

- Resource Allocation: Integrating risk considerations into budgeting processes

- Performance Metrics: Incorporating risk management into KPIs

Successful strategic risk management requires both structure and flexibility. The framework outlined here has been tested and refined through numerous implementations, consistently delivering results across various organizational contexts.

Remember, strategic risk management isn’t a one-time exercise – it’s an ongoing process that requires constant attention and adjustment.

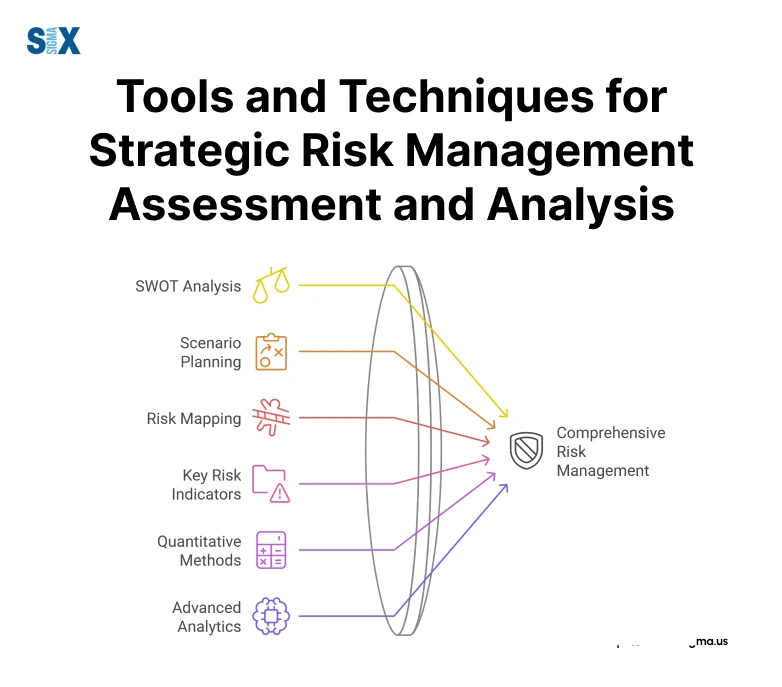

Tools and Techniques for Strategic Risk Management and Analysis

I’ve discovered that the effectiveness of strategic risk management largely depends on the tools and techniques employed. Here’s a comprehensive toolkit that combines traditional risk assessment methods with advanced analytical approaches.

SWOT Analysis: A Foundation for Risk Identification

While many consider SWOT analysis basic, I’ve enhanced this tool during my consulting work to make it more powerful for strategic risk management. We developed what I call a “Dynamic SWOT” approach that incorporates temporal elements and quantitative metrics.

For instance, we used this enhanced SWOT analysis to identify emerging threats that traditional risk assessment methods had missed. The key was linking each identified weakness and threat to specific strategic objectives and quantifiable metrics. This approach helped us proactively address potential risks before they materialized.

Scenario Planning and Stress Testing

Implement a comprehensive scenario planning framework that goes beyond simple “what-if” analyses. This approach involves:

Scenario Development

Create structured scenarios that test multiple variables simultaneously. For example, a pharmaceutical company developed scenarios that considered regulatory changes, market dynamics, and technological advancement simultaneously, providing a more realistic view of potential risks.

Stress Testing

Many organizations conduct stress tests that are too narrow in scope. Develop a multi-dimensional stress testing approach that examines how various risks might compound and interact under extreme conditions.

Risk Mapping and Heat Maps with Strategic Risk Management

Risk mapping has evolved significantly. Use a dynamic risk mapping methodology that incorporates:

Velocity Indicators

Traditional heat maps often miss the speed at which risks can materialize. Develop a three-dimensional risk mapping approach that includes risk velocity as a critical component.

Interconnectivity Analysis

I’ve observed that risks rarely exist in isolation. Enhanced risk maps now include interconnectivity indicators that show how risks relate to and influence each other.

Key Risk Indicators (KRIs)

Developing effective KRIs requires both statistical expertise and deep business understanding. A framework for creating meaningful KRIs should:

- Provide early warning signals

- Link directly to strategic objectives

- Offer actionable insights

Quantitative Risk Assessment Methods

Implement a comprehensive quantitative framework that includes:

Monte Carlo Simulation

Use this technique to model complex risk scenarios and their potential impacts. During a project with a manufacturing client, this approach helped quantify the potential impact of supply chain disruptions with remarkable accuracy.

Bayesian Analysis

Bayesian methods are particularly useful for updating risk assessments as new information becomes available. This approach has proven especially valuable in rapidly changing industries.

Advanced Analytics and AI in Strategic Risk Management

The integration of AI and machine learning into strategic risk management is an area where I’ve seen tremendous growth. You can develop frameworks that combine traditional risk assessment methods with advanced analytics:

Predictive Analytics

Develop predictive models that can identify potential risks before they become apparent through traditional methods.

AI-Powered Risk Monitoring

Organizations implement AI systems that continuously monitor for risk indicators across various data sources. This approach has proven particularly effective in identifying emerging risks in real-time.

Implementation Considerations

I’ve learned that the key to success lies in:

1. Proper Tool Selection

Not every organization needs every tool. Select the most appropriate tools based on specific needs and capabilities.

2. Integration

Tools must work together seamlessly. Develop an integrated risk assessment framework that combines multiple tools into a coherent system.

3. Continuous Improvement

I emphasize the importance of regularly reviewing and refining risk assessment tools and techniques.

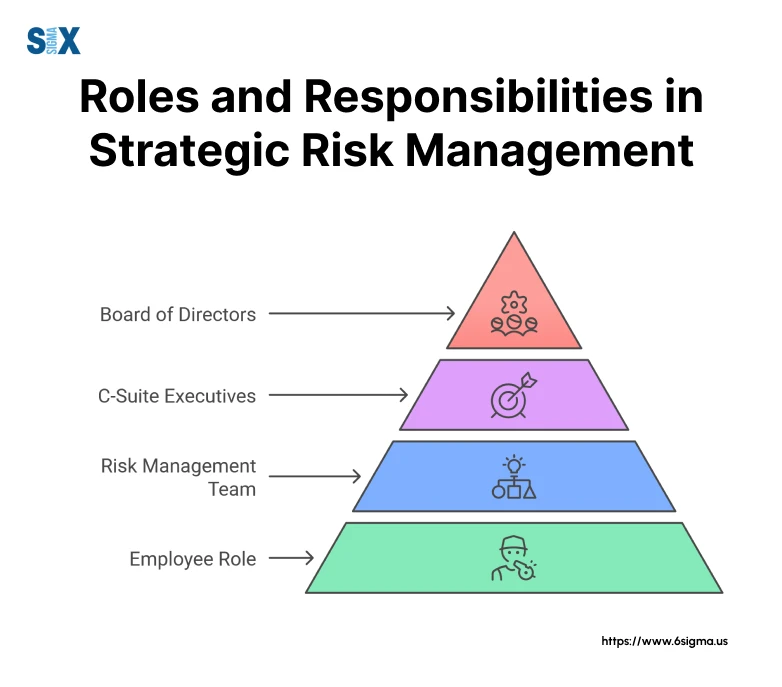

Roles and Responsibilities in Strategic Risk Management

Success depends heavily on clearly defined roles and responsibilities at every level. Here’s a comprehensive understanding of how different organizational layers must work together to create an effective risk management structure.

Board of Directors: Setting the Tone at the Top

Most successful organizations have boards that take an active role in strategic risk management. A framework that clearly defines the board’s oversight responsibilities should have:

Risk Governance Oversight

The board must establish and maintain appropriate risk appetite levels. You can implement a structured approach to defining risk tolerance across different business units. This framework can become the foundation for all strategic risk decisions.

Strategic Direction

Effective oversight requires regular engagement with risk-related strategic decisions. For instance, a major manufacturing company established quarterly risk review sessions where the board actively participated in evaluating and adjusting risk management strategies.

C-Suite Executives: Translating Strategy into Action

Their role is crucial in translating board-level risk appetite into actionable strategies.

CEO’s Role

The CEO must champion strategic risk management throughout the organization. Work with leadership to develop a risk-aware culture that started at the top. The CEO’s visible commitment to risk management became a powerful driver for organizational change.

CFO’s Responsibilities

Develop frameworks for integrating financial and strategic risk considerations. Implement a comprehensive risk-adjusted performance measurement system that helps align financial decisions with risk management objectives.

CRO’s Function

Establish clear lines of authority and responsibility. Create a robust reporting structure that enables the CRO to effectively coordinate risk management activities across all business units.

Risk Management Team: The Operational Engine

An effective risk management team needs both technical expertise and business acumen. Develop a risk management team structure that includes:

Risk Assessment Specialists

These professionals focus on identifying and analyzing potential risks.

Risk Monitoring Officers

Establish monitoring systems that enable risk teams to track and report on key risk indicators effectively.

Employee Role: The Front Line of Defense

One of the most important lessons I’ve learned is that effective strategic risk management requires engagement at all levels. Develop programs to enhance employee participation in risk management like:

Risk Awareness Training

A comprehensive risk awareness training program that helped employees at all levels understand their role in identifying and reporting potential risks.

Reporting Mechanisms

Create efficient reporting systems that enable employees to communicate risk-related concerns effectively.

Looking to Build a Strong Foundation in Strategic Risk Management?

Our Lean Six Sigma Yellow Belt program equips you with essential tools like Process Mapping, C&E Matrix, and FMEA to become a valuable contributor to your organization’s risk management initiatives.

Integration and Coordination

The key to successful strategic risk management lies in how well these different roles work together.

Communication Channels

Clear communication pathways between different organizational levels are crucial. Establish a multi-tiered communication system to ensure risk-related information flowed efficiently both up and down the organizational hierarchy.

Regular Risk Reviews

Implement structured review processes that bring together representatives from all levels to discuss and assess risk management effectiveness. These sessions prove invaluable in maintaining alignment and adjusting strategies as needed.

Performance Metrics

Develop comprehensive metrics that help organizations track how well different roles are functioning in the risk management process. These metrics have helped numerous organizations identify and address gaps in their risk management structure.

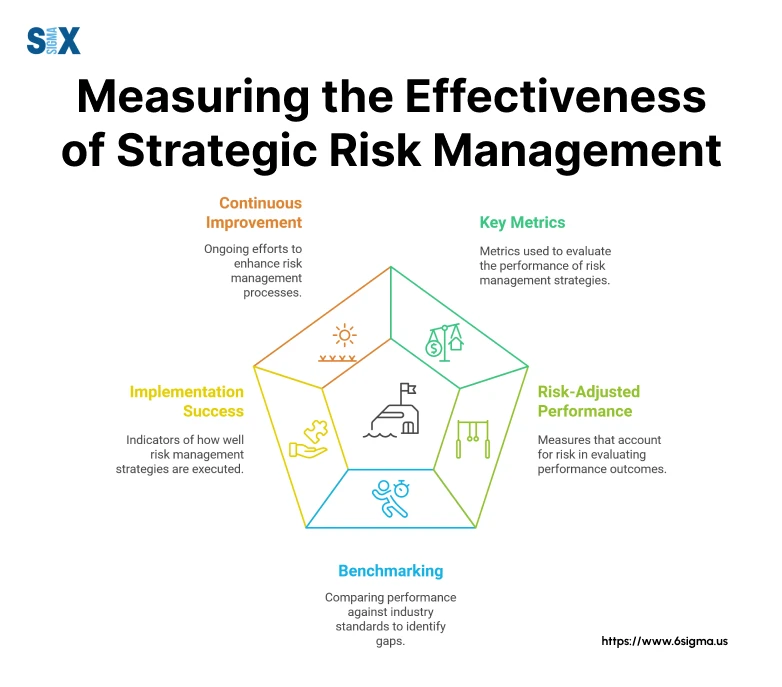

Measuring the Effectiveness of Strategic Risk Management

What gets measured gets managed. You need to develop comprehensive approaches to measure the effectiveness of strategic risk management programs that go beyond traditional metrics.

Key Metrics for Evaluating Risk Management Performance

Several critical metrics provide meaningful insights into risk management effectiveness.

Leading Indicators

You should develop a suite of leading indicators to help predict potential risk events before they materialize.

For instance, track market sentiment indicators, supplier health metrics, and technology adoption rates to identify emerging risks early. This proactive approach helps avoid several potential crises that could have impacted their market position.

Lagging Indicators

Lagging indicators provide valuable insights into the effectiveness of existing risk management strategies.

We typically track:

- Risk Event Frequency: A tracking system that measures not just the number of risk events but their severity and impact on strategic objectives.

- Response Effectiveness: Develop metrics to evaluate how quickly and effectively the organization responded to materialized risks, including measurement of response time and resource utilization efficiency.

Risk-Adjusted Performance Measures

Implement a comprehensive framework that includes:

Risk-Adjusted Return on Capital (RAROC)

You can modify traditional RAROC calculations to better reflect strategic risk considerations. This approach helps executives make more informed decisions about resource allocation and strategic investments.

Economic Value Added (EVA) with Risk Components

Develop enhanced EVA metrics that incorporate strategic risk factors. This provided a more complete picture of value creation while accounting for risk exposure.

Benchmarking Your Strategic Risk Management Against Industry Standards

Develop an effective benchmarking program that provides meaningful comparisons while accounting for organizational uniqueness.

Industry-Specific Metrics

Develop a customized benchmarking framework that considers industry-specific risk factors. For example, at a computer hardware and communication organization, we created a technology obsolescence risk index that became a standard for measuring risk management effectiveness in their sector.

Cross-Industry Comparisons

My experience across multiple industries has helped me identify universal metrics that enable meaningful cross-industry comparisons. For instance, during a government project, we adapted private sector metrics to create relevant comparisons for government institutions.

Implementation Success Metrics

Here are some specific metrics to measure the implementation success of strategic risk management programs:

Cultural Integration Metrics

Develop methods to measure risk awareness and integration across the organization. This includes tracking employee engagement in risk identification and reporting, as well as measuring the effectiveness of risk communication channels.

Process Efficiency Metrics

Implement metrics that evaluate the efficiency of risk management processes. For example, track the time from risk identification to mitigation implementation, helping identify and eliminate bottlenecks in the risk management process.

Continuous Improvement Indicators of Strategic Risk Management

My Six Sigma background has taught me the importance of measuring continuous improvement in risk management processes. Key areas I focus on include:

Learning and Adaptation

Develop metrics to track how well risk management processes adapt to changing conditions. This includes measuring the effectiveness of risk response updates and the integration of lessons learned.

Innovation in Risk Management

Implement metrics to track the adoption of new risk management tools and techniques, helping the organization stay at the forefront of risk management practices.

Practical Implementation Tips

I’ve learned that successful measurement systems should:

1. Align with Strategic Objectives

Ensure every metric is directly connected to strategic goals, making the measurements more meaningful and actionable.

2. Be Simple Yet Comprehensive

Develop a balanced scorecard approach that provides comprehensive risk oversight without overwhelming decision-makers with unnecessary complexity.

3. Enable Action

Emphasize the importance of creating metrics that drive action. Each measurement should provide clear insights into what needs to be improved and how.

Case Studies of Successful Strategic Risk Management

Proper risk management can transform challenges into opportunities. Let’s look at some case studies that demonstrate effective risk management strategies in action.

Global Manufacturing Corporation Navigating Geopolitical Risks

The organization faced a complex challenge involving geopolitical risks in their supply chain. The company operated manufacturing facilities across multiple continents and needed to navigate increasing trade tensions and regulatory changes.

The Challenge

The organization faced potential disruption to their global supply chain due to emerging trade restrictions and geopolitical tensions between key markets. We developed a comprehensive strategic risk management approach.

Our Solution

Drawing from my statistical background, we implemented a multi-faceted risk management strategy:

1. Risk Identification and Assessment

We developed a dynamic risk scoring system that incorporated geopolitical indicators, supplier diversity metrics, and market accessibility factors. This approach helped quantify previously intangible risks.

2. Mitigation Strategy

We created a flexible manufacturing network that could quickly shift production between facilities. This strategy included:

- Standardized processes across facilities

- Redundant supplier networks in different regions

- Local sourcing alternatives for critical components

The Results

The company successfully navigated several major geopolitical disruptions with minimal impact on operations. Their strategic risk management practice became a model for the industry.

Tech Company Managing Disruptive Innovation Risks

While consulting for a technology firm, we addressed the challenge of managing risks associated with disruptive innovations in their market.

The Challenge

The company faced the potential obsolescence of their core products due to emerging technologies. We developed a strategic approach to innovation risk management.

Our Solution

We implemented a comprehensive risk management strategic plan that included:

Innovation Radar System

We developed an early warning system for tracking technological developments and market trends. This system helped identify potential disruptions before they significantly impacted the business.

Strategic Response Framework

We created a flexible response framework that allowed the company to:

- Rapidly evaluate new technologies

- Develop strategic partnerships with innovative startups

- Maintain investment in both core technologies and emerging solutions

The Results

The company successfully transformed potential threats into opportunities, maintaining their market leadership position while developing new revenue streams from emerging technologies.

Financial Institution Mitigating Cybersecurity Risks

During my work with a major financial institution, we tackled the growing challenge of cybersecurity risks.

The Challenge

The organization needed to protect sensitive customer data while maintaining service accessibility and meeting regulatory requirements. This complex challenge required integrating strategic risk management with technical security measures.

The Solution

We developed a multi-layered approach:

Risk Assessment Framework

We created a comprehensive risk assessment methodology that combined:

- Traditional security metrics

- Business impact analysis

- Customer experience factors

This approach provided a balanced view of security risks and business objectives.

Implementation Strategy

The solution included:

- Real-time risk monitoring systems

- Automated response protocols

- Regular simulation exercises

- Employee training programs

The Results

The institution achieved industry-leading security standards while maintaining high customer satisfaction levels.

Key Lessons Learned

Through these case studies and my broader experience implementing strategic risk management across various industries, several common success factors emerge:

1. Integration with Business Strategy

Successful risk management must align with overall business objectives. Integrated approaches yield better results than isolated risk management efforts.

2. Data-Driven Decision Making

Organizations should develop robust metrics for risk assessment and monitoring. This quantitative approach proves crucial for making informed decisions about risk management strategies.

3. Flexibility and Adaptability

Successful risk management strategies must be flexible enough to adapt to changing conditions while maintaining core protective measures.

4. Cultural Integration

Organizations succeed when risk management becomes part of their cultural DNA rather than just a compliance exercise.

Best Practices for Effective Strategic Risk Management

Let’s look at certain best practices that can consistently lead to superior outcomes.

Fostering a Risk-Aware Culture

Successful strategic risk management begins with culture. Develop a framework for building a risk-aware culture that has since been implemented across numerous organizations.

Creating Cultural Alignment

I’ve found that cultural transformation requires more than just top-down directives. You can implement a comprehensive program that includes:

- Risk awareness training integrated into daily operations

- Regular risk communication forums

- Recognition programs for proactive risk identification

- Empowerment of employees at all levels to raise risk concerns

Continuous Monitoring and Adaptation

You need to use approaches for continuous monitoring that go beyond traditional periodic reviews. Implement a dynamic monitoring system that provides real-time insights into emerging risks.

Adaptive Framework Development

Successful monitoring systems must be:

- Flexible enough to adapt to changing conditions

- Robust enough to maintain consistency

- Simple enough for practical implementation

Leveraging Technology for Real-Time Risk Insights

You should implement technological solutions that enhance risk monitoring and response capabilities.

Data Analytics Integration

Organizations develop advanced analytics capabilities that provide deeper insights into risk patterns. Implement a predictive analytics system that could:

- Identify emerging risk patterns

- Quantify potential impacts

- Generate early warning signals

- Suggest mitigation strategies

The key is not just implementing technology, but integrating it effectively with existing processes and decision-making frameworks.

Balancing Risk Mitigation with Opportunity Exploitation

Effective strategic risk management isn’t just about avoiding risks – it’s about optimizing them. You should use a framework for balanced risk management that helps identify opportunities within risks.

Risk Assessment Phase

Begin by conducting comprehensive risk assessments that consider both threats and opportunities. This approach helps identify several growth opportunities within what initially appeared to be purely threatening situations.

Opportunity Identification

Develop systematic approaches to identifying opportunities within risk scenarios. This includes:

- Market positioning opportunities

- Innovation catalysts

- Competitive advantage development

- Strategic partnership possibilities

SixSigma.us offers both Live Virtual classes as well as Online Self-Paced training. Most option includes access to the same great Master Black Belt instructors that teach our World Class in-person sessions. Sign-up today!

Virtual Classroom Training Programs Self-Paced Online Training Programs